Here’s how you might shop for something in today’s world (totally not based on real events):

Imagine you’re at home, casually looking for a new air humidifier on your tablet. You check out a few websites with best-in-market options and add some stuff to the cart, but nothing beyond that. You then get distracted by a message from your friends and kind of forget that you were shopping.

A few days later, you get an Instagram ad for a humidifier and remember that you actually saw it in your previous search. So, you start exploring the product features and the pricing options. But then you remember that you should check your bank balance first. So you go into the banking app, start digging through your statements, and eventually get sucked into other stuff.

The weekend arrives. You head over to your friend’s place, and they tell you about this TikTok influencer they follow. As they show you some of the videos, you notice that the influencer also advertises that same humidifier. You already know that the product is good based on the product description, and if this influencer has it, it’s probably worth buying. So, you finally decide to go to the brand’s website on your phone, put the product in your cart and pay.

***

While this journey seems all over the place, it’s how people shop in real life. With the development of technology and social media, the usual customer journey has become incredibly fragmented across different touchpoints and devices.

This phenomenon makes up the bulk of what’s called “The Distraction Epidemic.” It’s a cultural shift that describes how the excessive use of media and technology has made us lose focus. So if you recognized yourself in the example above, you’re not alone – it’s a culture thing (*quietly closes the 100s of browser tabs open right now*).

But why does this happen? How do people shop on mobile today in this distracting environment? And what kind of ads will attract attention and make people tap “buy”? These were the questions we wanted to answer in our study, conducted with 2000 North Americans.

In this article, we focus specifically on mobile shopping behaviour and the ads people love most in an effort to outline which types of creative breakthrough. In the study, we asked people a few questions about their shopping habits. Then, we showed them 8 different ads from the sneakers category and asked them to choose their favorite.

Here are some basic details about the study:

- Base size: 2000

- Canada, US

- 18+

- Male and female

- Smartphone owners

How does multi-device usage affect people’s purchasing behaviours?

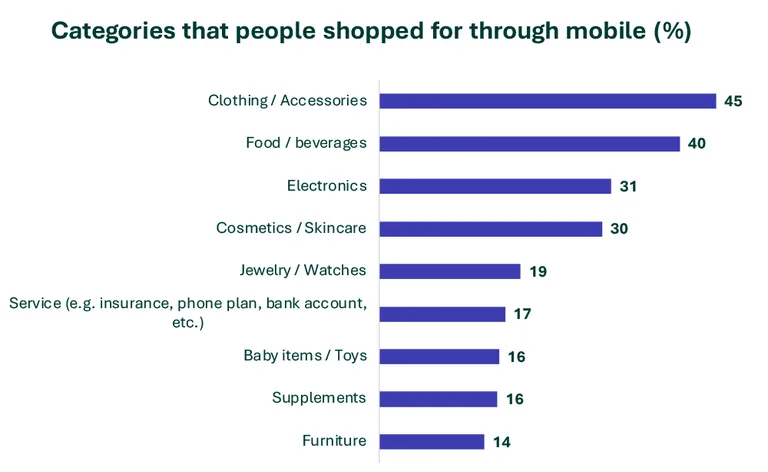

Categories people buy

About 44% of Canadians and Americans said they bought something online after seeing it in a mobile ad.

We then asked them which categories they recall shopping for on their mobile phones. Clothing & Accessories (45%), food & beverage (40%), and electronics (31%) categories had the most success engaging consumers in mobile shopping. So, it looks like people tend to buy things with a relatively low price barrier (i.e. most people can afford it) and are relatively low risk (i.e. they won’t spend tons of money).

In contrast, the least popular categories are baby items, supplements and furniture. These sectors are either not that widely used (e.g. only people with little kids will buy baby items) or might be considered high-risk (e.g. furniture is expensive and might require lots of customization, so people don’t like shopping for it on mobile).

Thoughts about ads

When it comes to buying, consumers tend to be pretty resistant to disruptive ads, and multi-device usage allows them to avoid them. 87% always or often skip ads online. 17% like to turn to another device to distract themselves – for example, they like to check social media on the phone while waiting for a Youtube ad to finish up on their laptop.

