Would you trust a robot with your savings? Some might say, “of course, they’re so accurate!”. Some might doubtfully say, “I don’t trust machines” (getting some I, Robot vibes here).

Robo-advisors, digital platforms that offer automated and data-driven financial planning and investment services without a human advisor’s interaction, have been on the rise for the last few years.

At Upsiide, we were interested in why people choose automated investment advisors over other types of investing and what kinds of features they look for in an investment service provider in general. We tested 37 features with US, UK and Canadian consumers and found out what they think of their service providers in general. After searching for some patterns, we were able to determine why consumers choose what they chose and what finance brands can do with these insights.

We did a similar study on everyday banking features and found some fascinating results. Check them out right here.

Before we run through the results, here are some details on our sample and an explanation of how Upsiide’s scores work:

- Number of respondents – 900 people in total

- Countries – UK, US, Canada

- 18-85, 55% male, 45% female

- Those who invest through one of the following:

- Self-directed investing

- Robo-advisor

- Bank branch

- Full-service investment advisor or investment council

- Employer-sponsored investment account

- Those who have more than $1 of investable assets

- The study was fielded between November 15th and November 18th, 2022.

The Interest Score is the proportion of people who liked an idea (in this case, an investment feature) and is expressed as a percentage. When respondents like two ideas, they are asked to trade-off between them, picking a favourite – which generates the Commitment Score (often referred to as “Commitment”). Finally, the Idea Score is based on a combination of the Interest Score and the Commitment Score – it’s an absolute score that’s been calibrated to predict the performance of an idea in-market.

And just in case you need a quick refresher, here are some definitions of different investment services we reference throughout the piece:

- Self-directed investing provides you with a variety of investment selections that you can manage by yourself online. Instead of leaving your investments on autopilot, you can take control of your investment decisions. This way, you pick your preferred investments and carry out your own investment strategy.

- Robo-advisors (also known as automated advisors) are services that use computer algorithms to build and manage a client’s investment portfolio. They require little human interaction. You set your parameters, such as your time horizon and how much investment risk you’ll accept, and let the computer automatically build and rebalance your investment portfolio.

- Investment through a bank branch means that bank branch-based advisors or financial planners will help you manage your investment portfolio in person, by phone or by other digital methods.

- Full-Service Investment Advisors, or an Investment Council, are stockbrokers/investment advisors that you can hire to get highly personalized advice and manage complex needs across wealth, tax, estate, retirement planning, etc. You’ll generally meet your advisor locally, at his or her office, to create and go over your financial plan.

- An employer-sponsored Investment Account is a type of benefit plan offered to employees at no or relatively low cost. These plans cover an array of services, including defined contribution pension plans, employee stock ownership plans, share options, etc.

Well, the numbers speak for themselves. Let’s see the results.

1. There is a widespread appetite to automate certain aspects of banking and investing

Almost half of the respondents use self-directed investing services (48%). In contrast, automated advisor users make up about 16% of the total (with only 144 people out of 900). It’s worth noting that these groups are not mutually exclusive, i.e. those who use automated advisors may also use self-directed investing services. Nonetheless, the low percentage of robo-investment advisor users shows that the mass market doesn’t yet feel confident relying solely on machines to manage their finances.

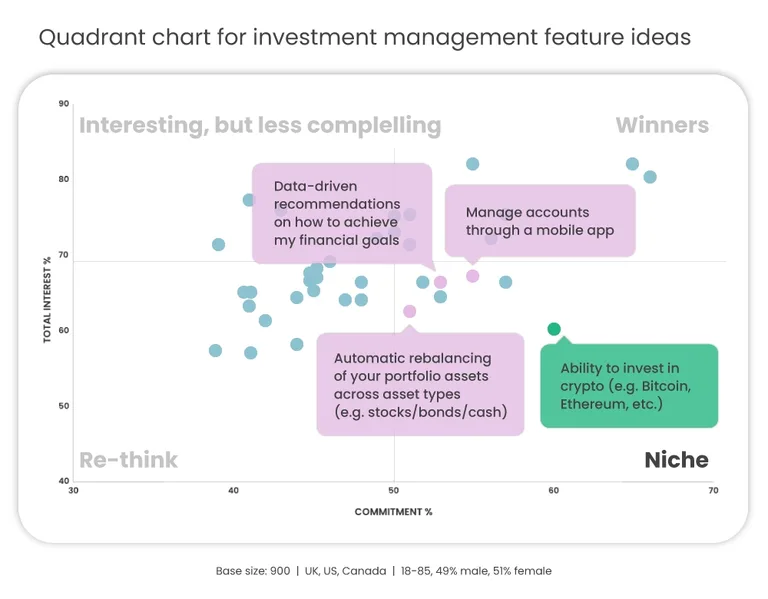

But let’s have a look at how the features spread out on Upsiide’s quadrant chart. The quadrant chart categorizes the features into four brackets, according to the balance between their Interest Score’ – how many people swiped right or liked a feature – and their Commitment Score – how often they chose a specific feature when pitted against another feature that they liked.

