What sustainability in fashion retail looks like and why it matters

Can retail and fashion ever be sustainable? Is it possible to be stylish and take care of the planet at the same time? What should businesses do to help consumers make more sustainable choices, and do they even have the power to do that?

The role of sustainability and ethical practices in business has evolved over the last few decades. But it’s in the last 10-20 years that global brands have put their money where their proverbial ‘mouths’ are to influence real change. And while much of this emphasis on sustainability stems from positive intentions from business leaders, it’s also true that consumers are demanding further action from brands they care about. The public has absolutely become more involved in learning how the food they eat, the drinks they drink, and the clothes they wear impact the environment.

Fashion retailers have been doing the hard work; looking inwards at operations and supply chain practices, scouring their marketing efforts to optimize messaging, selecting sustainable and eco-friendly packaging, and sourcing ethical materials. And yet, there’s still work to be done.

A bit of context about the fashion industry:

- Water usage: the fashion industry currently uses 79 billion cubic metres of water per year, which is 2% of all freshwater extraction globally (Common Objective, 2018)

- Plastic microfibers: approximately 35% of all microplastics that are thrown into the ocean are from synthetic materials (Science of the Total Environment, 2019)

- Rise of pollution: 57% of all discarded clothing end up in landfills (Common Objective, 2018)

Because of COVID-19, the role of sustainability in retail has become more urgent than ever. As the pandemic forced many to pause their daily routines and rhythms, sustainability and environmental problems became more prevalent in people’s minds. People had more time to consider what’s most important to them when making purchasing decisions, taking a closer look at the environment while doing so.

In a study led by McKinsey & Company post-pandemic, they note that “two-thirds of UK and German consumers are saying it has now become even more important to them to limit the impact of climate change”. IBM’s 2020 survey reports that “6 in 10 consumers are willing to change their shopping habits to reduce environmental impact”. It seems that the pandemic opened many people’s eyes; they realize how every little action has a massive effect on the planet.

What do consumers look for when choosing a retailer?

As consumers are becoming more conscious about what they buy and where their products are coming from, retailers need to meet customer expectations.

Whether it’s about messaging on-pack, the way the product is shipped to their door, fair wages for workers, or the sourcing of materials – customers are scrutinizing every little detail of the journey from production to transportation to unboxing.

People today are willing to pay a premium for a product created sustainably, or at least by a brand they perceive to be sustainable. Given the option to buy from a company of questionable character, consumers will often wait to make a purchase until they can do business with a brand they trust.

IBM:

75 percent of brand-driven consumers say they conduct substantial amounts of research prior to making purchases.

But how can retailers make sure that they communicate with consumers the right way?

The global sustainable investment is now worth over $30 trillion dollars – a 68% increase since 2014.

H&M recently launched a clothing recycling program to repurpose old garments to create brand-new items. Nike and Adidas have introduced shoes and clothing lines made of recycled plastic materials. Levi’s recognized their product’s excessive usage of water, which is why they started the Water<Less program, in which they committed to cut back their water usage by 96%.

In today’s world, a brand’s sustainability initiatives are a core part of its business strategy. But which parts of their sustainability practices matter most to their customers, and which initiatives need to be folded into their messaging hierarchy? To what extent?

At Upsiide, we decided to ask the public ourselves. We leveraged Upsiide’s idea screening methodology to understand what a nationally representative group of 500 US shoppers thinks about sustainability claims on retail packaging and tags and how they feel about sustainability in general.

In the following sections, we’ll share the data and key insights and show you how to create an effective on-pack claim.

Our methodology

So, how exactly did we learn what people think about sustainability in retail?

Asking people about their thoughts on such a wide-reaching topic is challenging, especially if you want to apply the findings to a specific brand or purpose. That’s why we’ve focused our research on learning the public’s buying behaviour in general and how they react to specific on-pack messages.

We surveyed 500 shoppers from across the USA and tested their reactions to 21 claims about sustainability. To identify which claims work best, we decided to include different variations of the same messages. This way, we not only get a sense of specific claims but also copy preferences.

Respondents were shown each claim one at a time, and they swiped right if they liked it and swiped left if they didn’t. Apart from choosing the claims, they also filled out a series of questions about their demographics, shopping behaviours and views on sustainability in retail.