About a third of respondents use an ad blocker on their phone to limit the number of ads they see. And 72% of those users leave the site if it asks them to disable the ad blocker. So it’s clear that people like to control their media consumption and want brands to earn their trust (i.e. they wouldn’t trust a random site that asks them to disable their ad blocker).

But that doesn’t mean consumers hate ads! They just don’t want them to be intrusive. In fact, our external research has shown that customers are more than twice as likely to recall ads if they see them on multiple devices – kind of like in the example above. If the consumer sees your ad on different devices, no matter if they skip it or not, they’re likely to remember it.

Shopping habits

North American consumers like to do their research before buying. Almost half read online reviews and check the company’s website before making a purchase. In contrast, only 9% buy something immediately after seeing it on the phone. This again shows that shoppers want to ensure they are buying from a trustworthy source and the brand is reliable.

Consumers also like to consider all available options. 46% prefer to buy the product from an online retailer (e.g. Amazon) if it’s available there. And only 24% buy directly from the ad itself. Again, shoppers don’t like getting something before exploring all options. Plus, we think some people just don’t like “being chased by an ad” if they click on it – which is fair, we’re not big fans either.

How results differ by generation

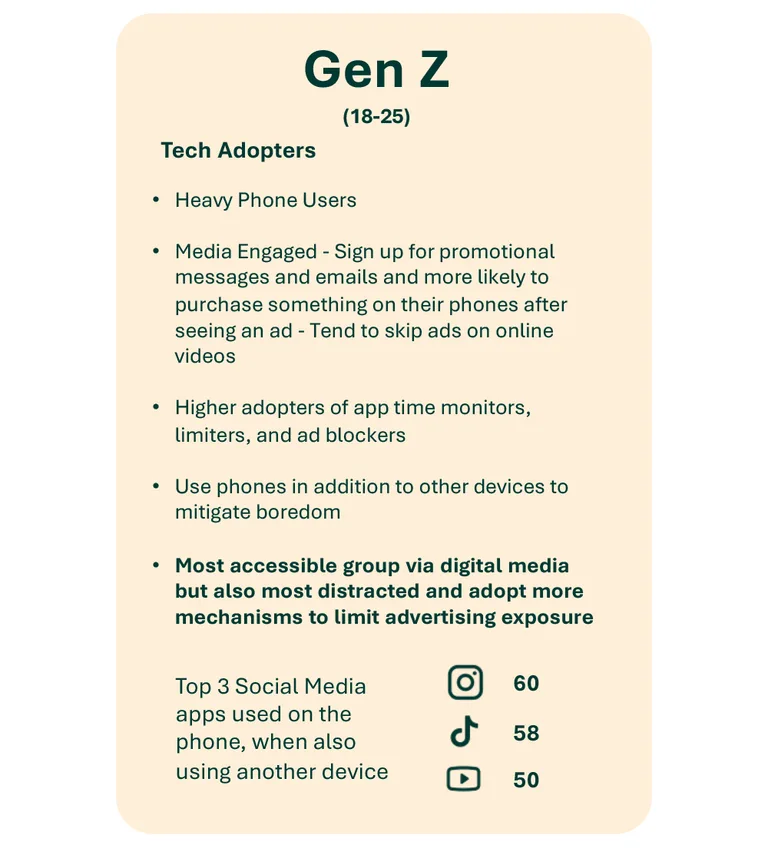

Gen Z, as expected, tend to be heavy phone users (i.e. they spend over 5 hours daily on their phones). They are aware of their usage of phones and use tools like app time monitors and ad-blockers. But at the same time, they are pretty open to promotional activities: they’re happy to sign up for promo emails if they’ll benefit them in some way and are more likely to buy something on their phones after seeing an ad.

Millennials like to use their phones for 3-5 hours per day, making them medium phone users. They are also quite open to marketing and promotions, though they aren’t as open as Gen Z. Still, they also like to adapt monitors and blockers to control their usage.

