Sustainability matters. But which claims do people actually care about?

Sustainability is one of the most important issues of the century. Spanning recycling, emissions, the environment, and ethical sourcing practices, sustainability covers a wide array of complex issues. And because it’s so diverse, sustainability means different things to different people.

One thing is certain, though: the importance of sustainability is growing. It’s upending industries as diverse as travel, fashion, and food. According to Nielsen, in 2021 the U.S. sustainability market is projected to reach $150 billion in sales. Deloitte’s research shows that almost half of all consumers are already choosing brands according to their environmental values. ‘Sustainability has reached a tipping point’, says IBM, with almost eight in 10 respondents indicating that sustainability is important for them. It’s not going away. And with climate change, social justice, and environmental degradation set to grow throughout the 21st century, consumer awareness will only increase.

- More people care than ever before: In Europe, 9 out of 10 people worry about the impact of plastics on the environment.

- Waste is a huge problem: It’s estimated that $80-100bn of plastic is thrown away each year after being used just once.

- And it’s getting worse: of the 6.3bn tonnes of plastic waste produced since the 1950s, only 9% has been recycled – and if nothing changes, by 2050, we’ll have x3.6 more plastic production than in 2014.

But with sustainability being such a broad term, affecting so many industries in different ways, how should you communicate to consumers about it? It’s not enough to be sustainable – in a competitive market of conscious consumers, you have to prove that you’re sustainable in meaningful ways. Getting it right matters. Unclear or competing claims are likely to confuse shoppers. Regulators are on the lookout for exaggerated claims. Journalists and consumer watchdogs are waiting to pounce on greenwashing. And competitors are always innovating, making today’s sustainable breakthrough tomorrow’s ‘so what?’

- The number of sustainability claims is booming: In 2014, The Guardian counted over 455 – and that number has continued to grow since then.

- Bad claims put consumers off: According to National Geographic Society’s ‘Greendex’, consumer cynicism about environmental claims lowers eco-friendly purchases.

- Get it right, and the rewards are huge: 57% of consumers are willing to change brands to help reduce negative environmental impact.

Shoppers with values

For years, marketers have preached that the latest generations of shoppers were much more value-conscious than their elders. But is it really true? The value-driven purchasing patterns of Millennials and Gen-Z have caused panic and confusion for so long now that these predictions are easy to dismiss as exaggerations. But the data back these claims up. Younger generations really are voting with their wallets – and they’re voting for more sustainable businesses.

Deloitte:

43% of consumers are already actively choosing brands for their environmental values

Forbes:

[sustainability] efforts create various opportunities: high brand image and value for money while removing or reducing the generation of material and toxic waste. And smaller packs are more suitable for on-the-go consumption, with less product waste

Business Insider:

A 2019 survey led by Hotwire found that 47% of internet users worldwide had ditched products and services from a brand that violated their personal values. Protecting the environment topped that list.

Getting green right

When sustainability first emerged, just being eco-friendly in a generic way was enough to make you stand out. Now, with so many claims and counter-claims, with so much more information available to consumers, and with so many more ways of measuring sustainability, you need to be much more considered in what you say. You need to know what actually works on pack, for which consumers, and on which type of products.

So we’ve asked US consumers to tell us. Using Upsiide’s innovation insights platform, we’ve investigated attitudes to on-pack claims on food and drink products in grocery stores. We’ve measured the efficacy of competing claims, cross-referenced it against different demographics, and explored what consumers say they want in future.

And the results are surprising. By investigating consumer attitudes, we can inform our on-pack claims with genuine insights from our target audience. We can prioritize the claims that we know to work. And we can shape the future of our packaging innovations with in-market data, ensuring that our sustainability claims are meaningful, appealing, and compelling enough to sell. Your customers can’t actually check that those eggs are from free-range chickens; they can’t break down packaging to verify that it’s made from recycled plastic. They can only accept such claims based on trust. So we’re finding out which claims they trust the most – and why.

After crunching the data and drawing out the insights, we’ll show you how to write an on-pack claim that really stands out.

How we discovered what people care most about (and why)

So, how do you discover which on-pack claims actually work?

Unless you really understand what matters most to your customer, your on-pack claims are just guesswork. That’s why we’ve undertaken in-depth research into how consumers view sustainable practices as a whole and how this translates to purchasing behaviour with on-pack claims.