Upsiide is designed not just to conduct surveys and gather data but to unearth marketable insights. Its intuitive, mobile-first surveying style makes the process far more natural for audiences, helping to ensure a high degree of accuracy. The Upsiide dashboard also makes it easy to visualize the data, allowing you to spot patterns, anomalies, and quirks far more easily. So that you can draw meaningful inferences based on real consumer behaviour, making your on-pack claim reflect reality.

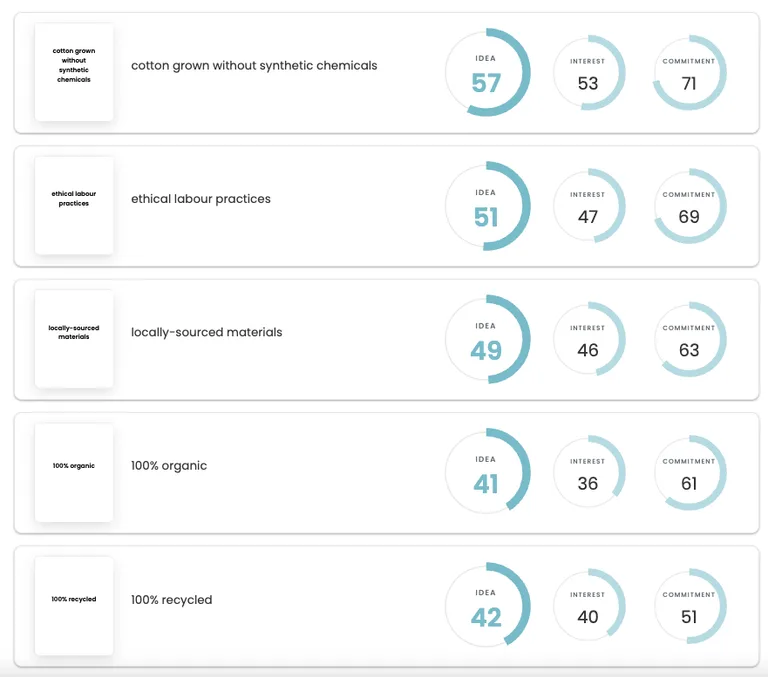

Each on-pack claim is given three scores:

Interest Score:

This is the proportion of people who liked an idea. The Interest Score is a percentage score.

Commitment Score:

When respondents like two ideas, they are asked to trade-off between them, picking a favourite. The Commitment Score is also a percentage score.

Idea Score:

This is a composite metric – so, an absolute score – that’s been calibrated to predict performance in-market. The Idea Score is based on a combination of Interest Score and Commitment Score. Though it might sound simple, we fine-tuned the relative weights of the Interest and Commitment Scores (using the Hierarchical Bayesian (HB) Linear Model) and consistently validated them with in-market realities. This resulted in a brand new metric that will help you predict sales volumes.

By prompting respondents to choose between the claims they like, we reveal the hidden strengths and weaknesses behind each.

How we divided the groups:

It’s also worth noting that throughout the study, we’ve grouped the respondents into 3 age groups:

- 18-34 years old – the youngest group of consumers

- 35-49 years old – the middle-aged group

- 50-88 years old – the oldest age group

This helped us understand the data in terms of demographics and find some interesting insights about how age influences purchasing behaviour.

Some highlights from the report

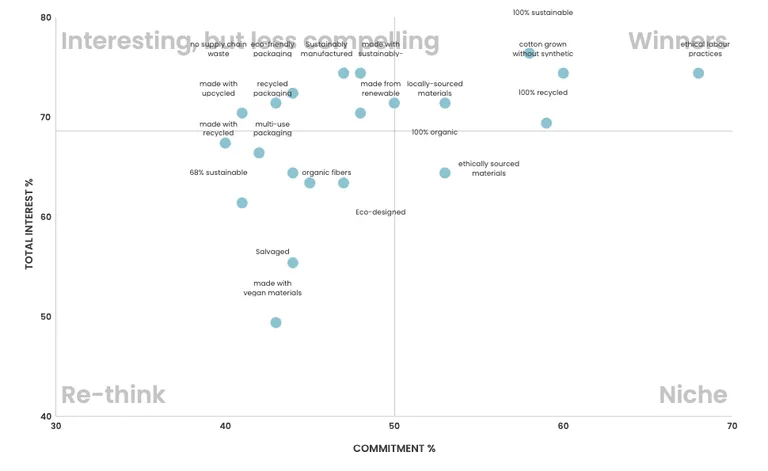

The quadrant chart below plots all 21 on-pack claims into four brackets, according to the balance between their ‘total Interest’ – how many people swiped right – and their Commitment Score – how often they chose the specific claim when pitted against another claim that they liked.