The Niche quadrant in the bottom right corner usually shows ideas with breakthrough potential, meaning that this feature has the potential to succeed with a specific consumer group. It’s evident that the “ability to invest in crypto (e.g. Bitcoin, Ethereum, etc.)” is an outlier in this corner. While only a small group of consumers found this feature interesting, those who did were very passionate about it.

But let’s also have a look at other patterns. Some of the ideas in this quadrant include “automatic rebalancing of your portfolio assets across asset types (e.g. stocks/bonds/cash)”, “manage accounts through a mobile app” and “data-driven recommendations on how to achieve my financial goals”.

What unites these ideas is that they’re all capabilities that automated advisor apps offer. The fact that people report high Commitment to these features shows that consumers are interested in automated advisors, even if they don’t use them or are not aware of them.

We also think this might mean people are interested in automating some parts of the tools they use. Since the majority of consumers use self-directed investing platforms, perhaps they still want to have the power to manage their finances manually with the option to automate some features (e.g. have an option to automatically sell a stock when it reaches a certain point). These kinds of tools already exist in some self-directed investing platforms, so maybe this result just shows the areas in which users want to be automated.

Nonetheless, the fact that these features appear in the Niche quadrant shows that there is a market for them – it’s about positioning them effectively with the right people. If robo-advisors can communicate these features to the right audience, they are likely to capture that market before self-directed investing platforms have the time to catch up.

2. Robo-advisor users intuitively prefer features that denote ease of use as opposed to the capabilities of, well, the robot

It seems like the general public is curious to use the features that automated advisors offer. So, we wanted to see how those same features performed with current robo-advisor users.

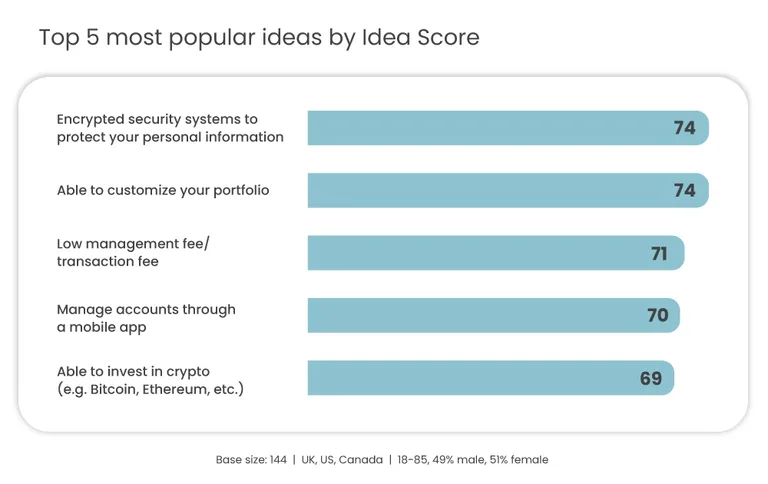

The top 5 most popular ideas are outlined below. Automated advisor users like the convenience and low-cost options that automated advisors offer – “low management/transaction fees”, “manage accounts through a mobile app” and “able to quickly transfer funds” rank third, fourth and fifth, respectively.

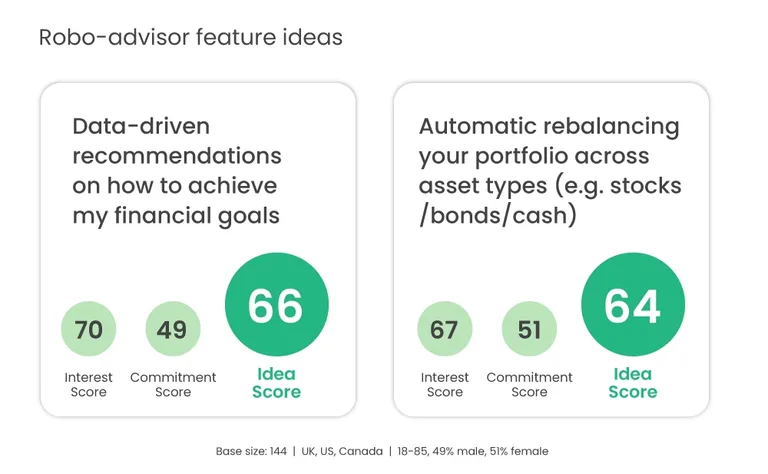

But what about the features that exclusively relate to robo-advisor capabilities, e.g. “automatic rebalancing of your portfolio assets across asset types (e.g. stocks/bonds/cash)” and “data-driven recommendations on how to achieve my financial goals”? Surprisingly, those two ideas didn’t perform as well as we expected.

