It’s no surprise that COVID-19 jumbled up many aspects of our lives. Even though most people associate lockdowns with a whole host of negatives, some industries benefited from them. Delivery services is one of those industries.

Our colleagues at Dig Insights, Upsiide’s parent company, have already covered the progress of food delivery services before, during and after the pandemic. According to the data provided by our friends at Drop, grocery delivery revenue has been up 212% in the US and 568% in Canada since January 2019. During the pandemic, the average grocery delivery spend per customer per month peaked at $354.85 in Canada and $249.75 in the US. While the average grocery delivery spend per month is now lower than during lockdowns, it is still 4-8% higher than pre-pandemic levels. This stat means that people still want to order groceries for delivery even after the pandemic has passed its peak.

Looking at these stats, it’s no wonder that grocery delivery brands levelled up their game over the pandemic. Instacart developed 15 new products and features that help consumers see which items are out of stock and get groceries delivered to their door so they can stay socially distanced. Uber Eats expanded beyond restaurant food delivery to grocery delivery, collaborating with their sister company, Cornershop, to insert themselves further into consumers’ day-to-day.

So, what makes those people continue ordering groceries through delivery after the pandemic when it isn’t strictly necessary anymore? Why do some people use delivery, and some go back to in-store shopping? And how can grocery delivery retailers keep their customers in the long term? We brewed up a new study to answer these questions.

We asked a total of 1000 North Americans about their habits and preferences when ordering groceries through delivery services. Users and non-users told us why they order or don’t use delivery brands. Finally, they also said what offerings would make them use grocery delivery more.

Here’s what our sample looks like:

– Base size: 1000

– US, Canada

– 50% male, 50% female

– Adults aged 18+

Respondents answered a series of screening and behavioural questions. They then went through an idea screening exercise and saw a bunch of offers. If they swiped right on an offering, they liked it. If they swiped left – they didn’t like the offering. If they swipe right on 2 offerings, they enter a trade-off; the respondent is required to select which offer they like more. This allows us to understand commitment. This approach lets us gather an Interest score, Commitment score, and Idea Score – an absolute score that is calibrated to predict the success of an offering in-market.

Now, for some insights fresh-out-the-kitchen.

1. While low prices and faster delivery speeds are the most popular overall, some sub-groups have different favorites.

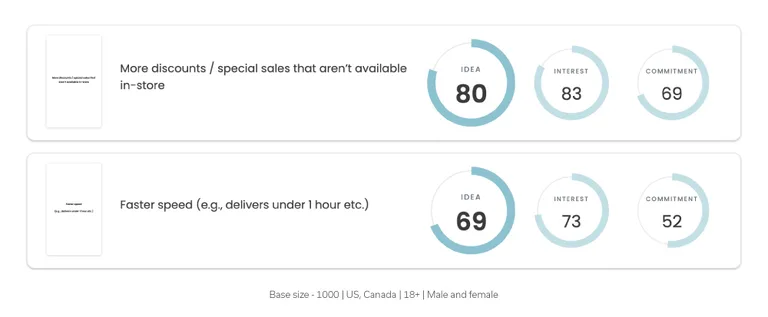

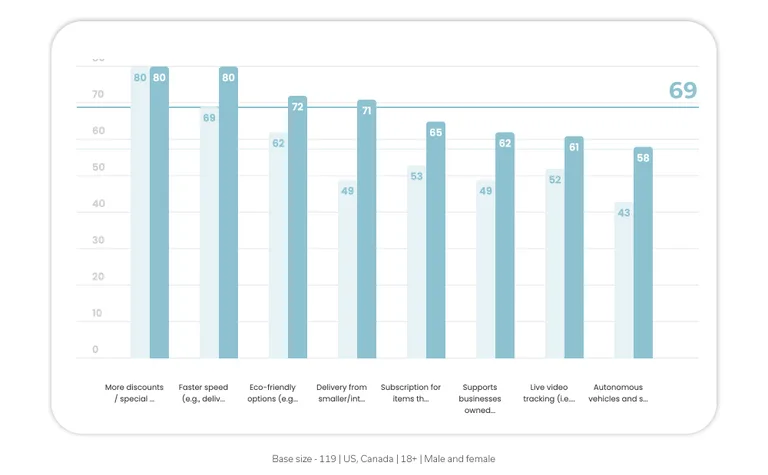

When we tested different grocery delivery offers, the two that came out on top of the idea screening exercise were “More discounts / special sales that aren’t available in-store” (Idea Score of 80) and “Faster speed (e.g., delivers under 1 hour etc.)” (69). These offers seem to be most popular across every sub-group, meaning that consumers are strongly interested and committed to them.