Those in the bottom-left quadrant need work; in their current formulation, they don’t draw enough Interest, and when they do, they don’t tend to maintain it against other favoured claims.

Those in the top right category (the ‘Winners’) are the opposite, scoring a high level of Interest and then sustaining it when pitted against other claims.

Those in between are more subtle; in the top right, ‘Compelling but vulnerable’, we have claims that gather high Interest Scores but low Commitment Scores.

In the ‘Niche’ category (bottom right), we have claims with lower Interest (indicating a weaker general appeal) but a high Commitment Score, indicating that those who like these claims are very loyal to them.

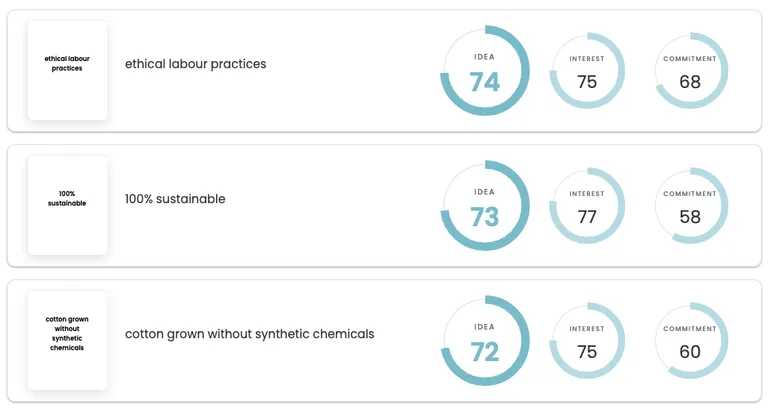

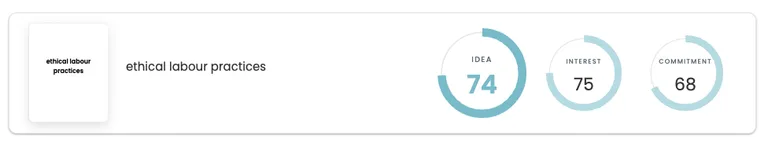

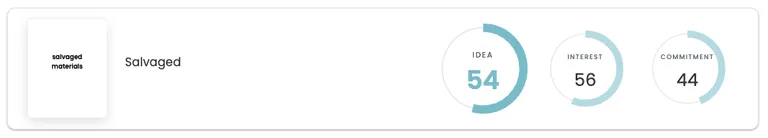

Overall, the chart shows that ‘Ethical labour practices,’ ‘100% sustainable’ and ‘cotton grown without synthetic chemicals’ are the clear winners. In contrast, ‘Made with vegan materials’ and ‘Salvaged’ are the weakest of the claims.

5 key discoveries about on-pack claims

Sustainability isn’t a top priority for most…or is it?

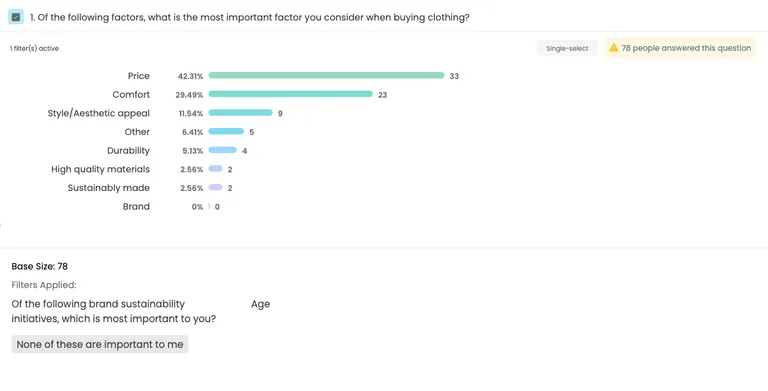

Even though there’s a general demand for more sustainable action from brands, sustainability isn’t the first thing that people think of when choosing a clothing retailer. When we asked people which factors influence their decision to buy clothing, 28% chose ‘Comfort’ and 27% picked ‘Price’. The claim ‘Sustainably made’ came in last place, with only 2% choosing this option when asked ‘what is the most important factor you consider when buying clothing?’.

