Innovation in any industry is hard. Innovation in financial services is very hard.

Angela Strange

Andreessen Horowitz

Innovation in the banking industry is particularly challenging; it’s so difficult to make changes and create new products due to the monolithic power that old-school brick-and-mortar banks have.

But times are changing. Brand new banking solutions to age-old problems have been breaking the status quo. These ideas have shaped a whole new space of the banking sector now called “neobanks”.

Neobanks or digital banks are fintech firms that offer apps and software for online-first banking technology. In most cases, neobanks don’t have physical branches and exist in the online realm. Because of their approach, their services are somewhat slimmed down and sometimes limited to basics like chequing/checking and savings accounts, though this allows them to offer lower fees and differentiated products and services.

But why do consumers choose neobanks over traditional banks, and vice versa? What kinds of features and offers do they find attractive? And how can banks make better offers and product promises to capture, hold and grow their customer base?

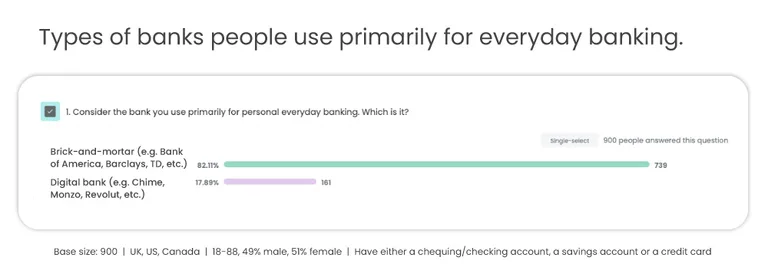

With these questions in mind, Upsiide went on a deep dive into the everyday banking sector. We ran a study with a total of 900 people in the US, Canada and the UK to understand what kind of banks people choose to bank with, what they think about their banks, and which features they love the most. In the end, we were able to identify the most important areas that banks and financial service providers need to tap into to capture demand.

Let us quickly explain the different scores on the Upsiide platform:

The Interest Score is the proportion of people who liked an idea (in this case, a banking feature) and is expressed as a percentage. When respondents like two ideas, they are asked to trade-off between them, picking a favourite – which generates the Commitment Score (often referred to as Commitment). Finally, the Idea Score is based on a combination of the Interest Score and the Commitment Score – it’s an absolute score that’s been calibrated to predict the performance in-market.

If you want to have a quick peek at the results, we’ve got a nice infographic for you right here:

We’ve crunched the numbers – time to check the results out.

1. Brick-and-mortar is here to stay, but neobanks have a chance to tap into unique markets

Traditional banks still capture the majority of the everyday banking market – 82% of respondents bank with brick-and-mortar institutions.