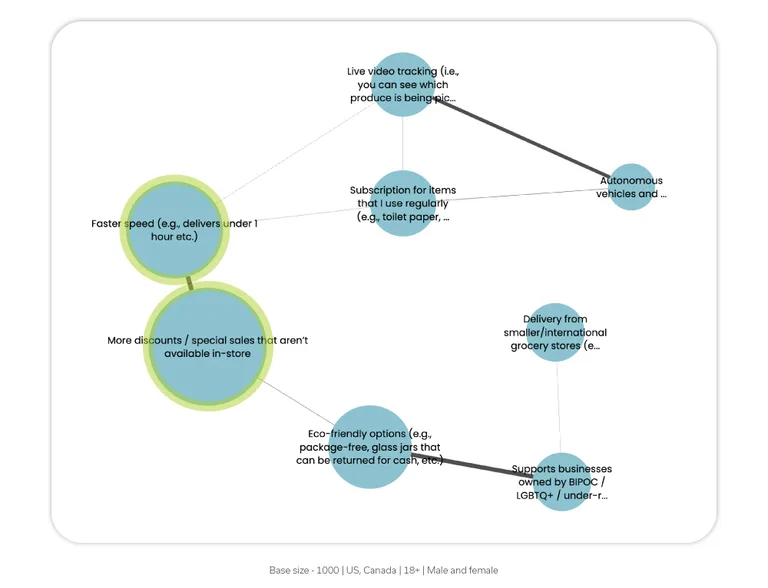

Both winning ideas are strongly linked on the Idea Map. This map shows connections between different ideas and allows us to see patterns in different idea clusters. The fact that discounts and faster speed have such a thick line connecting them means that people who like one offer also like another. A grocery delivery brand should consider placing these messages on their ads together to capture more interest.