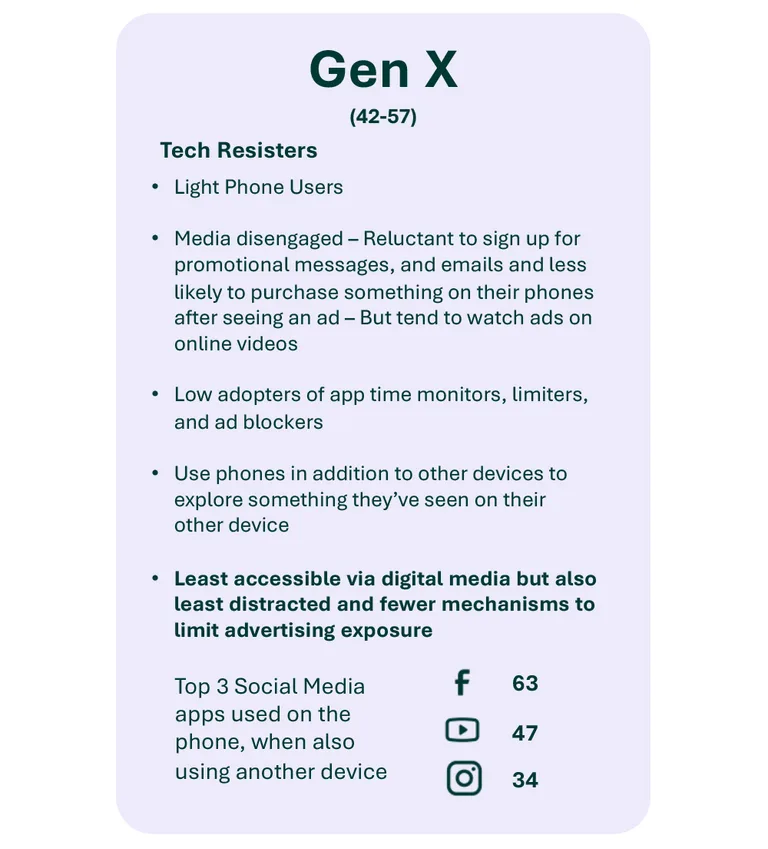

Gen X, however, uses their phone the least (less than 3 hours per day). They are reluctant to engage with any promotional messages and are less likely to buy stuff from mobile ads. But at the same time, they are the lowest adopters of app monitors and ad blockers, meaning they don’t limit their media consumption.

What can advertisers do to appeal to distracted consumers?

To answer this question, we turned to Upsiide’s idea screening feature. We decided to focus on the sports footwear category and test out 8 ads from different brands. Respondents swiped right if they liked the ad and swiped left if they disliked it. And when they liked 2 ads, they were prompted to choose a favorite.

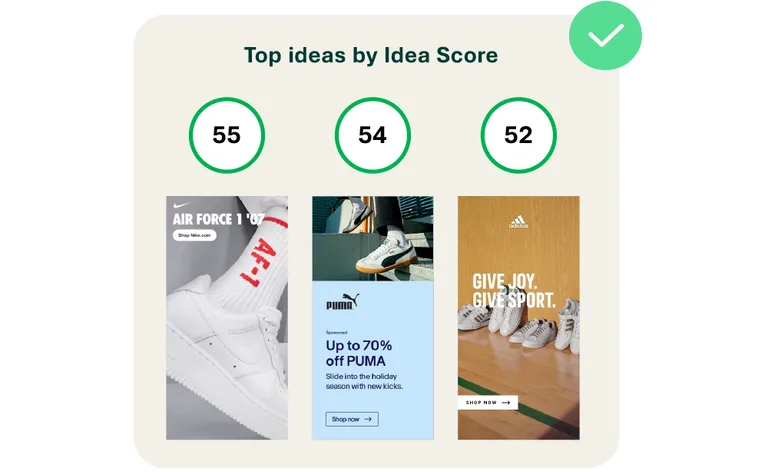

So, what were the most popular ideas? Here they are below:

Ads from Nike (Idea Score of 55), Puma (54), and Adidas (52) came to the top. We found some commonalities across all 3. It appears that compared to the other ads we tested, these three employ:

- Minimal text

- Singular visual point of focus

- Clear logo

- Big brand recognition

We think this could mean that simpler designs require less conscious mental engagement. So, in the real world, where consumers are bombarded by distractions, simple and easy-to-read ads are more likely to attract their attention.