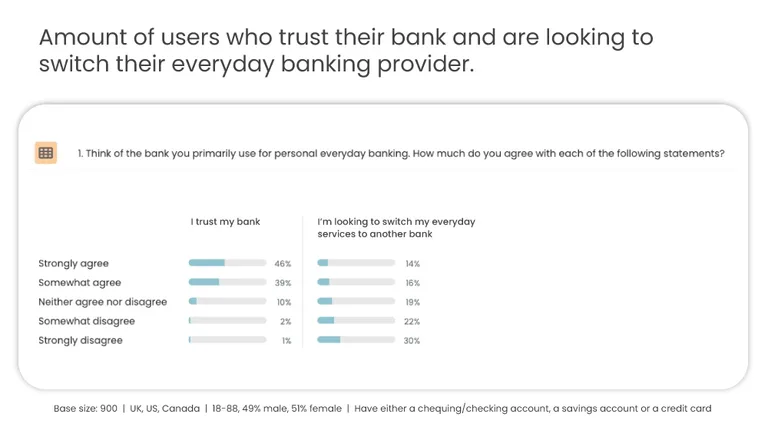

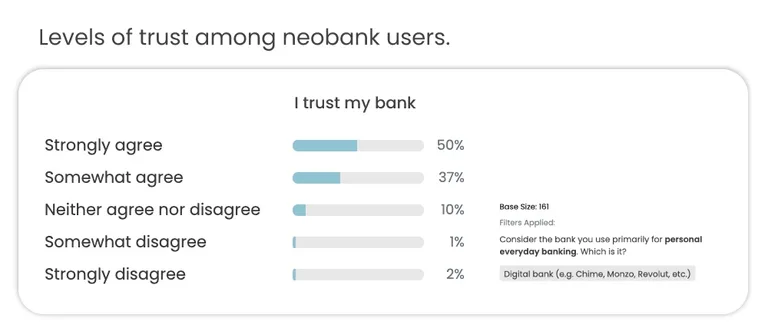

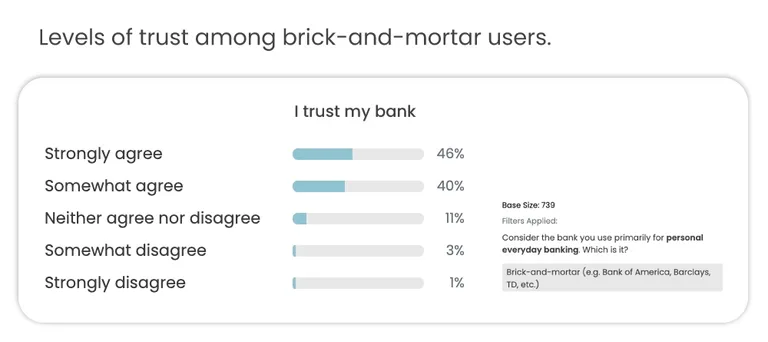

And they seem to be happy with that choice. When we asked consumers how much they trust their bank, 85% stated they strongly or somewhat strongly feel that way and over 50% strongly or somewhat strongly do not want to switch their banking provider.

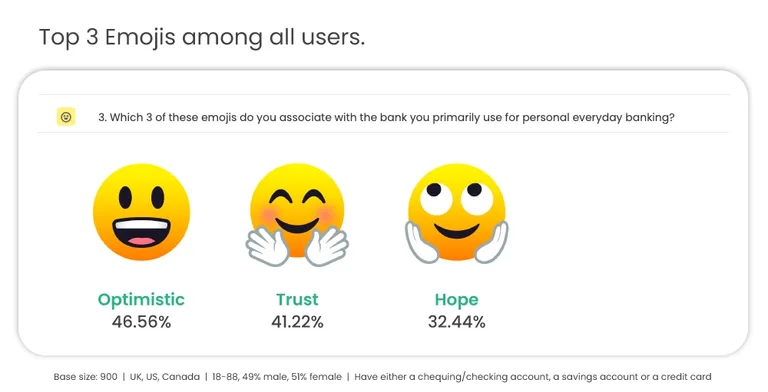

Consumers also associate their banks with positive emotions – the top performing emojis associated with their banks were “optimistic”, “trust” and “hope”.

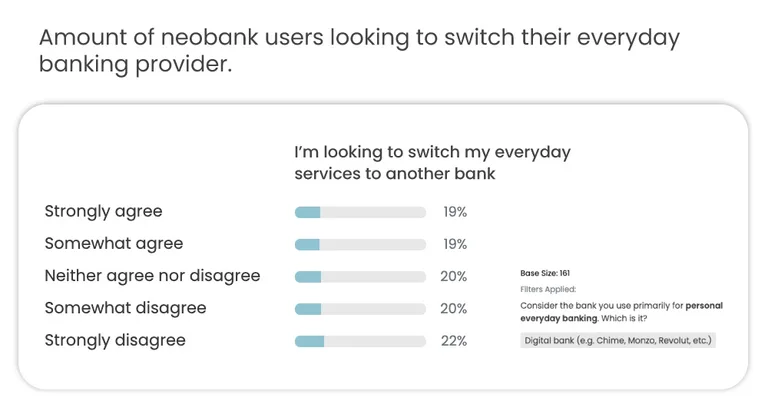

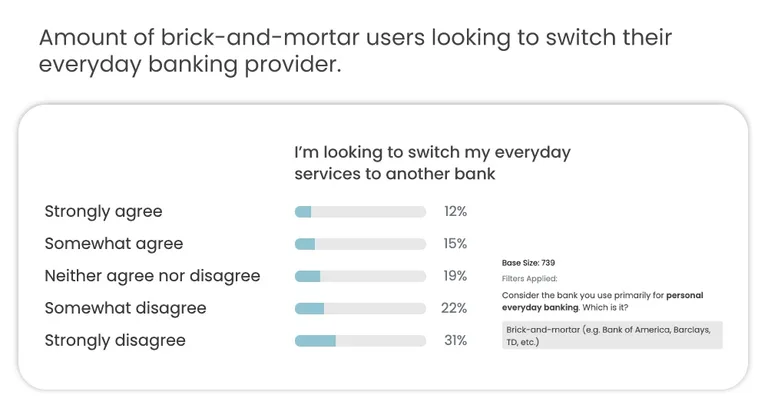

But neobanks have a chance to break through the strong presence of brick-and-mortar banks. Neobank users were generally split on their opinions when we asked if they wanted to switch to a new bank provider. About 40% of respondents stated that they strongly or somewhat agree that they want to switch their everyday banking provider. In comparison, only 27% of brick-and-mortar users are looking to switch banks.