We should note that claims that didn’t explicitly mention sustainability scored higher amongst participants. 10.2% of shoppers look for ‘high-quality materials’ and 8% seek clothing that is ‘durable’. While these claims don’t directly refer to sustainability, they are closely linked to areas of sustainability, such as the use of organic materials and natural fibres.

When you prompt people, around 50% say that sustainability is important

Based on the data above, you might think that people don’t really care about sustainability. But here’s another side of the coin. When we asked shoppers how important the issue of sustainability is to them, 53.2% believed that it’s “somewhat important” or “very important.” In other words, when you ask people if sustainability is important, over half of them agree it is. So what’s happening here? Our guess is that people genuinely want to make more conscious shopping decisions. But they have to consider so many things when buying a piece of clothing that sustainability just doesn’t top that list.

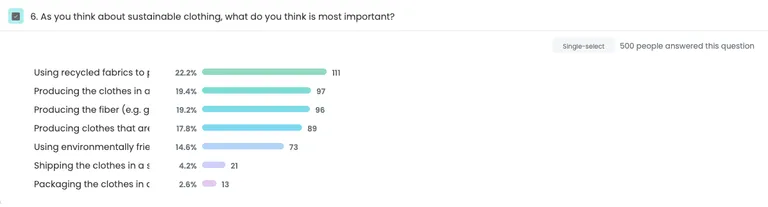

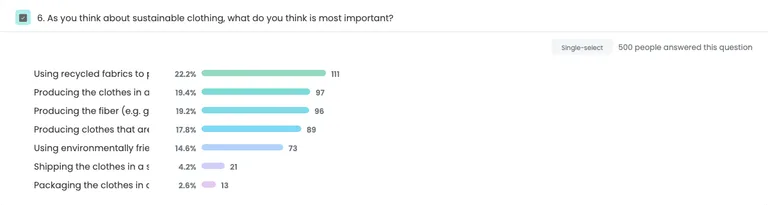

It’s all about the fabric

The clothing industry is often criticized for its damaging effects on the environment, accounting for 10% of global carbon emissions and 20% of waste water. But when we asked consumers which aspects of sustainability they care about in retail, the ecological footprint wasn’t their primary choice. 22.2% of respondents are looking for the use of recycled fabrics in clothing production. 25.4% are also interested in brands that manufacture clothing with sustainable materials. It seems that shoppers are looking for sustainable initiatives that are directly related to what they wear – i.e. what the clothes are made of and how the materials feel on their skin.

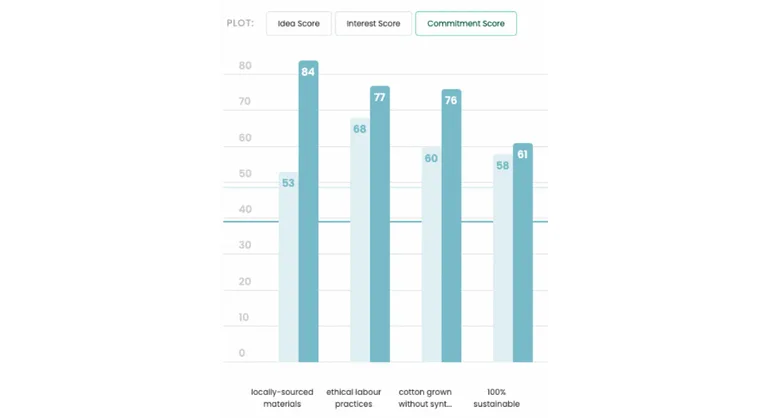

Age matters

Age was one of the biggest factors that influenced people’s attitudes towards on-pack claims. The 18-34 group chose ‘100% sustainable’ as the most popular claim (Idea Score of 71), but it moves down to second and third place as we go to the 35-49 and 50+ groups, respectively. Moreover, it looks like younger generations were more interested in claims that relate to environmental topics, like ‘100% recycled’ and ‘eco-friendly packaging’. In contrast, those claims come in 9th and 11th among people over 50.