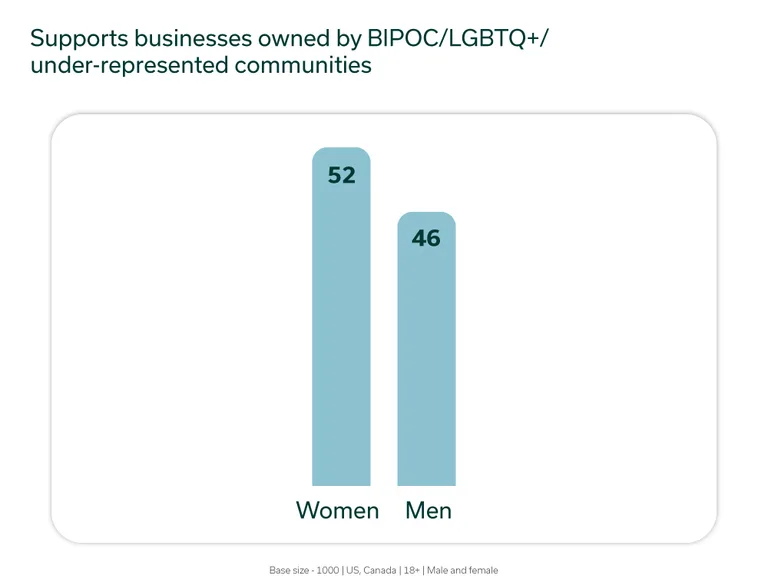

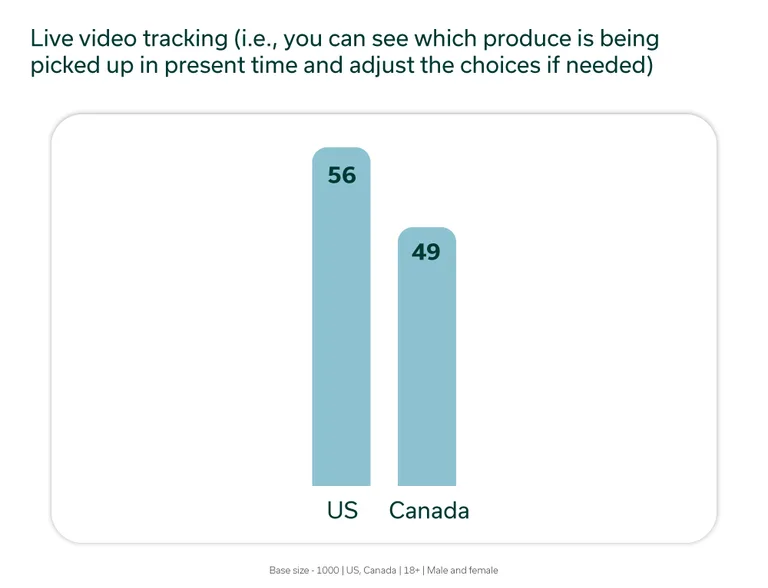

But there are also some outliers when we look at sub-groups based on gender or country. For example, women are more likely to choose a brand that “supports businesses owned by BIPOC / LGBTQ+ / under-represented communities” (Idea Score of 52) compared to men (46). Similarly, “live video tracking (i.e., you can see which produce is being picked up at the present time and adjust the choices if needed)” scored 56 in Idea Score with the US audience, compared to 49 with Canadians.

If we apply these results to the Maslow pyramid, we’d say that low cost and fast delivery are “essential” needs every brand should nail. But things like supporting under-represented communities or live video tracking are supplemental needs that could be great opportunities for differentiation.

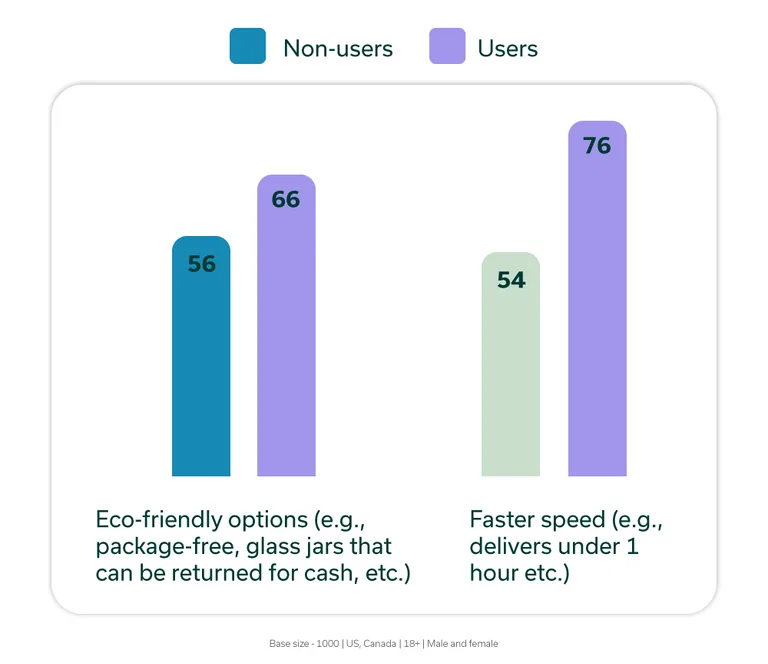

2. Non-users are less interested in fast delivery speed and more interested in eco-friendly options.

About a third of our respondents told us that they’ve never used a grocery delivery service. And when we asked which offers would make them use one in the future, the second most popular idea was “Eco-friendly options (e.g., package-free, glass jars that can be returned for cash, etc.)” with an Idea Score of 56. “Faster speed” came third, scoring 54 – 22 points lower than among the user subgroup.

We’ll say it again for the people in the back: non-users don’t find fast delivery all that meaningful. Maybe this offering doesn’t apply to their lifestyle, e.g., they have time to go shopping in-store or have a grocery store within walking distance.

On the contrary, they’d be more interested in using a grocery delivery service if it offered environmentally friendly initiatives, like plastic-free packaging. Maybe non-users who shop in-person are used to bringing their own bags to reduce plastic waste, and if they were going to use a delivery service, they’d want to mitigate the amount of plastic packaging/bags involved.