Surveying over 500 US shoppers from across the nation, our survey probed their differing attitudes to 27 sustainability claims, measuring their preferences for competing on-pack assertions. To calculate exactly where sustainability claims sit in the order of consumer preferences, among the 27 choices we included claims unrelated to sustainability. That way, we can test just how much people really care about sustainability – by forcing them to choose between a sustainability claim on the one hand, and (for example) a quality claim on the other.

As well as getting them to choose which claims mattered to them by swiping right or left, we also asked a series of questions designed to reveal their demography, shopping habits, general attitudes towards sustainability, and the extent to which their values shape their shopping behaviours.

Upsiide is designed not just to conduct surveys and gather data, but to unearth marketable insights. Its intuitive, mobile-first surveying style makes the process far more natural for audiences, helping to ensure a high degree of accuracy. The Upsiide dashboard also makes it easy to visualize the data, allowing you to spot patterns, anomalies, and quirks far more easily. So that you can draw meaningful inferences based on real consumer behaviour, making your on-pack claim reflect reality – not just guesswork.

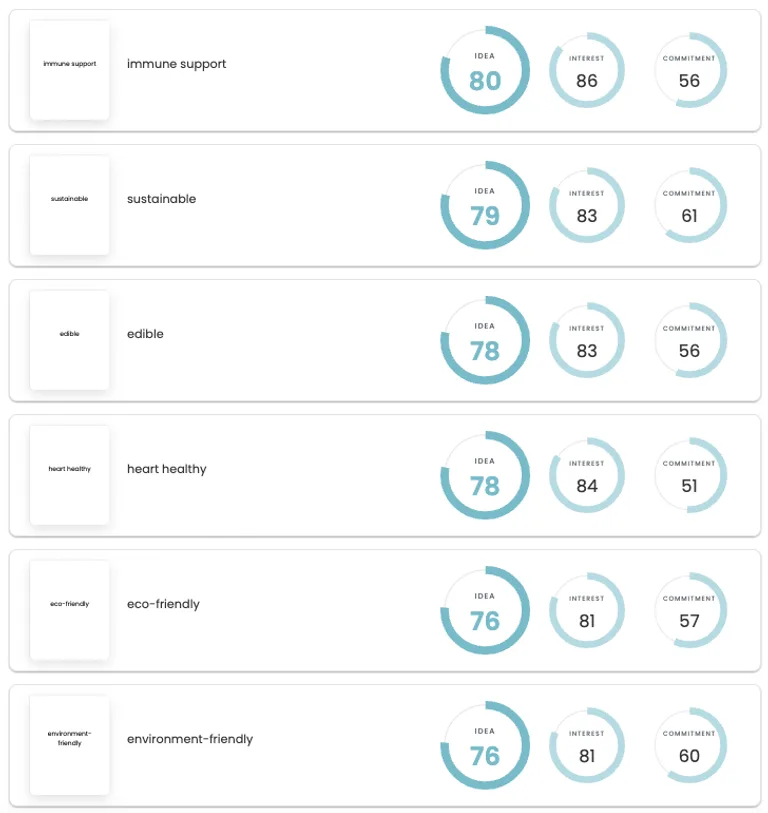

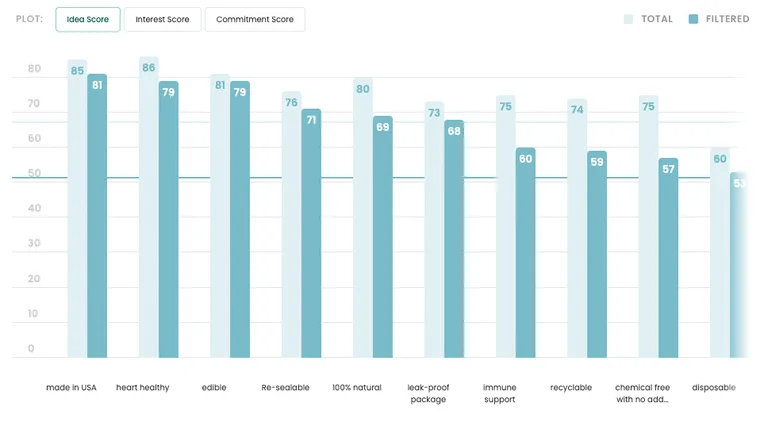

Each on-pack claim is given three scores:

- the Interest Score, calculating how often people chose it by swiping right

- the Commitment Score, revealing how often people chose that same claim when it was up against another claim that they liked. Take the claim ‘Re-sealable’, for example. People like it; its Interest Score, indicating how often respondents swiped right, was 83 – putting it firmly into the top five. But when pitted against other popular claims in a one-on-one choice, people tended not to choose ‘Re-sealable’: its Commitment Score was just 45.

