Restaurant food delivery apps have been our friends for years. Whether we want to celebrate something, indulge, or just get a last-minute dinner, we turn to services like UberEats, DoorDash, and GoPuff.

So, how did the pandemic affect how people use restaurant delivery services today? Folks at Drop brought us some interesting data. Today, Americans order food through restaurant delivery services 42% more often than pre-pandemic, while Canadians have had a 60% rise since the dreaded Covid-19 onset. And even though the restaurant delivery service sector experienced some drops in frequency after COVID’s peak, consumers still use these services 23% more often than pre-pandemic. In 2022, the restaurant delivery industry’s revenue in the US increased by 159%, as compared to Jan 2019. In Canada, this percentage went up by 347%.

We wanted to understand what kept people faithful to certain restaurant delivery services during and after the pandemic. We also wanted to find out who the most committed customers are so that restaurant brands can tailor their offers accordingly.

Pssst! Our previous article discusses how consumers use grocery delivery services and shines a light on the most appealing offers. If you want to learn what we found in that study, go right here.

A few details about the sample:

- Base size: 1000

- US, Canada

- 50% male, 50% female

- Adults aged 18+

Just like in our grocery delivery study, people answered a few behavioral and profiling questions. They then were shown 16 different offers that a restaurant delivery service might offer. Swiping right on an idea meant that they liked it; swiping left meant that they didn’t like it. This allowed us to calculate the Interest Score. If they liked 2 ideas, they were asked to choose their favorite – which helped us measure the Commitment Score. After we got both scores, we calculated the Idea Score – an absolute score calibrated to forecast the success of an offer in the market.

So, what did the study deliver?

1. Here’s what a frequent restaurant delivery customer looks like

Who doesn’t love the neat and tidy profile of their ideal customer? Lucky for the GrubHubs of the world, this study highlights exactly who they need to target.

Drop’s data showed that people have been ordering food through food delivery apps about 4 times a month post-pandemic. So, in the context of our study, we think a frequent user would be someone who said they order 3-4 times a month or more often.

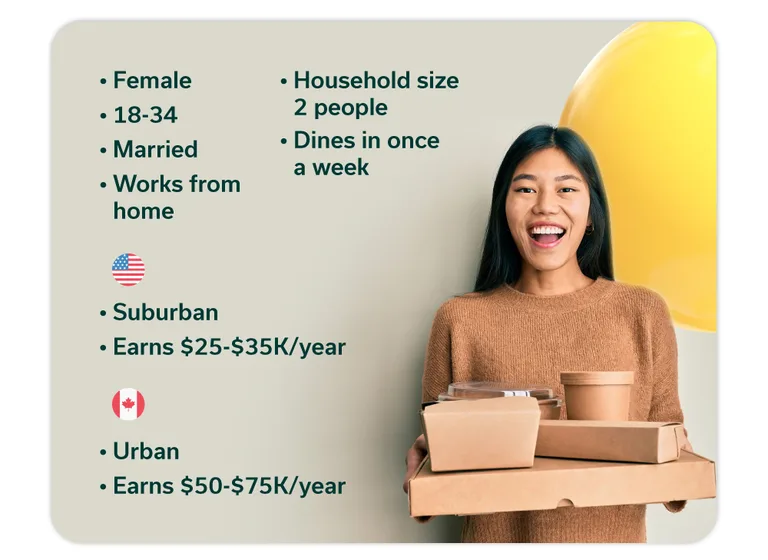

With this definition of ‘frequent’ in mind, an ideal restaurant delivery service customer is female since they make up over 50% of this subgroup. They are 18-34 and most likely married (although about a third are single too). In Canada, they probably live in an urban area. But in the US, they primarily live in the suburbs.

On average, they make about $25-35K per year in the US and $50-75K in Canada. They work from home and have approx. 2 more people living with them. Besides ordering from restaurant food delivery apps at least a few times a month, they also like to dine in a restaurant once a week.