Yet trust doesn’t seem to be a problem with neobank users, either: neobank users believe that their providers have their best interests at heart, just like brick-and-mortar users.

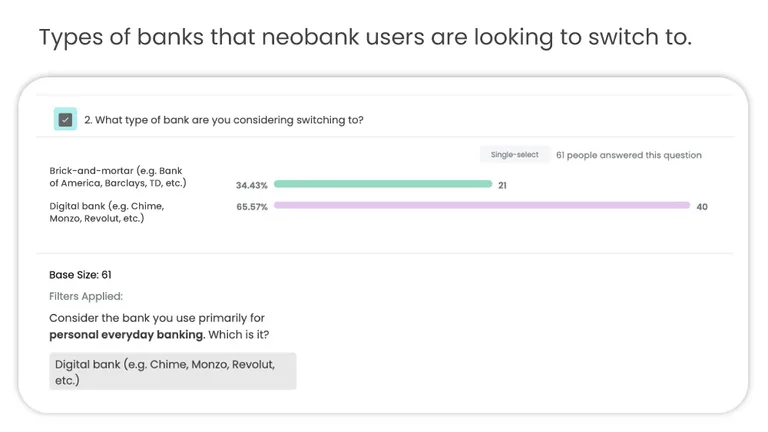

When we look at neobank customers who noted that they strongly and somewhat strongly want to switch providers, 66% tend to stick to the neobanks.

What this insight shows us is that neobanks are still pretty well received, and users tend to stay loyal to this type of banking provider. The fact that they are looking to change banking providers might suggest that these users are early adopters – they are looking for new neobank experiences, trialling different services and picking the digital banks that they love most.

Revolut’s founders once said that the neobanks’ mission is “to turn the financial banking sector on its head.” And we believe this upside-down structure definitely has a market – a market of early adopters who love this system and love exploring it more.

The implication is that digital banks may see greater churn. Because they are newer, they have likely attracted consumers who are open to change. So a challenge for digital banks will be to build relationships or at least behavioural loyalty.

2. If you don’t digitize, you get left behind

Every bank is a digital bank. TS Anil, global chief executive of Monzo, said “For banking services to not have been digitized is to have been lagging”. And our study is proof of that.

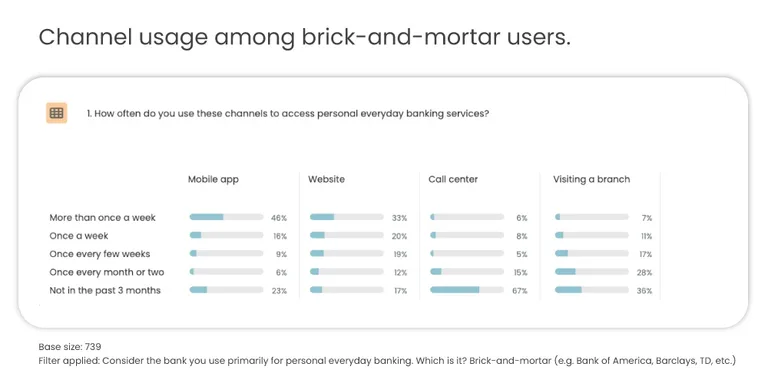

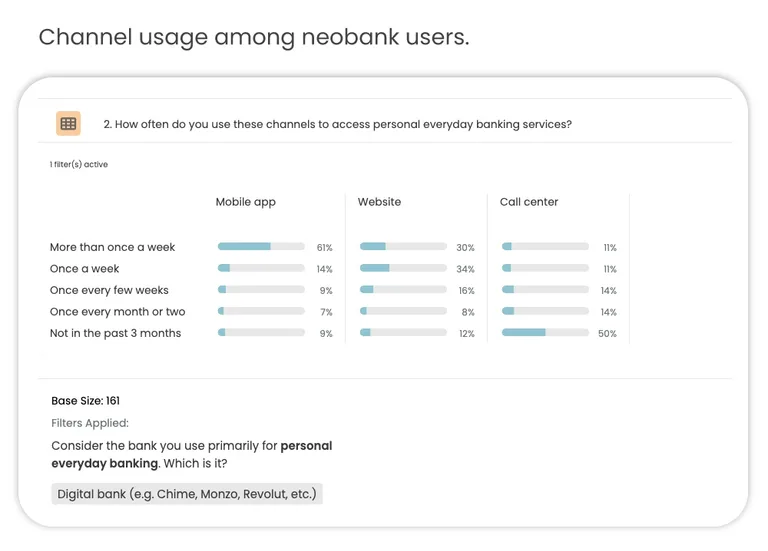

A mobile app and a website are the most used channels both among brick-and-mortar and neobank users – these channels are being accessed more than once a week or once a week. In contrast, brick-and-mortar users visit a branch once every month or two, whereas a call centre is something that both subgroups haven’t accessed in the last 3 months. It’s worth noting that this might have something to do with the pandemic, though still interesting.