- the Idea score, an average of both the interest and commitment.

By prompting respondents to choose between the claims they like, we reveal the hidden strengths and weaknesses behind the claims.

Over 500 shoppers, 27 on-pack claims, 23 questions, one consumer insights platform, and a lot of marketable insight.

So, which claims worked?

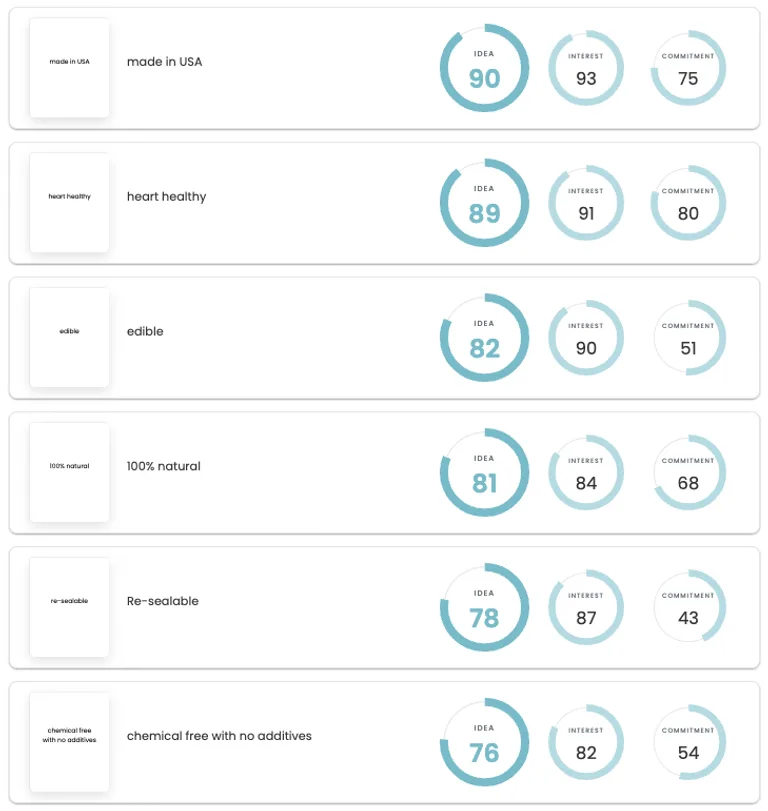

It surprised us, too. But the claim with the highest Idea score – averaged across all demographics – was ‘Heart healthy’, scoring 86 (out of a possible 100).

The rest of the top five? ‘Made in USA’ (85), ‘Edible’ (81), ‘100% Natural’ (80), ‘Re-sealable’ (76), and ‘Chemical-free with no additives’ (75). Digging deeper into the data helped reveal why these claims won.

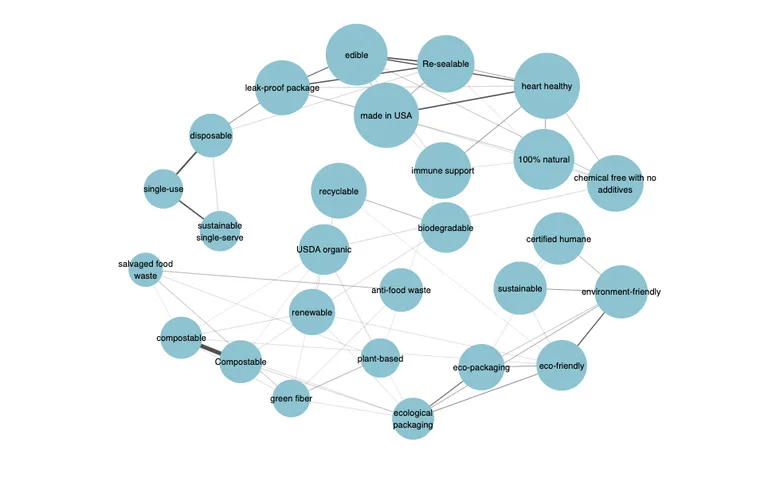

But those numbers only get really interesting when you analyze them according to demography – respondents’ age, education, shopping habits, and so on. Before you even apply these filters, Upsiide reveals meaningful correlations.