We think this customer profile would be useful for brands in case they’re looking for low-hanging fruit and just want to know what the frequent consumer looks like.

2. The restaurant food delivery industry is more resilient than other food delivery sectors

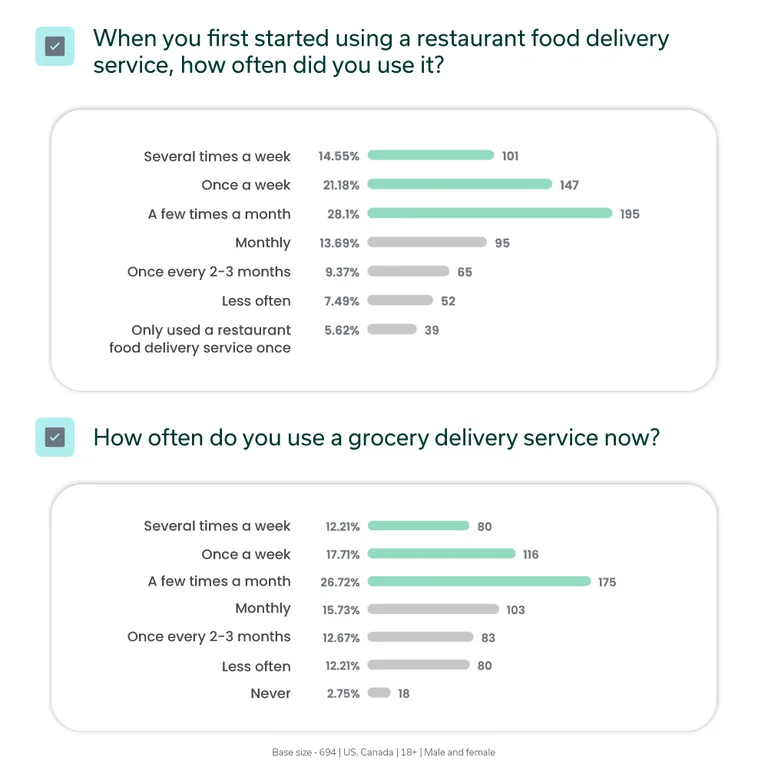

The frequency at which people order food through restaurant delivery apps seems more stable than in other food delivery industries. Here’s what we mean: we asked people how often they used restaurant food delivery services the first time they started ordering food. 64% said that they used them at least a few times a month.

This percentage doesn’t seem to have dropped much today; 56% said they still use restaurant food delivery services to the same extent today.

Comparing the results to our previous grocery delivery study, people seem to stay more loyal to restaurant food delivery services over time. 62% of grocery delivery customers said they initially used this service a few times a month or more often. But only 50% continued at the same rate. We guess this justifies those lazy days when we didn’t want to cook and “Ubered” pizza for all three meals (totally not based on a personal experience…).

Hey! Want to get all these insights in a more visual format? We’ve got a neat infographic right here 👇

3. 18-34-year-olds are the biggest opportunity for restaurant delivery brands

We already talked about who the ideal persona for restaurant delivery services to target. But which subgroup(s) could the brands tap into if they want to test new offers?

Our study showed that 18-34-year-old adults are the natural subgroup to optimize marketing efforts. These folks seem to be real restaurant food delivery aficionados.

Over 40% of them order meals through food delivery apps at least once a week, compared to the average of 30%. They also seem to be open to delivery for almost any reason; whether they want to try something new or don’t have time to cook, under-35-year-olds rate almost all potential reasons for using a restaurant food delivery service above other age groups.

The 18-34 group is also up for trying new brands, restaurants, you name it. More than half have tried 3+ restaurants. In the grocery delivery study, we called these people “explorers,” and we think this name works here too. Even though the date suggests that this segment really loves restaurant delivery, we think it could also mean that explorers aren’t always loyal to one brand. Delivery services need to remember that offering brand-new restaurant options on a regular basis is crucial to retaining this subgroup on their app.