The older group seems to be more concerned about social matters like ‘ethical labour practices’ (76) and the quality of materials they wear (‘cotton grown without synthetic chemicals’, 74). The latter claim was not as favoured in the 18-34 group, garnering an Idea Score of 65. We can see that a person’s age hugely influences their intuitive preferences.

Top Idea Scores for 18-34-year-olds:

Top Idea Scores for 50+ year-olds:

The most popular claim isn’t about the product

On the whole, consumers of all ages seem to be more attracted to claims that relate to how a company treats their employees. For shoppers who stated that the issue of sustainability in clothing production is “important” or “very important,” ‘ethical labour practices’’ came in second, with an Idea Score of 80. ‘Ethical labour practices’ moves into 1st place when it comes to Commitment Score; – when people had to choose between ‘ethical labour practices’’ and something else, they preferred the former.

And there’s more. Even respondents who told us that sustainability isn’t “particularly important” or “not at all important” to them preferred ‘ethical labour practices’’ over other claims, giving this claim an overall Commitment Score of 69%. This might mean that while environmentally friendly claims ((e.g. ‘100% recycled’ or ‘vegan’) don’t necessarily influence shoppers at the point of purchase, they do want brands to treat employees and suppliers fairly.

Commitment Score among people who chose the “not particularly important” and “not at all important” options.

So what about the people who don’t care about sustainability?

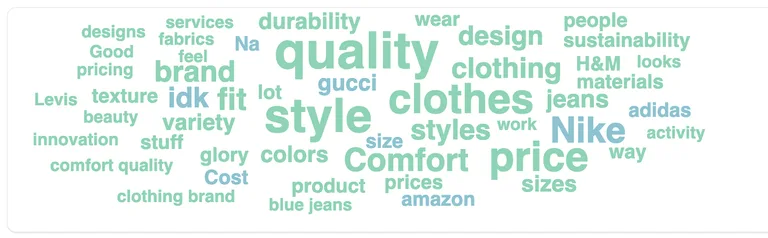

It might be tempting to only focus on people that are genuinely interested in sustainability. However, the results show us that there is a substantial amount of people who do not define sustainability as a top factor when shopping for clothes. When we asked consumers to tell us, in their own words, what they like most about their favourite clothing brand, the majority of the responses featured words like “quality”, “comfort”, and “style”. Sustainability doesn’t spring to mind.

The most used words and phrases to describe why people like their favourite brands

If we look at the data about shoppers’ clothing purchasing habits, we see that roughly one quarter (27%) ‘often’ consider a brand’s sustainability practices before buying, while 28% ‘sometimes’ consider this info. This is the second time that we have seen over half of consumers claim to be influenced by sustainability messaging.

The question lies not in whether you should target people who don’t care about sustainability but how you should approach this group through your messaging. Our data reveals that there are specific claims that work best for subgroups within this segment.