This chart maps all 27 claims, positioned among similar claims. The boldness of the lines indicates the strength of the correlation – for example, the thick line between ‘Disposable’ and ‘Single-use’ shows that respondents who liked one tended to like the other.

Some are obvious, but some are very insightful. The connection between ‘Heart healthy’, ‘Made in USA’, and ‘Re-sealable’ could indicate an older demographic – who are concerned about their health, who are patriotic, and who focus on tangible, practical issues over wider and less tangible concerns like the environment.

But this is just the outer layer – there are some far more surprising results in store. Let’s tear open this data and see what’s inside.

5 surprising discoveries about on-pack claims

#1: Age matters. A lot.

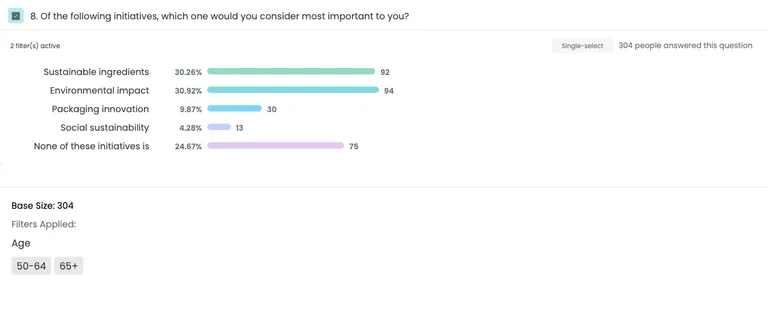

Of all the demographic factors we measured, age had the biggest impact on the popularity of on-pack claims. The top-rated claim among 18-34-year-olds was ‘Immune support’ – but for the next group up, 35-49-year-olds, it drops to 5th. And when you get to the over-50s, it barely scrapes the top 10. Patriotism (‘Made in USA’) also correlates with age; it barely makes the top 10 with 18-34-year-olds but is the highest-scoring among those over 65 and the second-highest among 50-64s. And practical considerations seem to matter more with age (‘Resealable,’ ‘leak-proof package’). The lesson? Age can drastically change the perceived value of your message. So, get to know your target audience.

18-34 year olds:

50+:

#2: Belief in sustainability claims varies

Credulity isn’t consistent. In other words, some groups are much more likely to believe in on-pack claims (and thus to score them highly) than others. When asked to rate how well US grocery stores are doing with sustainability in general, those who rated their store as doing ‘Very well’ or ‘Somewhat well’ also scored on-pack claims higher in general: four of their top 5 claims have scores of 80 or more, while those who condemned their store’s sustainability efforts as ‘Somewhat poor’ or ‘Very poor’ only had two above 80 in their top 5, suggesting less credulity and more skepticism. The same pattern emerged when respondents were asked to rate their grocery store’s efforts on sustainable packaging – those who rated it as doing ‘Somewhat poor’ or ‘Very poor’ also tended to be less impressed by the claims, with the highest claim (‘Edible’) scoring just 81, suggesting that they are less credulous. The fact that ‘Edible’ – the simplest, most basic on-pack claim imaginable for food and drink – emerged as the top scoring among this group suggests a wider antipathy towards sustainability in general.

Somewhat well / Very well:

Somewhat poor / Very poor:

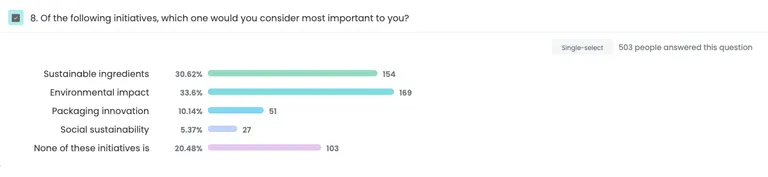

#3: People say they value sustainability (but the results are more complex)

On the whole, most people say they care about one sustainability concern or another. Out of our 503 respondents, 400 chose one of ‘Sustainable ingredients’, ‘Environmental impact’, ‘Packaging innovation’, or ‘Social sustainability’, as their top-rated initiative. So you’d expect these people to rate on-pack claims relating to the environment and sustainability the highest, right? But even among those who chose ‘Sustainable ingredients’ as their priority, the on-pack claim ‘Sustainable’ didn’t even make the top five. In fact, no matter which initiative is chosen as the most important, ‘Made in USA’, ‘Edible’, or ‘Heart healthy’ ranked in the top three among all groups. On the whole, on-pack claims regarding the environment and sustainability did rank higher among the 400 than the remaining 103 (who answered ‘None of the above’ when faced with those sustainability initiatives), but it wasn’t enough to dislodge the perennially popular ‘Made in USA’, ‘Edible’, and ‘Heart healthy’.