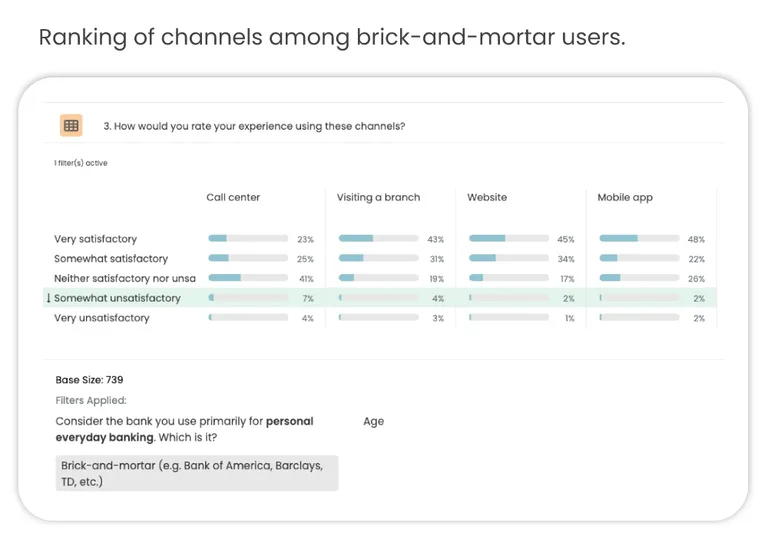

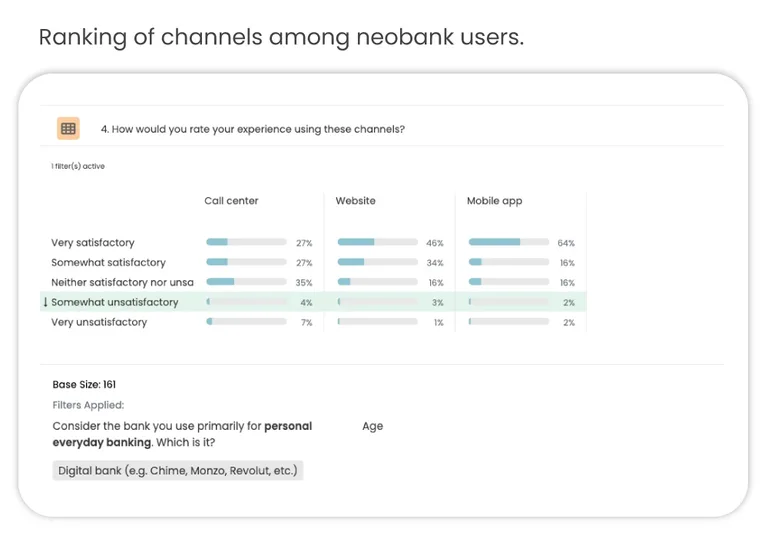

And there’s a clear reason for that. A mobile app and a website are ranked as the most satisfactory channels, whereas a call centre is considered somewhat unsatisfactory or very unsatisfactory among both subgroups.

The unpopularity of the call centre might be explained by different things, e.g. service is not as convenient or quick as tapping/clicking a few buttons, consumers may not like engaging with interactive voice response (IVR) systems, or maybe the customer service is not as good as it is online. This trend shows that there’s a strong call for banks to digitize effectively, even (and maybe especially) if they are brick-and-mortar.

It’s interesting to note that, for both types of banks, the mobile app is the primary interaction, followed by the website. This means that the customer experience of digital and neo-banks is similar. In this context, brick-and-mortar banks need to find ways to differentiate themselves with a unique mobile app experience. Whether it’s a better interface or innovative features (such as the one we describe in Insight #6), a good app seems to be the deal-breaker for consumers.

3. The perfect bank offer must nail two things – security and convenience

We surveyed consumers to tell us which features they would love to see more of when it comes to managing chequing/checking and savings accounts, credit cards and online banking. Across the whole study, we discovered that features related to the protection of personal information and provision of comfort are highly popular among both brick-and-mortar and digital users.