4. Under 35-year-olds also care about the economics of your business

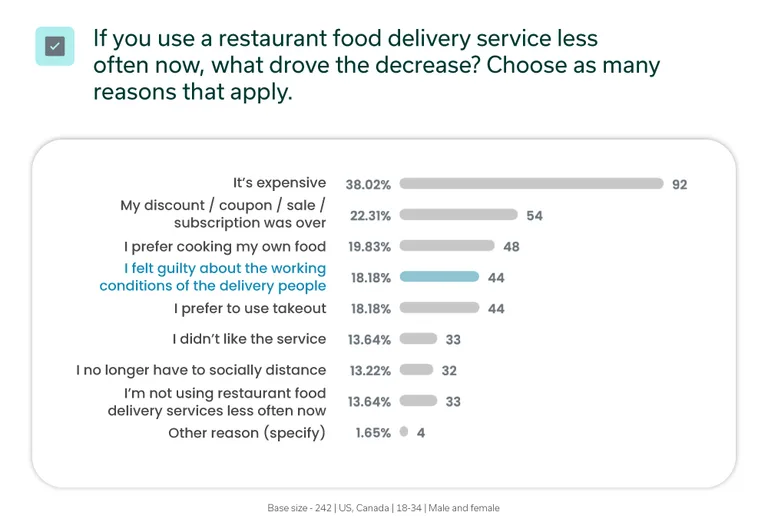

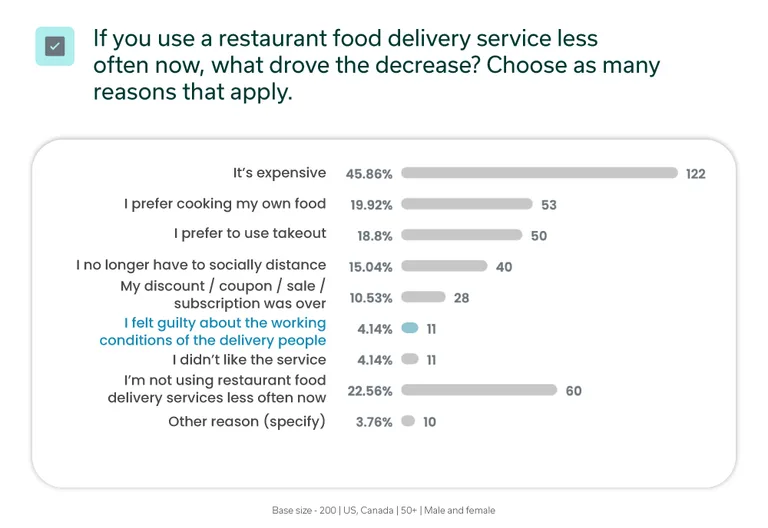

We asked people why they might be using food delivery services less often now than in previous months. We saw some interesting differences between the 18-34-year-old subgroup and other age groups.

18% of under-35-year-olds said they felt guilty about the working conditions of the delivery people. This percentage goes down exponentially as we look at older age segments. Only 4.5% of people over 55 said they ordered less because they felt guilty about the working conditions of delivery folks.

That’s not to say that older people just don’t care about the workers’ environment. It could be just that they aren’t as aware of this problem as the younger generation.

Nonetheless, our study shows that different age groups have different motivations for lessening their use of restaurant delivery services.

5. While everyone loves lower prices, Canadians also want to see more eco-friendly options

Diving into the results of our idea screen exercise, we found that ideas related to low cost are high performers (as you’d likely expect). “Free delivery” was the top-voted offer with an Idea Score of 87. “Free meal delivery on your birthday” (73) and “More discounts / special sales that aren’t available in-person (i.e., online order only discounts)” (72) are in second and third place. So, it’s clear that practically everyone wants to save a buck or five.

But if we look at how different countries reacted to offers, Canadians ranked some specific ideas higher than Americans. “Eco-friendly options (e.g., recyclable packaging, compostable packaging, etc.)” got an Idea Score of 63 with Canadian shoppers, compared to 54 with American shoppers.