Most important initiative – Sustainable ingredients:

Most important initiative – Environmental impact:

#4: Education isn’t everything

You might expect – as we did – that the more highly educated would be more discerning with on-pack claims. That they might, for example, prefer more nuanced and detailed claims over broad generalities. But that’s not what the data says. ‘100% natural’ was the most popular environmental claim across all education groups, from those who had only completed some of the high school (scoring 77, ranking 4th) right through to post-doctoral students (89, ranking 2nd). Is income more important? Hardly. ‘100% Natural’ scores very similarly for the bottom quartile and the top quartile, getting ‘79’ from those earning below $35,000 and 80 among those earning $100,000 and over. This suggests that having a clear, simple message is effective regardless of education or income.

Post-graduate / Graduate:

High school / Did not graduate:

#5: Nearly everyone could use a little more help

Across most of our questions, people were split. But when we asked them the extent to which they agreed with the statement ‘I would like retailers to provide more information to help me make sustainable choices’, only 50 or so of our 500 respondents disagreed. This shows that people generally want to make more sustainable choices – but that they need help to do so. And well over half of respondents also said that they would be willing to pay more for sustainable products – suggesting that they’re willing to put their money where their mouth is.

Wait, what about those who don’t care about sustainability?

It’s true: a substantial minority are not interested in sustainability. When we asked our respondents about which sustainability initiatives mattered most to them, around a fifth of respondents – 103 – answered ‘None of the above.’ This roughly correlates to the small but persistent minority who showed less enthusiasm for sustainability claims, and who showed less credulity towards such claims in general.

You need to make your product sustainable, and you also need to communicate its sustainable credentials. But you don’t want to put off the ‘Don’t care’ people. So how should you approach this group? Do on-pack sustainability claims actively put them off purchasing? And, if they can be reached, what’s the best way of communicating with them? Our data shows that you can make meaningful on-pack claims with this group – and that, despite their unwillingness, you definitely need to consider sustainability regardless. Here’s why.

Old before I buy

When you break down the ‘None of the above’ group by age, you notice something: the majority (75 / 103) are 50 or older. Just 9 of them were in the 18-34 category, suggesting that a lack of interest in sustainability correlates with age. Now, if you’re hoping to sell to a broad age range, this matters. But even if older people make up the majority of your sales, you should still think carefully about your sustainability positioning. The next generation cares a lot more. Brands that have a cohesive message on sustainability are more likely to win and maintain their favour. Besides, some seniors do care: 39 over 65s listed ‘Environmental impact’ as their top concern (although almost as many, 34, answered ‘None’). And with new regulations and pressures from retailers looming, you need to develop a stance toward sustainability in retail packaging – even if your audience is old-fashioned seniors.

75 of the 103 people who said that they didn’t care about any of the sustainable initiatives listed were 50+ years old.

I could care less

However, important preferences can still be found within the ‘Don’t care’ group. Among the ‘None of the above’ group of 103 respondents, the same three on-pack labels still came out on top: ‘Made in USA’, ‘Heart healthy’, and ‘Edible’. The values behind these claims reveal what this group prioritizes. First, ‘Made in USA’ shows that they care where their food comes from – even if that concern is motivated more by loyalty to their social group rather than environmental provenance. Second, they are concerned about their health; hence, ‘Heart healthy’ comes in second place. And thirdly, they give more credence to simple, factual claims that are easy to prove: and so ‘Edible’ scores highly. Moreover, ‘100% Natural’ ranks fifth-highest among this group (despite scoring just 69), showing that they do respond to certain kinds of sustainability claims. Finally, they also care about practical packaging claims, with ‘Re-sealable’ and ‘Leak proof’ ranking 4th and 6th. So you can still improve your product’s sustainability while maintaining interest across different groups.