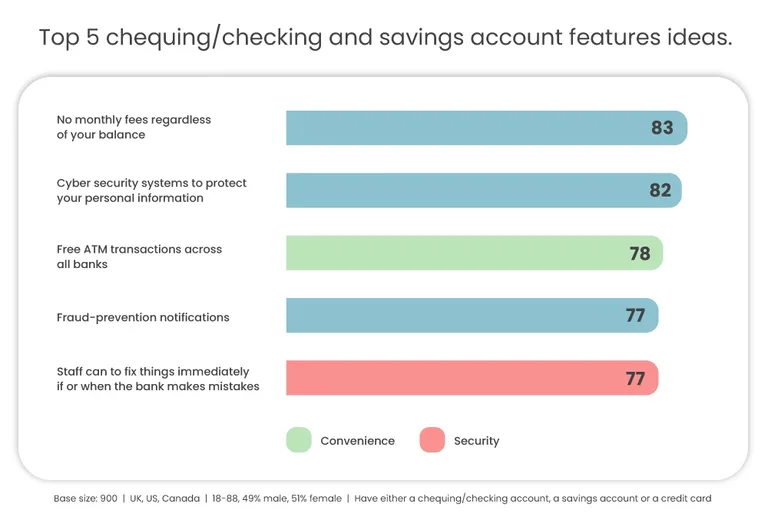

Chequing/checking and savings accounts:

The top five winners in this territory are outlined in the chart below. We went ahead and found commonalities and patterns in the data. If we were to group some of these offers into buckets, we can see that “cyber security systems to protect your personal information” and “fraud prevention notifications” would be combined into the Security bucket. “Free ATM transactions across all banks” and “staff can fix things immediately if or when the bank makes mistakes” make up part of the Convenience group.

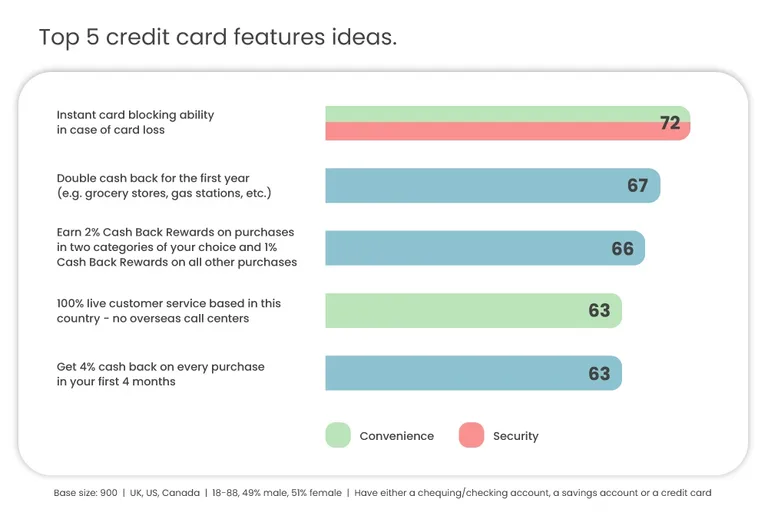

Credit cards:

Among the top 5 features in the credit cards idea screen, we can see “instant card blocking ability in case of card loss” to fall both into the Security and Convenience buckets. “100% live customer service based in this country – no overseas call centres” can be categorized in the Convenience group.

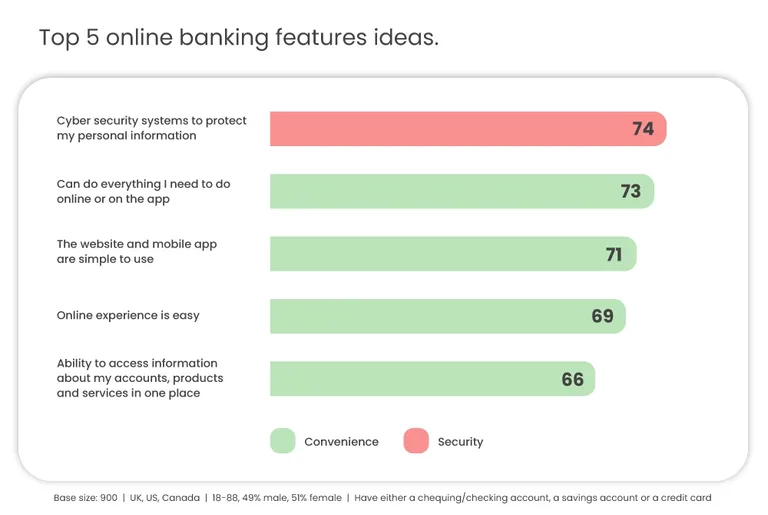

Online banking:

Finally, all of the ideas in the top 5 list of online banking features fall into our categories. “Cyber security systems to protect your personal information” is clearly in the Security group, whereas the remaining four ideas are in the Convenience group.