We think this might be because consumers consider the above aspects of robo-advising as a given, i.e. something that should already be covered by the platform. On the other hand, it could also be that these ideas might not be as important to this sub-group as more features that emphasize ease of use like ‘able to quickly transfer funds’. This insight is particularly important to consider as a financial institution builds its messaging hierarchy.

3. All consumers still value personalization and human interaction across their banking and investment providers

We wondered what other areas of innovation automated advisors could tap into in the future, and it looks like (in general) people are looking for features that go beyond something robots can offer.

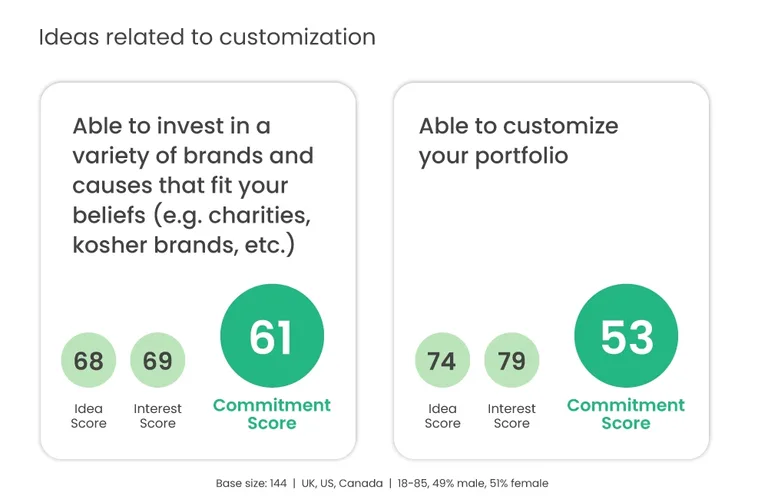

The first area that people seem to be interested in is customization. “Ability to customize your portfolio” scored the highest in the Interest Score, meaning that people found this idea the most attractive. “Ability to invest in a variety of brands and causes that fit your beliefs (e.g. charities, kosher brands, etc.)” was the highest ranking idea in terms of the Commitment Score (Commitment Score of 62%, compared to the average of 48%), meaning that people chose this idea over other ideas that they also like. Due to its high Commitment Score, this feature could give a brand an opportunity to differentiate an offer meaningfully. While not everyone wants to invest to support their values, for those that do, it will cause them to shift their asset allocation.

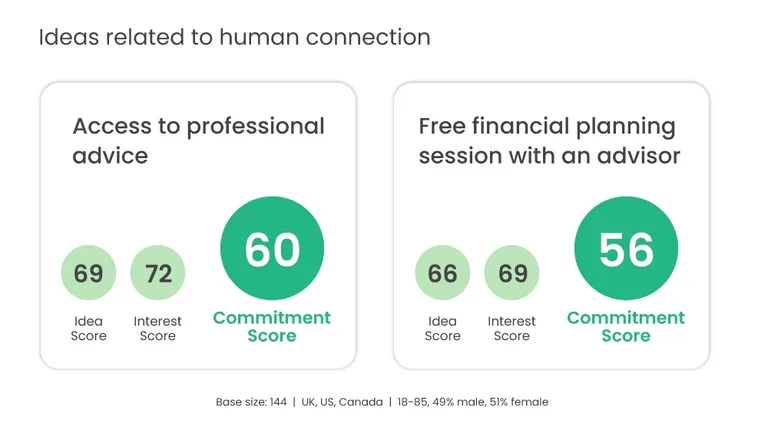

The second area is human connection. In terms of Interest Score, features related to human advisors didn’t rank high in Interest score, meaning that automated advisor users placed less emphasis on humans. But when we look at features that ranked high in Commitment Score, they, in fact, performed well. “Access to professional advice” was one of the top 3 ideas in the Commitment Score. “Free financial planning advice” appeared in the Niche quadrant when we filtered to the robo-advisor user group and has a Commitment score of 56%. This means that this small group of people who liked human-related features found them very appealing.

Customization and human support are not something that all robo-advisors out there offer at the moment, but it looks like some automated advisor users still find these features important. Despite the platform’s ability to manage your finances using a sophisticated algorithm, people still crave human interaction to adjust their portfolios and perform more complex tasks.