The darker blue bars show the responses of the ‘None of the Above’ group, compared to the general respondents ((in lighter blue). They correlate, and ‘100% natural’ still makes the top 5 – but when the claim is explicitly environmental, there’s a big drop off (so ‘100% Natural’ plummets from 80 to 69)

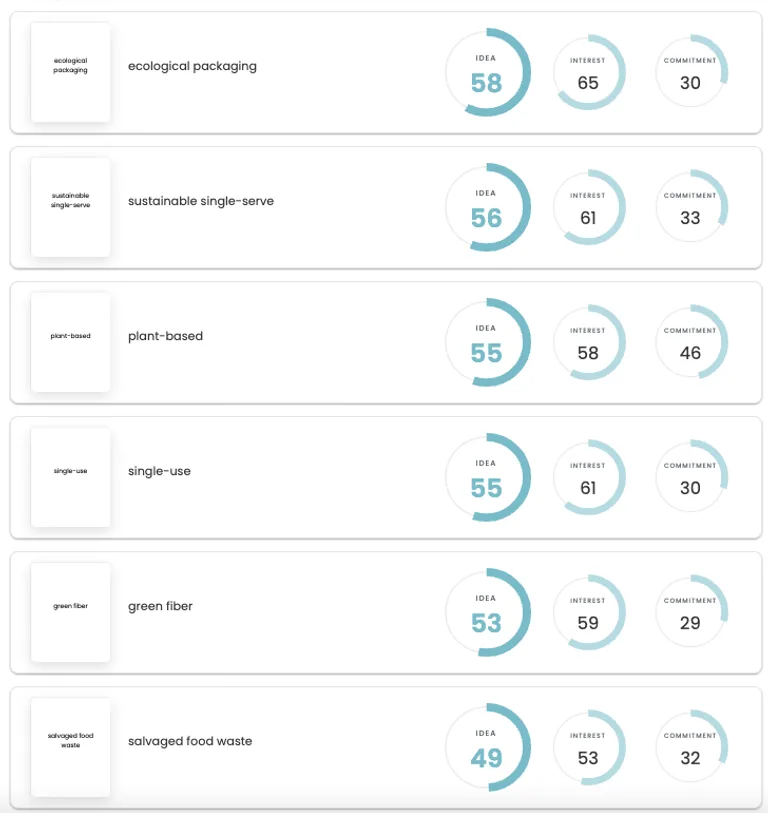

The ones no one liked

You can learn a lot from what people dislike. Looking at the bottom-ranking on-pack claims among all groups, some important lessons stand out. First, this is food and drink – it’s got to be appetizing. It is no surprise that the claim that came dead last was ‘Salvaged food waste,’ scoring just 49. No matter how conscientious or climate-conscious you are, no one’s appetite is aroused by the thought of eating ‘food waste’ that’s been ‘salvaged’. The same goes for ‘Compostable’ (scoring 59) – there’s a time and a place for thinking about decomposition, and it’s not in the grocery store. Another factor is clarity. Do enough people really understand what ‘Plant-based’ means or why it might be of use to them? Apparently not – it was ranked in the bottom five among all groups. And it pays to be punchy. Claims like ‘Sustainable single-serve’ (scoring just 56) and ‘Ecological packaging’ (58) are not only unclear; they’re also convoluted. You’d be forgiven for reading them and thinking, ‘So what?’ It’s important to remember that if people reject an on-pack sustainability claim, it might not be that they don’t care – it might be that they just don’t like how the message has been phrased.

The bottom six claims, across all groups.

Here are the key lessons from our report

There are so many competing claims about sustainability and even more nuances among shoppers’ attitudes towards them. So, how do you decide how to act? Fortunately, Upsiide helps you crunch the numbers and draw actionable insights.

