Ever since we’ve started loosening pandemic restrictions, there has been a steady rise in inflation. Sure, a bit of inflation was expected. But with an influx of money into the market, some supply shortages, and a war in Ukraine, the inflation rate shot to 30-40 year highs. In Canada, inflation hit 6.7% in March (the highest since 1991). And in the USA, inflation grew to 8.5% in March (the largest 12-month increase since 1981).

Everyone is worried about inflation – if you’ve spent any time scrolling through news feeds, you’re aware of the mounting concern. Many businesses think it will take two years to get inflation under control, and in the US, inflation overtook labor quality as the top business problem for small businesses.

But how is inflation impacting people’s shopping behaviors?

We did quantitative and qualitative research to gain a deep understanding of how inflation is affecting Americans and Canadians. Through our research, we were able to isolate three primary segments of US and CAN consumers. The study also uncovered the changes consumers are making as a result of increased prices and, ultimately, what that means for brands struggling to get through this inflationary period.

Consumers’ Financial and Emotional Struggles

It’s not easy out there. Close to 50% of consumers across the US and Canada are worse off financially than last year. Worse still, 71-77% say household income is not keeping up with inflation, leading to more than 60% of consumers being unable to keep up with the cost of living. This financial struggle is impacting more than consumers’ wallets; worries are wreaking havoc on consumers’ emotional and mental well-being.

The stress likely stems from the 39-48% that are concerned they or a household member could lose a job due to inflation. If that’s a primary concern, it makes sense that you are stressed about money and feel overwhelmed by your financial burdens, which is how 63% and 60% feel, respectively.

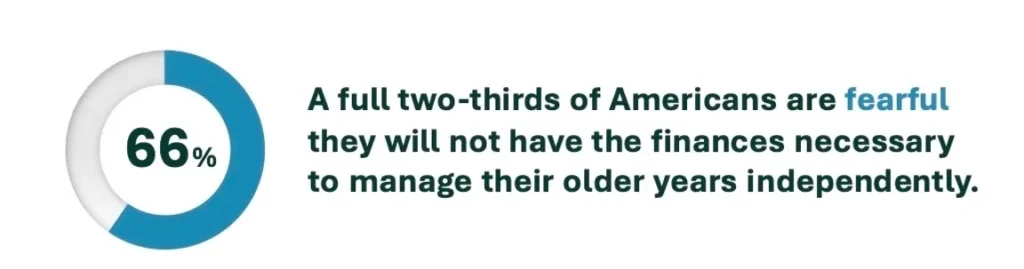

But it’s not even the here and now that’s stressing out consumers, as 66% are fearful they won’t have the finances necessary to manage their older years. Many have found ways to cut back and adapt right now, but there is much uncertainty about what lies ahead.

Struggling, Adapting, or Thriving?

While many are struggling, that isn’t necessarily the case for all consumers. We found three distinct segments of people, and we’ve labeled these segments: Still Thriving, Adapting, and Struggling. (These segments make up roughly the same percentage of consumers across the US and Canada.)

Struggling

Unfortunately, this segment makes up the largest percentage of people in Canada and the US, as 42% of consumers fall into this segment. In this segment, consumers’ financial situation means they are focused on themselves and the impact of inflationary changes on their personal circumstances. Because of this, they’re incredibly reactive to the market. They are spending carefully and making significant compromises in the face of inflation yet still struggling to keep pace with the increased cost of living. These people are most likely to cut back on all forms of spending and to have switched their primary grocery store due to inflation. Because of this, they often shop around and take advantage of deals, flyers, and loyalty points to offset spending.

Adapting

Even though this is the smallest segment of the three, their might is envious. This group tends to skew younger (Millenials or Gen Z). Therefore these consumers are not particularly concerned about their financial security. This group’s financial circumstances mean they’re still focused on the personal impact of inflationary shifts, but unlike those in the ‘Struggling’ segment, they can be more proactive. They are confident in their financial future despite having the highest debt load, with their biggest concern being job loss.

This segment’s primary response to inflation has been to switch service providers (financial, insurance, mobile, cable, and internet) to save a bit of cash. They are also adjusting spending priorities by delaying education or purchasing a house as inflation rises.

Still Thriving

As the name suggests, this segment of consumers is hardly impacted by inflation. They don’t have to worry about keeping pace with their day-to-day expenses, in contrast to the other two segments, and can mostly live life as they had before – taking price fluctuations in stride. As one would expect, they are least likely to have made any significant changes to their spending habits or shopping behaviors.

What’s maybe a bit more interesting about this segment is that they are less focused on the personal impact of inflation. This segment often feels they have financial, career, and home security. Therefore, they can focus more of their attention on those around them that are feeling the pinch. Their empathy is high as they see those around them making tough choices to stretch budgets with rising prices.

How Consumers’ Habits are Changing Due to Inflation

Most consumers (64-69%) are making purchasing and income decisions because of inflation. Primarily, cutbacks and switching.