Restaurant food delivery brands should consider this finding as a standout when marketing their offering to Canadians. These shoppers want to do good for the planet, so giving them ways of satisfying that goal would naturally make it easier to convert recurring customers. Luckily, brands could do so many things: use more recyclable packaging, switch to electric cars/bikes, or reward delivery people who walk instead of using transportation.

6. Above all, people want brands to nail the basics of delivery

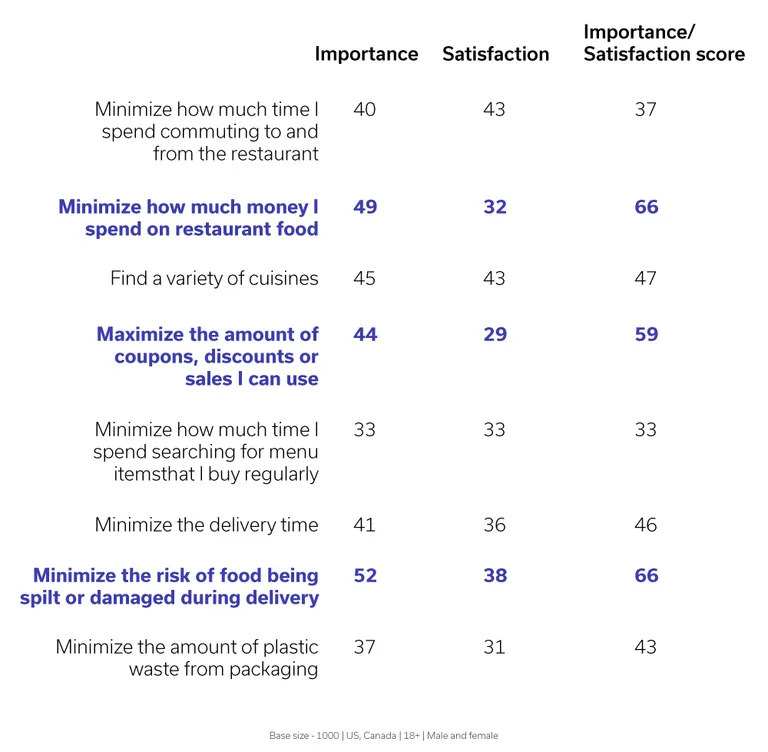

We asked people to tell us which aspects of restaurant food delivery are the most important to them. They also told us which of those aspects they are most satisfied with. Armed with this info, we calculated an Importance/Satisfaction score. This score shows if there are any gaps that brands need to fill. The higher this score, the more likely people have an issue with an aspect, i.e. they find it important but aren’t satisfied with their ability to do it.

The top aspects are, again, related to cost. “Minimizing how much money I spend on food” and “Maximize the amount of coupons, discounts and sales I could use” scored 66 and 59 in Importance/Satisfaction score, respectively. This means there’s a gap in these aspects, which speaks to the cost savings motivator we discussed before.

But it’s not always possible to control prices (inflation is still a thing!). So, which aspects of their offering can restaurant delivery services control?

Another important and least satisfactory aspect was “minimizing the risk of food being spilt or damaged during delivery” (which also got 66 in the Importance/Satisfaction score). This shows that while people want lower costs, they expect retailers to improve the basics of delivery, i.e. deliver food in good condition. Brands should apply this learning in how they train, package and transport food.

Restaurant food delivery services will keep evolving

If brands want to succeed, they should look to our portrait of the ideal customer. Tailoring their offerings to 18-34-year-olds will help, too, but retailers should also think about how to retain loyal customers, ensuring an optimized mix of promos, marketing that is personalized to specific subgroup preferences, and a routine fresh dump of restaurant partners.

If you work in the grocery, meal kit, or restaurant food delivery sectors or just want to learn about these industries, we have the perfect resource for you: check out what’s happening across all three of these industries by watching the video below.