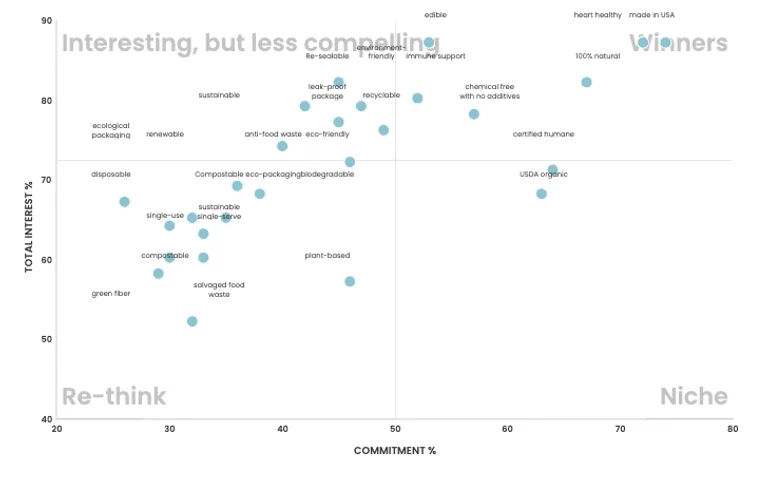

The quadrant chart plots all 27 on-pack claims into four brackets, according to the balance between their ‘Total interest’ – how many people swiped right – and their Commitment Score – how often they chose it when pitted against another claim they liked. Those in the bottom-left quadrant need work; in their current formulation, they don’t draw enough interest, and when they do, they don’t tend to maintain it against other favoured claims. Those in the top right category (the ‘Winners’) are the opposite, scoring a high level of Interest and then sustaining it when pitted against other claims. Those in between are more subtle; in the top right, ‘Compelling but vulnerable’, we have claims that gather high Interest Scores but low Commitment Scores. In the ‘Niche’ category (bottom right), we have claims with lower Interest (indicating a weaker general appeal) but a high Commitment Score, indicating that those who like these claims are very loyal to them.

The chart shows us that ‘Made in USA’, ‘Heart healthy’, and ‘100% Natural’ are the winners, while ‘Renewable’ and ‘Ecological packaging’ (among others) need work. But why?

The best claims are the ones about you…

What unites ‘Made in USA’, ‘Heart healthy’, and even ‘Edible’? What unites ‘Immune support’ and ‘Chemical free, no additives’? And why were these claims always, always more popular than ‘Sustainable’, ‘Recyclable’, or ‘Eco-friendly’? It’s that they’re directly relevant to the end user. Saying that something is ‘Recyclable’ tells us about the product, but it has little benefit to you, the user. Whereas something that claims to be ‘Heart healthy’ or ‘Immune support’ is offering something to the user: better health or defence against disease. And while ‘Made in USA’ might seem like an outlier, in reality it follows the same pattern. For those who identify with their national tribe, in-group loyalty is a very powerful driver. By claiming to be American-made, the claim gives the user a sense of community and group commitment. And in the United States, this form of patriotism is especially powerful. This insight was true no matter what filter we used: age, gender, location, you name it. Claims with a direct impact on the user or their in-group consistently outperform those which do not.

→ The lesson? No matter what the claim is, make it relevant.

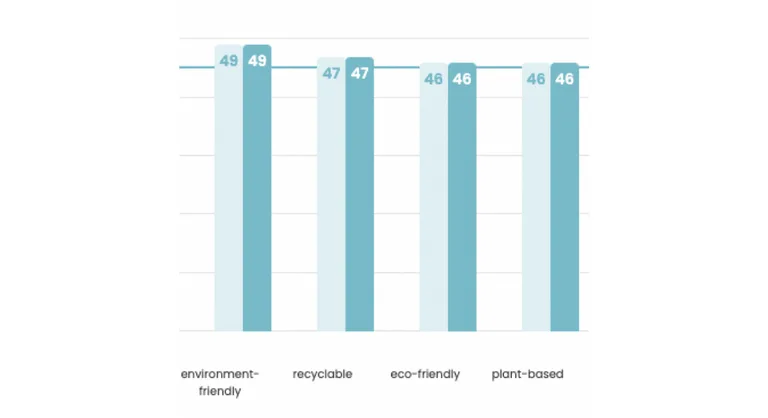

…which makes environment-focused claims tricky

Environment claims (e.g. ‘Sustainable’, ‘Eco-friendly’) are difficult to pull off. As they’re almost wholly about the product, they don’t confer much of a benefit to the user. For those who believe strongly in environmental causes, they’re more effective, but even those who self-identify as being interested in sustainability won’t choose environmental messages over claims that actually benefit them (like ‘Heart healthy’). That’s why nearly all of the environment-focused claims have poor Commitment Score – on the whole, people are interested, but when these claims come up against ones that offer a more direct and personal benefit (like ‘Heart healthy’) they’re discarded. None of the environment claims score higher than 50 in their Commitment Score. But the most consistently successful environmental claim – ‘100% Natural’ – is the exception that proves the rule. Although it does refer to the environment, it also implies a benefit to the user. Why? Because something that’s ‘100% Natural’ sounds like it will be healthier than something that isn’t, giving you a safer, healthier, more wholesome food and drink product.

A snapshot of the environmental claims – none manage a Commitment of more than 50

→ The lesson? Choose sustainability claims that imply a benefit to the user.