Psst! If you like what you’re reading, we’ve got a neat infographic with all the findings in one place. Download it, save it, share it – it’s all yours!

3. People don’t order groceries as often now as they used to

Drop’s data revealed that the frequency of grocery delivery has fallen since the pandemic. In the US, it’s only 7% higher than pre-COVID. In Canada, it’s 18%. But we wanted to know what this looks like in reality.

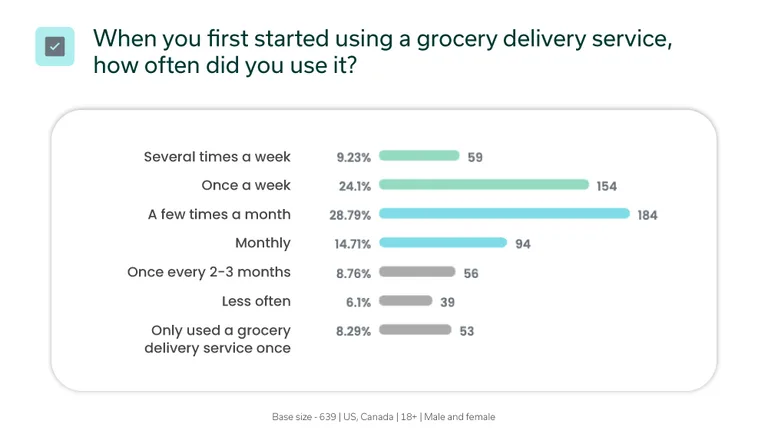

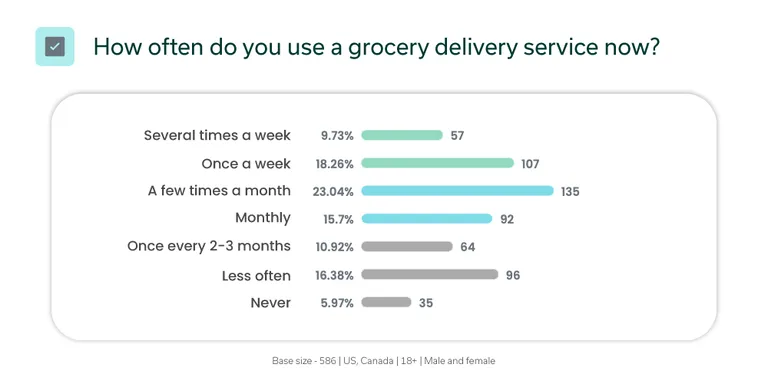

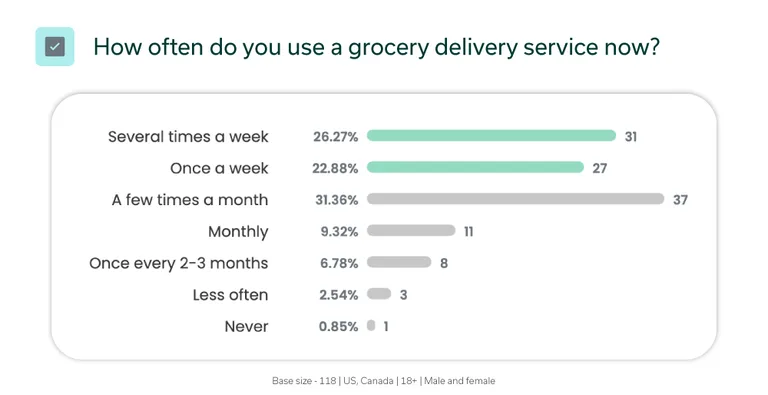

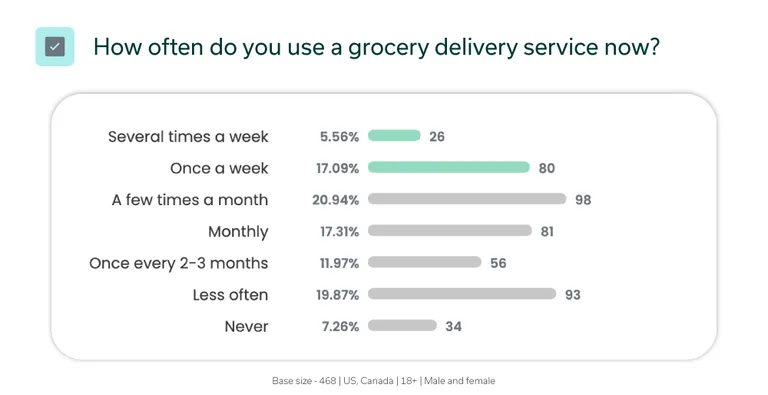

When we asked respondents how often they used a grocery delivery service the first time, over 30% said they ordered at least once a week. 44% indicated to have ordered at least monthly. But when we asked how often they use these services now, 27% said at least once a week, and 39% said at least monthly. While the drop is not that drastic, it still signifies some softness in frequency.

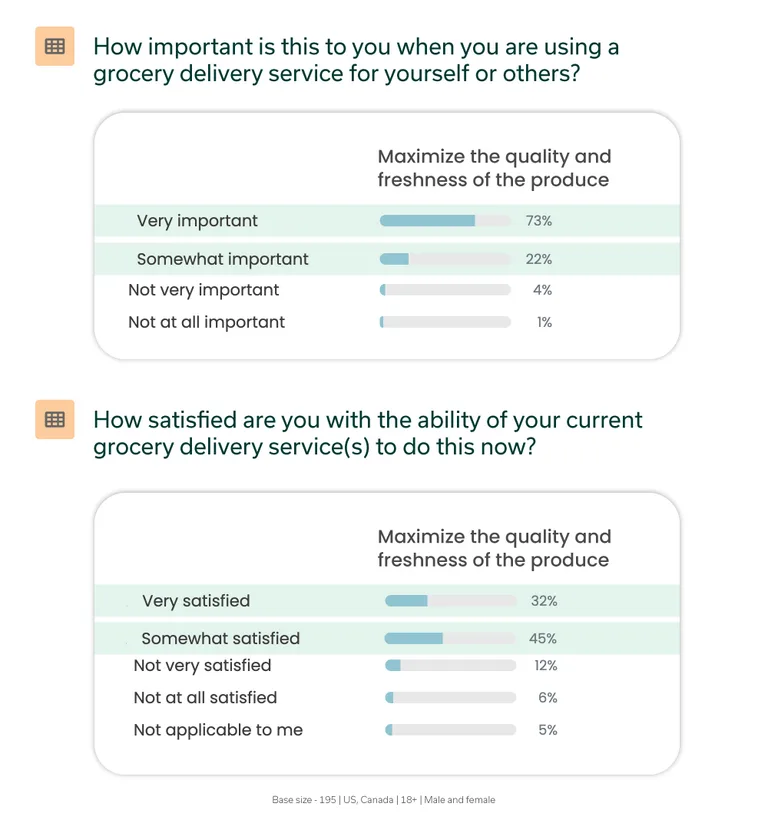

If we look at people who use grocery delivery services less often than once every 2-3 months, we can pinpoint the problem. We asked respondents to tell us what aspect they find the most important in grocery delivery and how satisfied they are with it. 95% said that “Maximizing the quality and freshness of the produce” is very or somewhat important. But only 77% are very or somewhat satisfied with their ability to get fresh produce.

If we calculate the Importance-Satisfaction rating, it would be 113. This rating shows that this subgroup finds it especially hard to get fresh veggies and fruits when they use grocery delivery services. Brands need to encourage their staff to pick produce of the highest quality. You got it: this is a no-bruised-apples territory!

This data aligns with the top reasons why people use grocery delivery services less often now. 32% chose “I prefer selecting my own produce,” and 31% said, “It’s expensive.” Maybe brands need to find a way to improve how people pick groceries. Or maybe consumers could find value in a loyalty/subscription program that helps them save money. It’s still hard to say that these initiatives will definitely help increase the frequency of delivery orders, but it would be worth experimenting with.

4. The more grocery delivery brands people try, the more likely they are to commit to getting grocery delivered regularly

We wanted to figure out how shoppers’ behavior changes if they use several grocery delivery brands. The results show that the number of brands that a person uses is directly correlated with their commitment to grocery delivery.