A bank or a financial provider can use this data as a basis to start creating a variety of features related to security or convenience. Of course, the bank can choose to move away from these areas to differentiate itself, but we believe these are a good source of inspiration for innovation or marketing messages (if these features are already a core part of your offering). It might also be possible to disrupt the category by creating an offer that does not fall into these territories or that borrows cues from multiple territories to create something new.

4. The winning offer should be about delivering experiences that solve people’s frequent needs

As we looked at the ideas on a large scale, we discovered that consumers are less interested in offers that solve specific or niche problems. They are more inclined towards features that solve a problem or satisfy a need they experience every day.

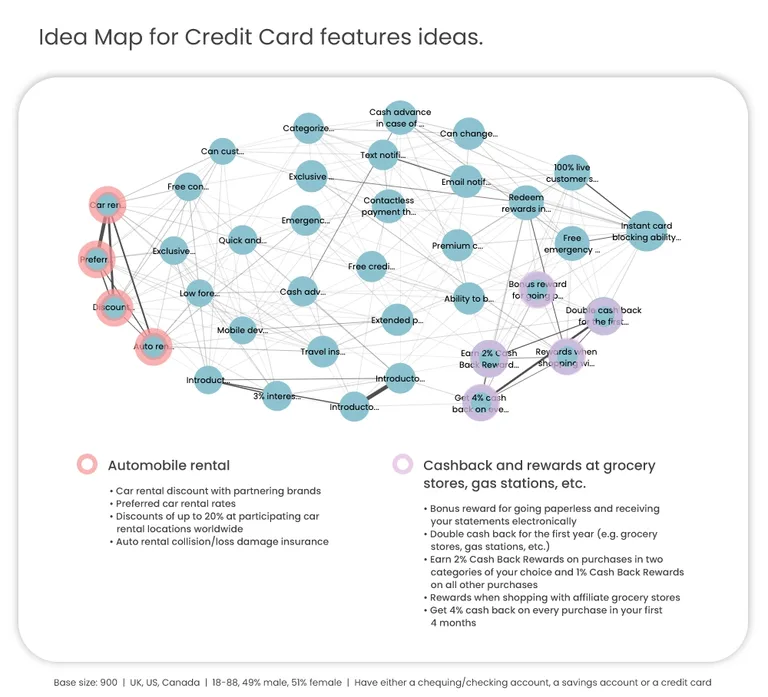

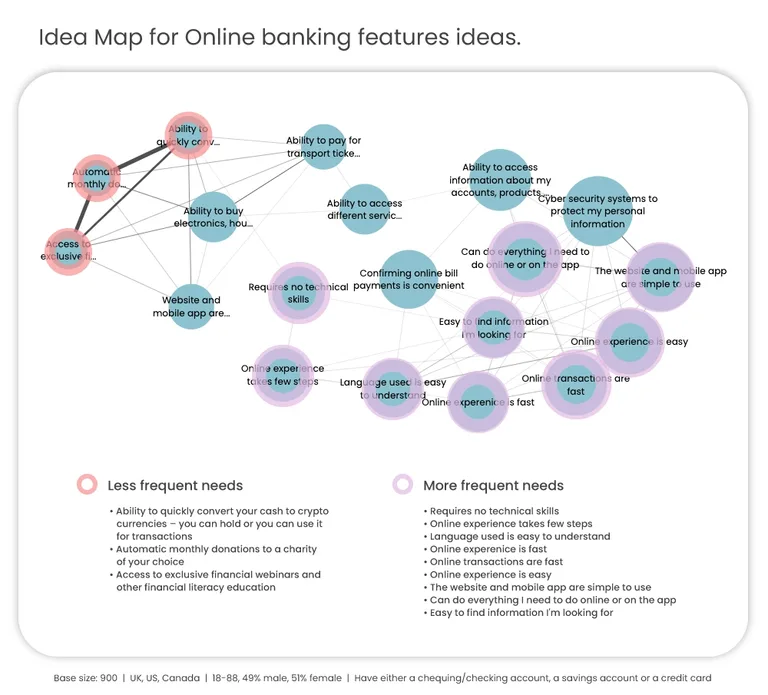

To see how the ideas mapped out, we used our Idea Map tool. Idea Maps illustrate the relationship between the ideas in your study. The thickness of lines between nodes and the proximity of nodes represent the strength of the relationship. The ideas that appear closely interconnected (have a high frequency of connections) are perceived as sharing similar attributes. Ideas that linger on the periphery or don’t cluster on the map and with fewer connections are perceived as sharing fewer attributes in common with the other ideas.