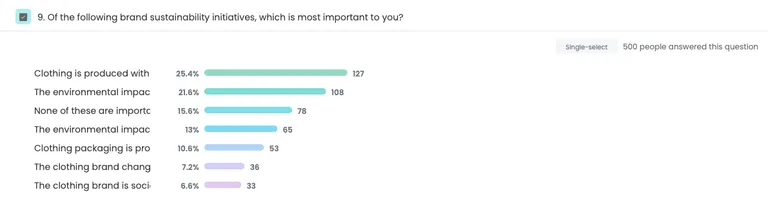

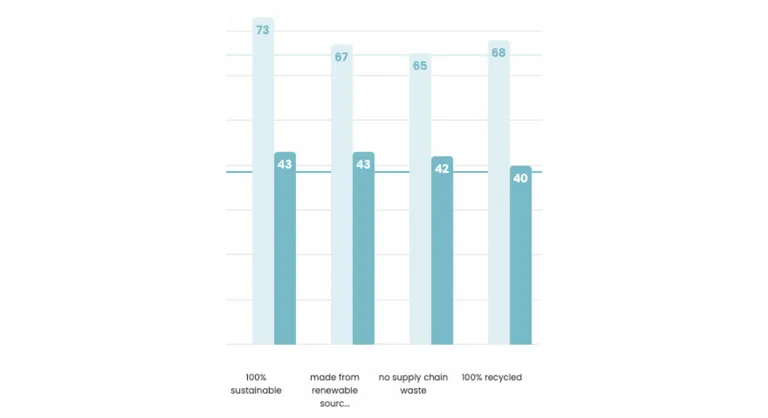

We’ve identified this specific “Uninterested in Sustainability” segment by isolating those people who answered ‘None of the above’ to the question “Of the following brand sustainability initiatives, which is most important to you?”. There were 78 respondents who chose this option, who make up 15.6% of the total respondent base.

Older generations just want to feel good in new clothes

If we look at the “Uninterested in Sustainability” group, we see that approximately 50% of them are people aged 50+ (42 out of 78). In contrast, there are only 17 participants aged 18-34, which indicates that sustainability is a less popular topic with the ageing population.

The older people are, the more specific their interests become. It seems that the older population is more interested in the way the clothes feel and how they were made. ‘Cotton grown without synthetic chemicals’ tops the chart among this group. Although shoppers in the older age group appear to be less committed to sustainability, they still care about practical packaging claims that relate to the tactile experience of wearing the clothing.

However, there’s a winning claim that edges out the “cotton grown without synthetic chemicals” in the Commitment – it’s ‘locally-sourced materials’, which gained a whopping 84% in Commitment Score. This result suggests that the older age group cares not only about supporting local businesses but also about reducing carbon footprint.

Prove your point

Even though 15.6% of respondents told us that none of the proposed sustainability initiatives were of interest to them, some sustainability claims appeal to them more than others. This group chose on-pack claims that are easier to prove either by touching the material (‘cotton grown without synthetics’) or looking up the source of the fabric (‘locally-sourced materials’).

It’s also interesting to see how those who are ‘Uninterested in Sustainability’ react to claims with percentages. On-pack messages that use numbers or proportions did not fare as well with the contingent of respondents that are “Uninterested in Sustainability.” While all respondents loved claims like ‘100% sustainable’ (73) or ‘100% recycled’ (68), the Idea Scores for these claims were only 43 and 40 for the “Uninterested in Sustainability” respondents. Perhaps there’s certain skepticism about the validity of those numbers: what does it mean to be 100% sustainable? Is it possible for a product to be made exclusively with recyclable materials?

The darker blue bars show the responses from the ‘Uninterested in Sustainability’ group as compared to the entire respondent base (in lighter blue). It’s visible that more generic claims like “100% Sustainable” did not work as well as they did with the rest of the participants (The Idea Score for this claim plummets from 73 to 43).

Claims that no one liked

So what about those claims that the “Uninterested in Sustainability” group didn’t like? Firstly, this group wasn’t fond of clothing “made of vegan materials” – this claim scored only 22 in the Idea Score. Despite the fact that preventing animal cruelty is a growing trend among many fashion brands, it seems that this segment especially has not yet got its head around moving from animal-sourced fabrics like leather and wool.

The way materials are produced matters to this group a lot. Everyone wants clothes that are fashionable, durable and high quality. Therefore, when they see that their money goes into “salvaged” clothing or “made with upcycled materials,” the associations might be that clothing produced in this way aren’t worth buying because they’re less durable or high quality.

Another insight relates to the use of the word “organic.” The claim “organic fibers” scored pretty low amongst those that are “Uninterested in Sustainability” (26 in Idea Score). You may think that when a piece of clothing is organic, it’s better for you and, therefore, might be more popular. But perhaps the issue lies in the associations that the term organic brings. Organic often means “expensive” because it costs more to produce the product. And when we look at the most important factors that this group identifies when buying clothing, “price” was picked by 42.3%.

Finally, clarity was highly important. What does it mean to wear clothes made of ‘ethically sourced materials’? What does being ‘eco-designed’ entail? Not only are these claims unclear, but they also reveal something about consumers across the board. When a shopper sees these messages, they might ask, “How can I know if they designed this product with environmental protection in mind?” and “Does the way they sourced the materials affect the quality of clothes?”. Buyers might need more details when they see sustainability-specific jargon. Therefore, when you place a claim on the item tag, you need to make sure to use clear phrasing so that your audience knows exactly what your practices are all about.