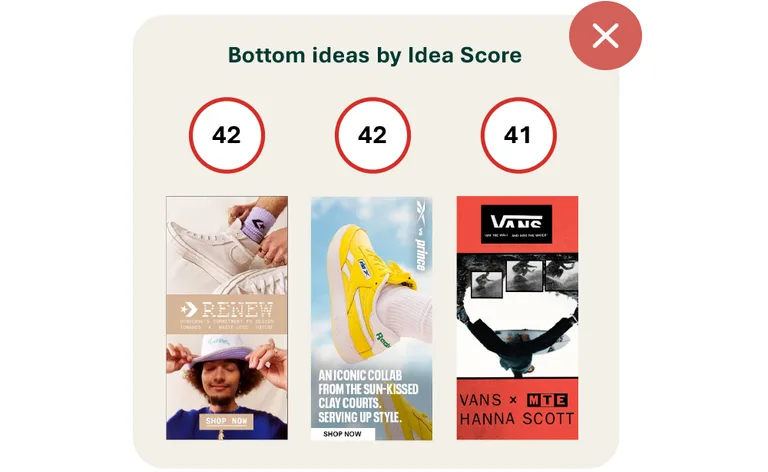

As for the lowest-performing ads, here’s what we’ve got:

These include ads from Converse (Idea Score 42), Reebok (42) and Vans (41). We think these bottom ones didn’t do so well because of the following:

- A busier and sometimes cluttered design

- Louder visuals/colours

- Multiple points of focus

- Obstructed / crowded brand logo

While these ads seemed pretty bright, their design featured too much extra stimulus, so respondents might have thought they required more effort to read/register mentally. Hence why they ended up at the bottom of the leaderboard.

Brand recall

54% of American adults say brand familiarity is the most important reason to pay attention to an ad on a smartphone. And this next section of the survey proved that.

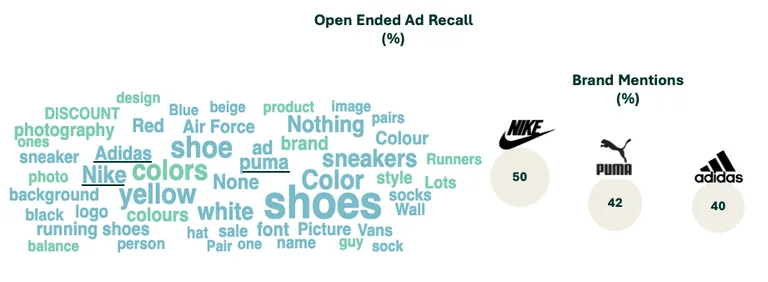

We wanted to understand which ads left the biggest impression on consumers. So, after the idea screening exercise, we asked respondents to recall brands they saw.

The most mentioned brands were Nike (50% recall), Puma (42%) and Adidas (40%). As big and established global brands, they had a headstart over other brands, which probably impacted the results.

But it’s also worth noting that these brands also did a great job creating brand awareness with their distinctive brand assets, like the logo and design style. So, people remembered them the most. This result shows that in a distracted environment, brand recognition goes a long way to helping you break through.

Key takeaways

Here’s what it all means for brands:

1) Brands need to capture consumers’ attention quickly

Try to employ simple, clear communication that requires the minimum amount of active processing to have a lasting impact.

2) Leverage the power of your brand

In a crowded media landscape, branding is a powerful tool to maximize breakthrough. So, focus on building brand awareness and creating unique brand assets that will make you more easily recognizable in different ad formats and executions.

3) Keep in mind that your challenges vary by audience

- Younger consumers are the easiest to reach but most distracted. So, focus on capturing their attention quickly before they move on.

- Older consumers are the hardest to access but most present. Take advantage of any opportunities to connect.

Want to learn more?

We hosted a whole event on the findings from the study, so check it out! Our AVP, Gillian Geddie, shared more fun insights we discovered and discussed their impact on brands.