Credit cards:

The credit cards Idea Map is pretty well spread out, though we can see some small territories forming.

If we move our gaze from left to right, we can see that the clusters of ideas gradually change from broad to specific. For instance, the cashback-related ideas in the bottom right corner are regularly useful – i.e. cashback can be applied at a variety of places, such as grocery shops and gas stations. Also, a wide range of people can relate – everyone goes grocery shopping.

In contrast, the ideas on the left are primarily about automobile rental. Not only is this cluster of ideas very specific to just one area of service (car rental), but it’s also used by a lower number of people – i.e. not every person rents a car.

Online banking:

The features in the online banking idea screen also reinforce the idea that consumers are looking for features that impact their lives frequently instead of particular offers.

The most popular ideas are the ones in larger circles on the right side. What unites them is that they are describing the user experience while using online banking – e.g. “the website and mobile app are easy to use” and “online transactions are fast”.

On the other hand, the ideas on the left in smaller circles are very specific – e.g. “Ability to quickly convert your cash to cryptocurrencies – you can hold or you can use it for transactions” and “Automatic monthly donations to a charity of your choice”. It’s interesting to see that despite not sharing any common traits as bank offerings, they are connected so closely on the map. Our assessment is that they are closely interlinked because of how specific they are compared to all the other ideas in the study.

5. Banks should focus on empowering customer autonomy

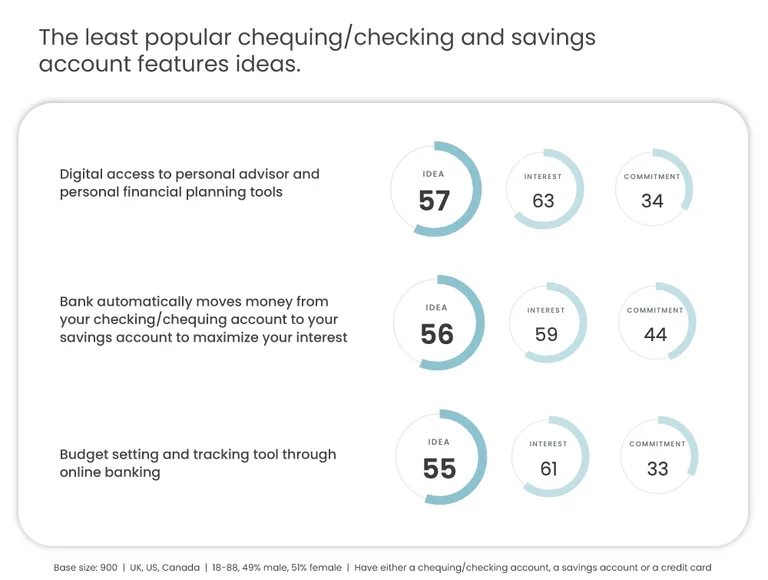

The least popular ideas in the checking/chequing and savings accounts idea screen include “digital access to a personal advisor and personal financial planning tools” (Idea Score of 57), “bank automatically moves money from your checking/chequing account to your savings account to maximize your interest” (56), and “budget setting and tracking tool through online banking” (55).