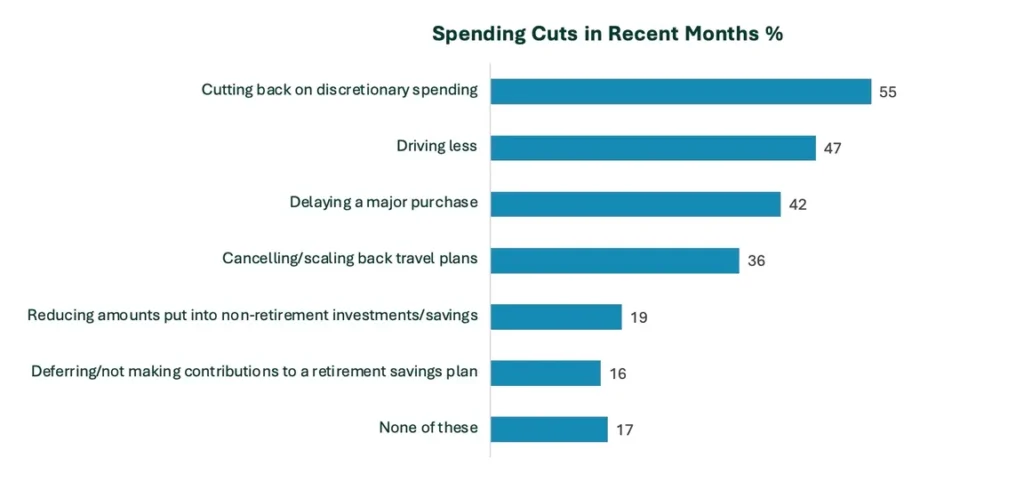

Cutbacks

More than 75% indicate they are making compromises to adjust for rising living costs. This could be in the form of delaying or canceling major purchases such as travel (about two-thirds of consumers), reducing the amount of fresh food (meat and fruits and vegetables), and eliminating discretionary food and apparel purchases. And just over 10% of consumers have cut subscriptions and memberships to help save money.

Spending on fresh food is most impacted. Consumers are either cutting back on the amount of meat or fresh fruits and veggies they consume. Or they are waiting until these products go on sale and stocking up. This is especially the case for meat; consumers will stock up on meat when there’s a deal and freeze it to make it last longer – presumably until there is another deal to be had. This resourcefulness has helped consumers reduce wastefulness, but it has also made them spend more time finding the best deal.

If you want to know more about how inflation affects people’s grocery shopping habits, check out this Upsiide article.

Switching

Another tactic consumers use to manage their way through inflation is switching providers or brands. Consumers are most likely to switch their providers in industries with low barriers to switching, like grocery stores. Dollar stores have become a good option for some household food staples like canned goods. Telecommunications and childcare providers are some of the other top areas people are looking for to find a cheaper alternative.

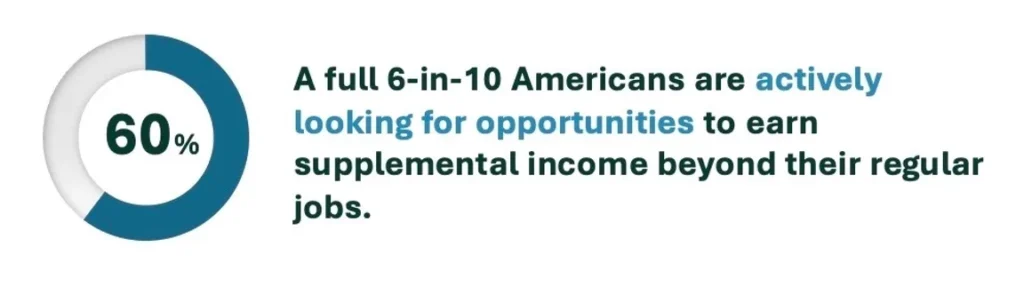

Supplemental Income

One of the more surprising revelations from this study was that 51% and 60% of consumers in Canada and the US, respectively, are actively looking for opportunities to earn extra money (side hustle, anyone?). So, not only has inflation impacted buying power – causing many consumers to cut back on spending – it is pushing people toward trying to earn some of their buying power back with a second job.

Implications for Brands

At the end of the day, what does this mean for brands? It’s not just about the financial component. The emotions consumers are feeling have a huge impact, too. The stress and feeling of being overwhelmed are very real. But through this, consumers are proving resilient and resourceful. The challenge of helping consumers cope with inflation provides a renewed imperative for brands to better connect with their existing customers while also providing an opportunity to win over new ones.https://share.transistor.fm/e/964cbdef

Clarity is essential

Make sure you have a clear understanding of who your target consumers are and how inflationary challenges are impacting them. Our complete report dives deep into the 3 segments we’ve isolated and should serve as a foundation from which to continue exploring the motivations and drivers behind your target audiences’ decisions.

Align marketing & promotions with evolving consumer priorities

It’s key to have a deep insight into how your consumers’ shopping & buying behaviors have changed over the last year, and the trade-offs they are most willing to make across essential and discretionary spending.

Have genuine empathy for your consumers’ struggles

Make sure you understand how your product(s) fit into their lives and the functional & emotional “jobs” they use your products to accomplish. Be authentic in your efforts to help them make the best of a challenging situation.

Stand out as a solution to your consumers’ challenges

Look for ways to position your brand so that it stands as the answer to help consumers better meet their goals as they adapt to rising prices. Don’t overlook the opportunity to connect your brand with the feelings of pride and accomplishment consumers experience when they successfully maneuver through these hard financial moments.

We’ll Get Through This Together

We’ve made it clear – inflation has affected consumers in a major way, but people are also proving to be resilient and resourceful as they adapt, stretching their budgets and adjusting their priorities. While the impact of inflation shows up in changing consumer habits and shopping behaviors across a wide range of products, helping consumers cope with inflation also provides brands with an opportunity to better connect with existing customers.

Many consumers are finding a silver lining in this obviously difficult time by developing better money management habits, making food purchases last that little bit longer, and getting creative with what ‘having fun’ means. There is an opportunity for brands to connect with this newfound sense of development and worth. For those in the ‘Struggling’ segment, working to survive, to the rising prices, brands have an opportunity to prove all hope is not lost by showing people how their products can solve problems.