Whatever you want to say, say it clearly

The best claims are always the clearest. The worst performing are usually obscure. There’s no doubting what ‘Made in USA’ means, for instance. Another important example is shown by ‘100% Natural’ – which had extraordinary cut-through across all groups. ‘Immune support’ might offer a more direct benefit, but because this language isn’t very meaningful for older generations, interest in it drops sharply beyond the 18-34-year-old group. ‘100% Natural’ is effective because it means something to everyone. ‘Natural’ is an emotionally resonant claim (who doesn’t want natural?), and ‘100%’ is completely unambiguous. That’s why it was equally popular with all groups. Remember: on-pack sustainability claims are still marketing.

→ The lesson? Choose claims that are clear, direct, and universal.

Sustainability is coming

Among those over 50s – a group encompassing 304 of our 503 participants – ‘Sustainable’ isn’t in the top 10. It’s 13th, behind ‘USDA organic’, ‘Anti-food waste’, and ‘Leak-proof package’. Compare that to 18-34 year olds, among whom ‘Sustainable’ ranks 2nd, joined in the top 5 by ‘Eco-friendly’ and ‘Environment-friendly’. As this generation matures, it’s likely that they’ll carry their beliefs well into their middle age, passing them on to their children. Even with some drop-off, these environment-conscious values are likely to grow in importance.

→ The lesson? You should start thinking about communicating sustainability on-pack now.

How to choose a convincing on-pack message

…Consumers do not necessarily know what to expect for sustainability in packaging. To act proactively, packaging players must understand, at a granular level, how consumers buy and use the products in a given category and how consumers dispose of the packaging now in use.

Step 1: Who’s it for?

If our research shows one thing, it’s this: understanding your customers is vital, and engaging with them as early as possible in your journey is vital. It’s tempting just to follow the crowd and stick a ‘100% Vegan!’ label on your product, but unless you know who your target audience is, you could end up either confusing or repelling your customer. So, canvas your audience and find out what matters to them in terms of sustainability before you begin. After all, even eco-conscious consumers will be influenced by a number of factors, of which sustainability is only one. So if you’re going to have three on-pack claims, and only one is about sustainability, you need to pick the most effective one, the one that’s going to resonate with your audience – and drive purchase.

Step 2: Be single-minded

Once you’ve identified your target audience and consulted them, you must become single-minded. There are so many factors nowadays that the temptation is to include all of them. Our product is recyclable! Eco-friendly! 100% vegan! Sustainable! Each of these claims could be effective, but trying to squeeze them all in so that you can please everyone could actually harm your brand. Instead, try to prioritize claims that show the strongest cut-through and those which feel most closely connected to your brand.

Step 3: Clarity comes first

There’s no use making a claim that people don’t understand. So, whether you’re composing or choosing your claim, go for something that’s direct, clear, and unambiguous. Rather than claiming your product has ‘Ecological packaging’ (which is likely to elicit the thought, ‘So what?’), saying your packaging is ‘Recyclable’ is clearer. Same with ‘Plant-based’ – it’s more specific than ‘100% Natural’, but it has far less cut-through. On-pack isn’t the time to get super detailed; save that for the back-of-pack copy (or, better yet, your website).

Step 4: Make it relevant

Whatever your target audience might claim about their sustainability credentials, one thing is clear: the most effective claims always relate directly to the user. Ask yourself: does this claim directly benefit the user? If so, you should prioritize it over other claims. ‘Recyclable’, ‘Sustainable’, and other environment-focused claims are still important (and their importance will most likely grow), but they’re not the most impactful to consumers – even the ones who care a lot about sustainability. So, always pick claims that emphasize the benefit to the user over those that don’t.

Step 5: Stand back

Finally, take a moment to look at the on-pack claim through your audience’s eyes. They’re the ones who are going to be eating or drinking your product – first and foremost, it has to make sense to them. Not your packaging specialists, not your marketing team, not the head buyer at the grocery store; your shopper comes first. So ask yourself: is this claim clear to them? Does it directly benefit them? Does it affect how appetizing our product is to them? If your claim survives those questions, you’re good to go.

A bit about us

For marketing and insight teams that need to predict which ideas, concepts, and designs will perform best-in-market, Upsiide is the innovation insights platform that tells you which is the right move for your business’s future. Upsiide was developed by the insights pros at Dig Insights, who are passionate about reinventing the language of research, and putting it into the context of today’s business goals.

Get in touch to see how we can supercharge your innovation process.