The bottom six claims across the “Uninterested in Sustainability” group

5 key takeaways from our report

Now that you’re armed with key insights about people’s attitudes towards sustainability claims, what do you do next? Don’t worry, we’ve got you covered.

Tell a compelling story about you and your people

There’s a reason why respondents chose ‘Ethical labour practices.’ You might be asking, why would people choose this claim over more environmentally-charged messages like ‘100% recycled’ or ‘Made from renewable sources’? It seems the reason is that it gives consumers a glimpse into the internal practices of the brand they’re buying from. When a brand says that it makes clothing from recyclable materials, it only tells us about the product. Consumers want brands to tell them about the culture inside the business and the people that work at the company. We’ve seen brands within the fashion and retail industries come under fire for disregarding child labour laws or providing dangerous working conditions in their factories. The fact that we also uncovered that nearly 20% of respondents care about employees and suppliers receiving fair wages only reinforces the idea that consumers are looking for a transparent and honest conversation with businesses they can trust.

19.4% of participants stated that they prefer their clothing to be produced by people who work in good working conditions and are paid fairly.

The lesson?

Consumers care about people within your business – if you’re using ethical labour practices, you should shout about it.

Focus on feel(s)

While talking about your employees and brand culture is a great strategy to attract attention, you need to make sure that you’re also addressing people’s clothing needs. As we’ve seen from the data, shoppers are – above most else – looking for comfortable clothing. Whether the garment is made of recycled or organic fabrics, your product should fulfil the most basic need – protect the body and make for a relaxing, comfortable fit. That’s why claims like ‘Cotton grown without synthetic chemicals’ and ‘Made with sustainably sourced materials’ are so successful. Comfort and the quality of the fabric are especially important if you want to win over your audience.

The lesson?

Choose sustainability claims that speak to the benefits when wearing the clothing.

Clear messaging wins wallets (and hearts)

The words you choose for your sustainability claim make a huge difference. The least popular on-pack messages are the ones that are hard for the consumer to visualize. Look at ‘Ethical labour practices’ and compare that to ‘Salvaged.’

It’s also important to be careful with claims that involve percentages that are…too specific. On the one hand, a claim like ‘100% sustainable’ works across the majority of shoppers; the claim implies that you’re receiving a fully sustainably-made piece of clothing. On the other hand, ‘68% sustainable’ wasn’t as favoured – it might make the consumer question the quality and validity of the product (ie. why only 68%?).

The lesson?

Choose claims that include direct, well-known phrasing.

Show us the proof

Sustainability is hard to measure, especially when you’re a shopper who might not be as well-versed in all of the social and environmental initiatives that your business is taking on. Therefore, consumers assess the product through factual and tangible factors like the quality of the material (‘cotton grown without synthetic chemicals’) and where and how it was produced (‘locally sourced materials’ and ‘made with sustainably sourced materials’). On the whole, shoppers trust sustainability claims that brands make (68% of respondents stated that they believe in sustainability information that they see on clothing), but they want to have the option to verify and track the information themselves.

The lesson?

Back up your claims with accurate and measurable data. While most consumers trust clothing brands, if the claims aren’t clear, you’re less likely to win their business.

Everyone cares about sustainability

The older generation (50-88 years old), which encompasses 40.2% of respondents, is concerned with the social aspects of sustainability, like practicing ethical labour (scoring 76 in Idea score). The younger generation, 33.6%, look for claims that reassure them of the sustainable origins of the product (‘made with sustainably sourced materials’ scores an Idea score of 71). If a person says that they aren’t interested in sustainability, it doesn’t mean that they don’t care about the environment or society. It might mean that they perceive sustainability differently.

The lesson?

Get to know your target audience and start thinking of tailoring your sustainability messaging on-pack to that audience specifically.

A bit about us

For marketing and insight teams that need to predict which ideas, concepts, and designs will perform best in the market, Upsiide is the innovation insights platform that tells you which is the right move for your business’s future. Upsiide was developed by the insights pros at Dig Insights, who are passionate about reinventing the language of research and putting it into the context of today’s business goals.

Get in touch to see how we can supercharge your innovation process.