Almost 20% of respondents have used more than 3 delivery retailers. We call these enthusiasts “explorers”. We think the fact that people use more brands is actually a good thing; the more people try, the more likely they find an option that works for them and commit to it. After all, 49% of explorers order grocery delivery at least once a week.

To compare, only 23% of non-explorers (i.e., people who only have used 1 or 2 brands) use grocery delivery services at this frequency.

When we looked at how this subgroup rated the offerings, we noticed that all ideas ranked much higher than the rest of the sample. The average Idea Score among folks who have ordered from 1 or 2 grocery delivery brands is 61. This number rises to 69 with people who have used 3+ brands.

This result could mean that grocery delivery explorers are much more receptive to new offerings and could be an excellent market for testing innovations. For example, “Delivery from smaller/international grocery stores (e.g., small Asian stores)” got a whopping Idea Score of 71 among explorers, compared to 49 among non-explorers. The fact that explorers are more open to innovations could mean that they’re perfect guinea pigs to test new creative, messaging, and features with.

The top 3 reasons why people use 3+ brands are faster delivery times, saving money on delivery or products and better delivery options (e.g., scheduled times). If brands want to attract more multi-users, they need to develop offerings that align with these reasons. For example, it could be a subscription service that lets you save more money, loyalty points or delivery under 30 minutes or less.

5. People who don’t like grocery delivery might never like grocery delivery

As we looked at non-users, we found a really curious insight. Some people just prefer to go in-store for their groceries.

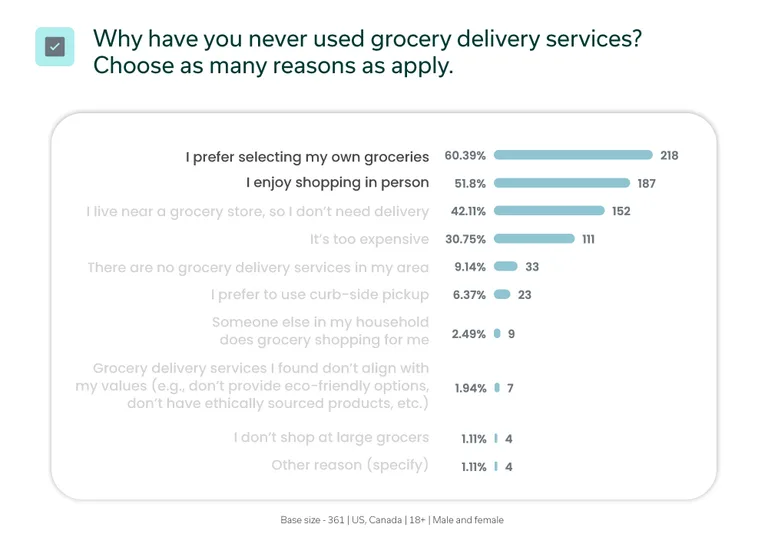

We gave respondents a bunch of reasons for not using a grocery delivery service. Some of them were more practical (e.g., “I live near a grocery store, so I don’t need delivery”), and some were emotional/sentimental (e.g., “Grocery delivery services I found don’t align with my values”).

The top 2 reasons appeared to be “I prefer selecting my own groceries” (60%) and “I enjoy shopping in person” (52%). The latter is an emotional reason – it brings some people to walk around the grocery store. And while something like “I just like choosing my own fruits and veggies” might sound kind of practical, it’s also a little bit emotional too (i.e., “I enjoy the process of looking, smelling and picking my own produce”, for instance).

To sum up

Now that we’ve covered all these learnings, it looks like grocery delivery brands have their work cut out for them. First, they should look beyond lowering their prices or offering faster delivery speeds. They should make tailored offers to different subgroups (including non-users). Brands should keep in mind that people order less over time, but folks who try more brands are actually ready to commit more to delivery. And finally, retailers should bear in mind that people who shop in stores really like it, so they need to think more creatively to lure them to the delivery side.

Grocery delivery is only one of the 3 studies we conducted on food delivery. Keep an eye out for more insights we’ve discovered in our brand-new meal kit and restaurant food delivery studies.

And if you want to get all the key learnings from our 3 studies in one place, you’re in luck! We just ran a special event and outlined important trends every food delivery brand must know. Watch the recording now to improve your delivery offers!