An automated advising provider can use this insight to create new offers that would fulfil the consumers’ needs in an innovative way. Wealthsimple, for example, is one of the leading Canadian robo-advising services, and one of its unique selling points is portfolio customization and access to socially responsible organizations.

4. The perfect robo-advisor should offer…

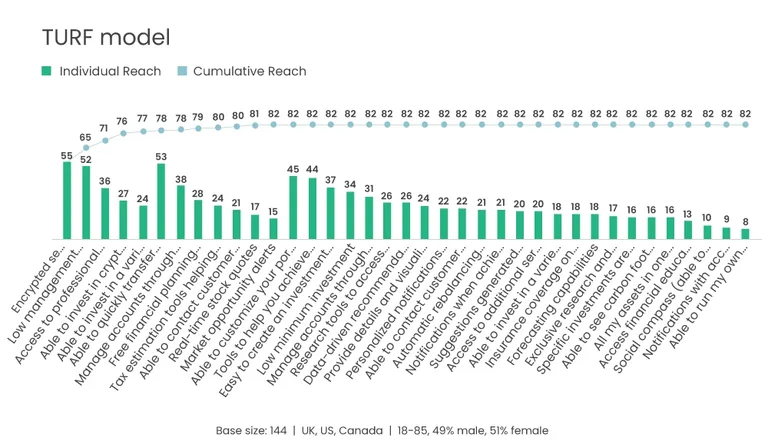

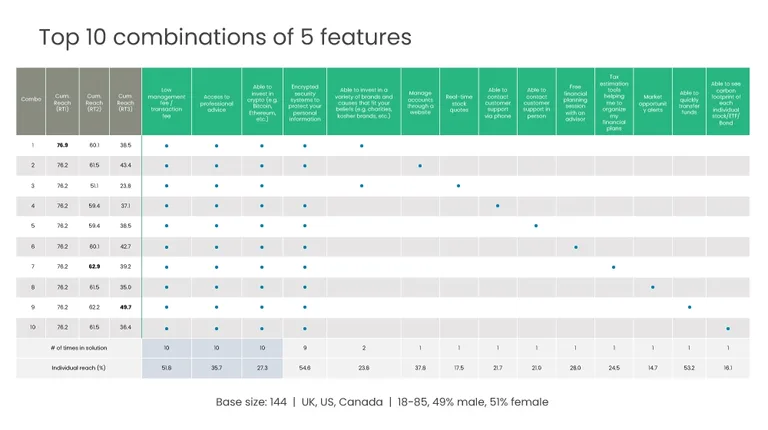

Now that we know some areas that automated advisors should consider tackling in the future, we wanted to sum up our findings and determine which offers an ideal robo-advising provider should feature to capture the most consumers. And for that, we leveraged Dig’s TURF (Total Unduplicated Reach and Frequency) modelling tool.

TURF tells us the combination of products/features that appeal to the most people. This model can then help a brand identify an optimal portfolio of features.

The chart above shows that 55% of consumers are interested in “encrypted security systems to protect your personal information.” But if the brand also offers “low management/transaction fees”, they can reach 65% of consumers. The percentage of customers reached increases as we add more features, until the results slowly plateau.

We can see that the top 5 features include:

- Encrypted security systems to protect your personal information

- Low management fee/transaction fee

- Access to professional advice

- Ability to invest in crypto (e.g. Bitcoin, Ethereum, etc.)

- Ability to invest in a variety of brands and causes that fit your beliefs (e.g. charities, kosher brands, etc.)

But this is not the only combination of features a robo-advisor can use. TURF modelling reveals 10 different feature mixes that have the potential to reach a similar percentage of people. According to the table above, the features that appear in all 10 feature mixes are “low management/transaction fees”, “access to professional advice” and “ability to invest in crypto (e.g. Bitcoin, Ethereum, etc.)”.

And depending on the brand’s capabilities and resources, it can choose two other features in the table. For instance, if for some reason, the robo-advisor provider doesn’t have the capability to offer the “ability to invest in a variety of brands and causes that fit your beliefs (e.g. charities, kosher brands, etc.)”, it can focus on offering the ability to “manage accounts through a website” and develop a super user-friendly website.

It’s interesting to see “access to professional advice” in the list of top 3 most frequent features. This fact proves again that consumers are looking for a bit of human interaction to help them manage their finances instead of exclusively a machine.

To conclude

Investing through robo-advisors is still in the early stages of adoption, primarily because consumers are still getting used to computers managing their finances (purely digital banking wasn’t a thing until a few years ago!). But change is slowly happening, and automated advisor providers can look for ways to entice consumers with specific features and messaging