Global insights transformation sounds ambitious on paper.

And it is. It’s about balancing the need to shift mindsets, manage and empower stakeholder relationships, and ultimately move a whole system forwards.

At the 2025 Quirk’s New York conference, our CEO and Co-Founder Paul Gaudette and EVP of Qualitative Insights Patricia King sat down with Jennifer Picard, Global Insights Transformation Lead at Opella, to share how she’s navigating the complexity of leading global transformation.

Jennifer didn’t just talk about results (though 86% global compliance in 6 months is no small feat). She unpacked the mindset shifts, behavioural changes, and partner dynamics that make real transformation stick, and where it often goes wrong.

Here are the takeaways.

1. Transformation isn’t a project. It’s a behavior shift.

Jennifer’s role isn’t to run insights studies, it’s to move the entire organization in one direction. That requires changing how people think about insights, not just the tools they use.

She shared that transformation only works when you address both:

- Behavioral change: Aligning on what to test, when, and why, and making testing about learning, not just validating.

- Operational change: Building toolkits that are fit-for-purpose, easy to adopt, and clearly positioned within your ways of working.“If you want to scale globally, you need to standardize, and that starts with a shared mindset, not just shared tools.”

“If you want to scale globally, you need to standardize, and that starts with a shared mindset, not just shared tools.”

Jennifer Picard

2. Agile doesn’t just mean fast. It means timely, iterative, and useful.

While the term “agile” might be overused, Jennifer reminded the audience that when embedded properly, a focus on agility unlocks speed and strategy.

To kick off transformation work at Opella, Jennifer started with agile testing; not because it was the most glamorous first step, but because it delivered clear business impact fast, helping earn executive buy-in.

“Each time I introduce Upsiide into the organization, there’s high appeal and very quick adoption of the tool. Why? Because it’s really filling a strategic gap for us around assessing innovation potential.” – Jennifer Picard

That momentum has allowed the Opella team to expand into more exploratory innovation work like agile qual initiatives, which Dig Insights and Jennifer co-developed to fill the unmet need of understanding early-stage resonance.

“Sometimes what you need isn’t another tool. It’s a solution built with your ways of working in mind.” – Jennifer Picard

The Quadrant Chart helped them see how they fare against their competition and which brands drive more consumer commitment. The Network Map, in turn, revealed where they might share connections with rival brands and if there might be an opportunity to differentiate.

2. Iterate research to solve for evolving business scenarios

The Hershey Company truly understands the power of iterative research. Before they even dove into the brand research, they conducted several early-stage tests to really narrow down the number of brands they might consider for the new product.

They weren’t just number-hunting to find the best brand with the best score. They wanted to learn which brand should be considered for the new product and why.

Upsiide’s Idea Screen, Assess and Develop survey templates helped them get to the nitty gritty of this research, with templates designed for every stage of the innovation process.

By conducting tests iteratively, Hershey was able to understand not only which brands deserve to be considered for a new product but also why. That’s how they knew whether the score was actually “good.”

3. Add value by showing data in terms of incrementality and share

If you’ve conducted research before, you might be familiar with typical metrics like purchase intent scores or measures on attitudinal scales. But these kinds of metrics don’t always tell you whether your innovation will be actually profitable.

Instead, it would be more impactful if you could show your stakeholders the business-related metrics such as market share, incrementality, or cannibalization and interaction across products. Luckily, Dig has just the right tools for that.

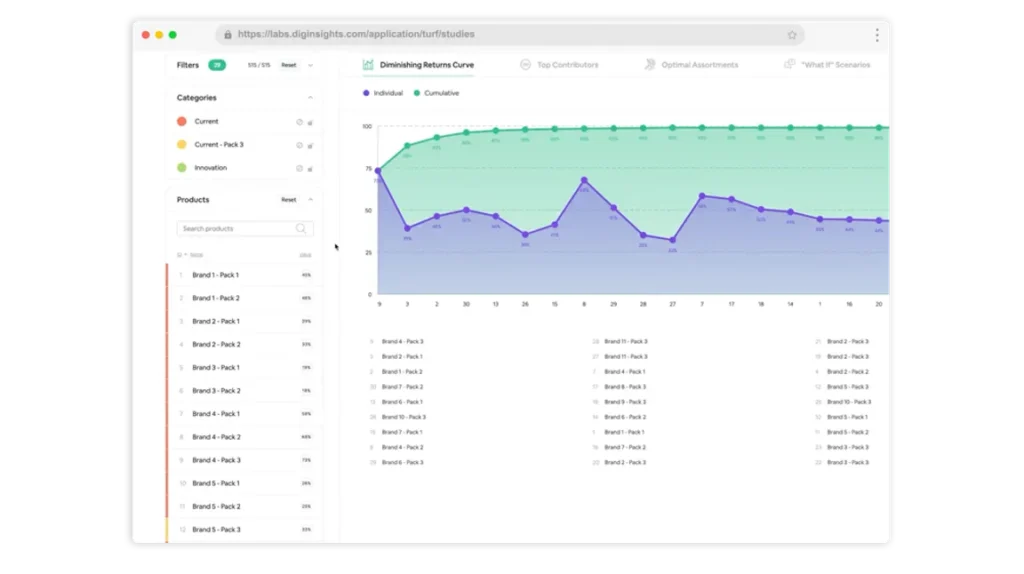

Hershey used Dig’s TURF tool to find the best combination of brands that would capture the interest of the most amount of consumers.

The beauty of TURF is that you can create a whole range of scenarios and combinations in case there are any changes in your brand strategy. For example, if Hershey decides that they cannot optimize Brand 1 for this new product, they can use TURF results to find the next most incremental option that would bring the same market share results.

Another way that Hershey proved the value of their research is by using Upsiide’s Market Simulator tool. They were able to simulate real market conditions, identify how much market share their brands would steal from competitors and see which SKUs would be impacted the most.