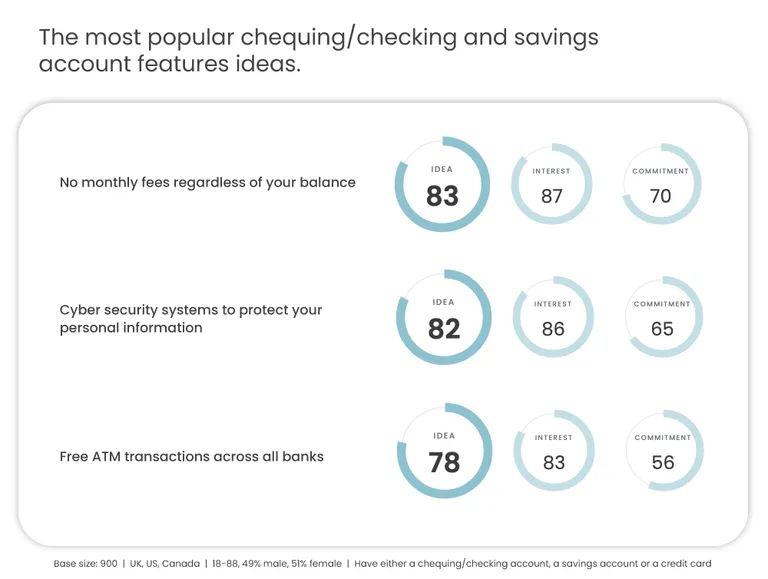

In contrast, the winners include “no monthly fees regardless of your balance” (83), “cyber security systems to protect your personal information” (82) and “free ATM transactions across all banks” (78).

Can you see the difference between the most and least popular ideas? The losing features are all about services that let your bank plan out and manage your finances for you. The winners, however, include offers that allow you to lower your costs and protect your data.

It seems like, despite the fact that consumers generally trust their banks, they don’t want their provider to manage their personal banking for them. Instead, they want their banks to provide the tools and environment to do everything themselves. Perhaps this insight explains the whole point of everyday banking – you don’t need someone else to tell you how to spend your money on the basics. You just want to have the convenience and low cost to do it yourself.

6. An opportunity to innovate might lie in retail integrations

It’s good to see what consumers want to see more of from their banks, but we also wanted to know which new features they would want to use in the future. We’ve included a few new ideas that could show potential. The results in the online banking idea screen showed some compelling results.

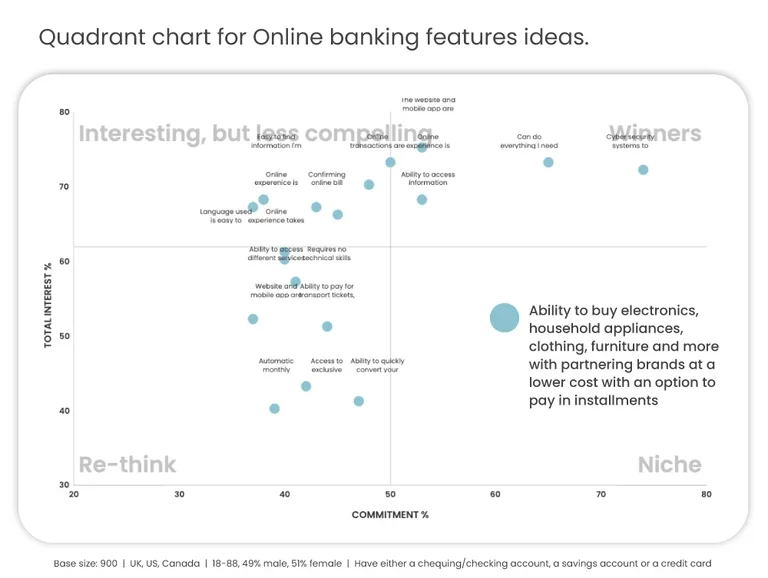

The quadrant chart below categorizes the banking features into four brackets, according to the balance between their ‘Total Interest’ – how many people swiped right – and their Commitment Score – how often they chose a specific feature when pitted against another feature that they liked.

One of these innovation ideas appeared as an outlier in our study. “Ability to buy electronics, household appliances, clothing, furniture and more with partnering brands at a lower cost with an option to pay in installments” is clearly in the Niche corner, performing relatively low on Interest and relatively high on Commitment. This means that while this offer wasn’t very interesting to the broader group, those who did like the idea continued to pick it over others.

We often find ideas with breakthrough potential in the Niche quadrant, meaning that this feature has the potential to succeed with a specific audience group if a bank wants to pursue it in the future.

The fact that this feature was more related to shopping shows that consumers are looking for opportunities to combine retail purchases with everyday banking. If banks collaborate with retailers to let consumers shop seamlessly through the bank, this could open the banks to a whole new area of innovation. And the same goes for retail: with the acceleration of online shopping during the pandemic, “piggybacking” on banks might help brands improve their sales and create another channel to convert shoppers.

To sum up

The rivalry between brick-and-mortar banking and neobanking is not always black and white. While neobanks make banking simple and digital-first for consumers, traditional banks carry a heavy load when it comes to complex issues.

Brick-and-mortar banking is not likely to vanish in the next few years, and the data proves this out. But when we assess the consumers’ attitudes towards banking in general, we see some strong trends that govern both traditional and digital banking.

There’s so much more that we discovered from our study of everyday banking. If you want to share the results with your friends and colleagues, see the infographic with all the insights you need.