Have you ever tried a new dish, and something about the flavour or smell instantly sent you back to your childhood? It might be the rhubarb pie that you used to have every Christmas. Or the ramen soup that your mom cooked when you were sick. Or the empanadas that you and your granddad made every weekend when you were a kid.

This is the power of food: it connects us to our past and culture, wherever we come from. Conversely, food also connected us to other people’s cultures. In fact, different international foods have become so widely adopted and enjoyed that they’ve merged into new cuisines entirely that take inspiration from a variety of cultures.

This was the inspiration for our latest study, supported by Dig’s Diversity & Inclusion Committee. We ran a survey using Dig’s automated research platform Upsiide. The study was run with 1000 people in Canada and the USA to understand what cultural foods mean to them, and why they try foods from different cuisines.

We also leveraged Upsiide to test different types of Dumplings and Curries – foods much beloved by Dig employees themselves. After testing 20 different variations of dumplings and curries, we discovered which ones people like most and why they love them.

These insights helped us create a completely original menu for an aspirational Dig Café that contains dumplings and curries that have the most potential in-market.

Before we dive in, it’s important to understand the methodology we used to assess the potential of these dumplings and curries. Let’s run through the different scores on the Upsiide platform:

Upsiide’s Interest Score is the proportion of people who liked an idea (in this case, dumplings and curries) and is expressed as a percentage. When respondents like two ideas, they are asked to trade-off between them, picking a favourite – which generates the Trade-off Score (often referred to as Initial Commitment). Finally, the Upsiide Score is based on a combination of the Interest Score and the Trade-off Score – it’s an absolute score that’s been calibrated to predict the performance in-market.

Now, it’s time to dig in to our findings!

Insight #1: People’s desire to stay connected to their culture drives their food choices

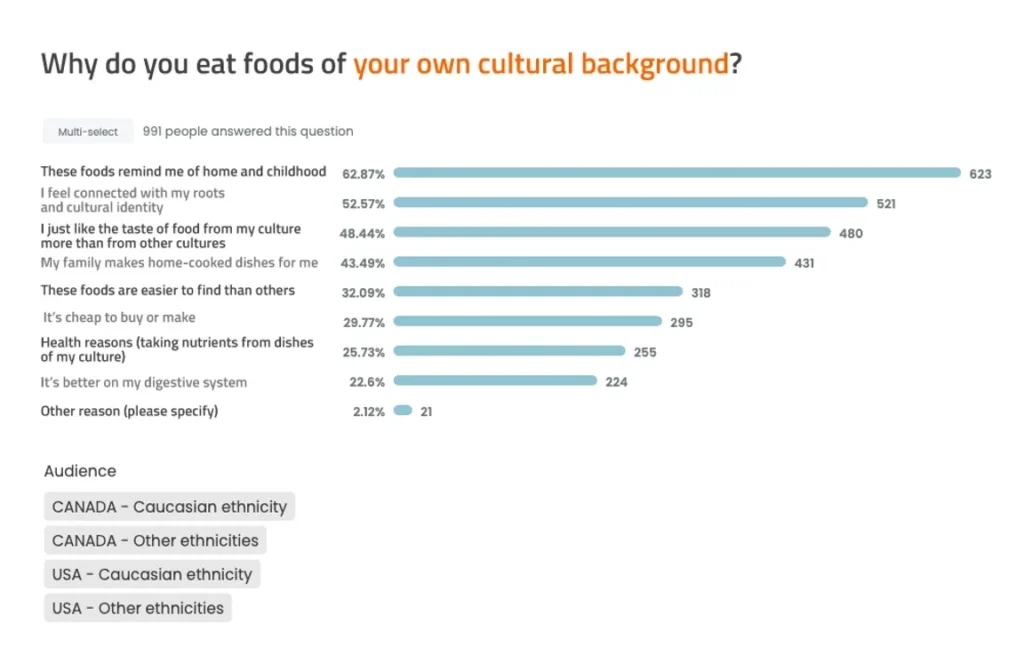

We asked consumers why they eat foods from their culture. The options they had to choose from can be divided into two categories:

- Practical reasons – e.g. health, accessibility, ease

- Cultural reasons – familiarity with ingredients, pride of belonging to one culture, and connection to family

Overall, we discovered that the main reasons consumers like to eat their own cultural food is because of a sense of belonging and heritage. 65% of respondents cited cultural reasons like nostalgia for childhood/family and feeling a connection to their roots as the reasons they eat food from their own culture.

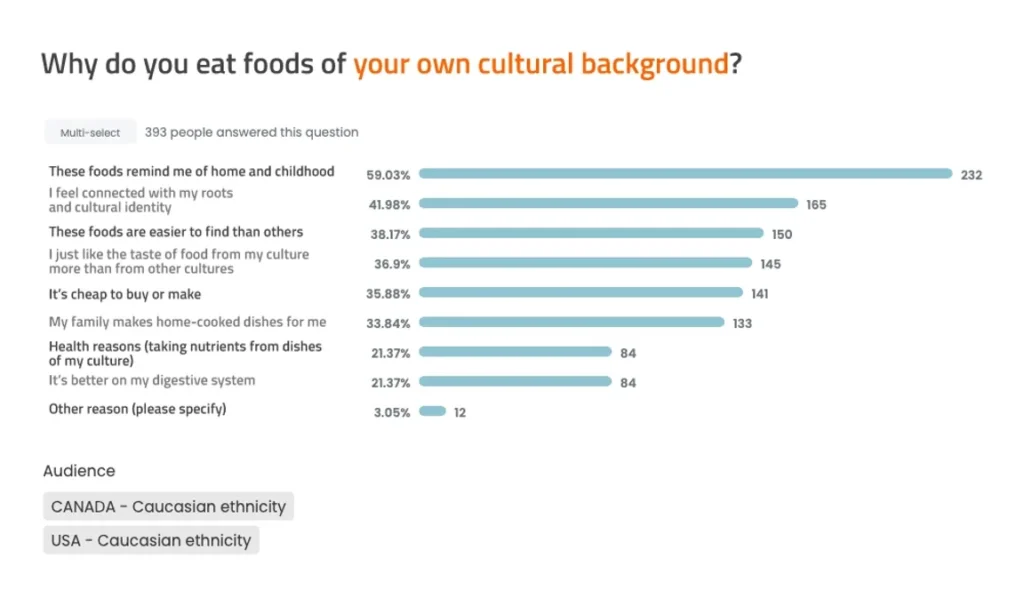

But what happens when we start dissecting the results based on ethnicity? Let’s have a look at Canadians and Americans that identified themselves as Caucasian. While many stated that food of their own cultural background reminded them of childhood (59%), we also see that they preferred those foods because they are easier to find than others (38%) and because they are cheap[er] to buy or make (35%).

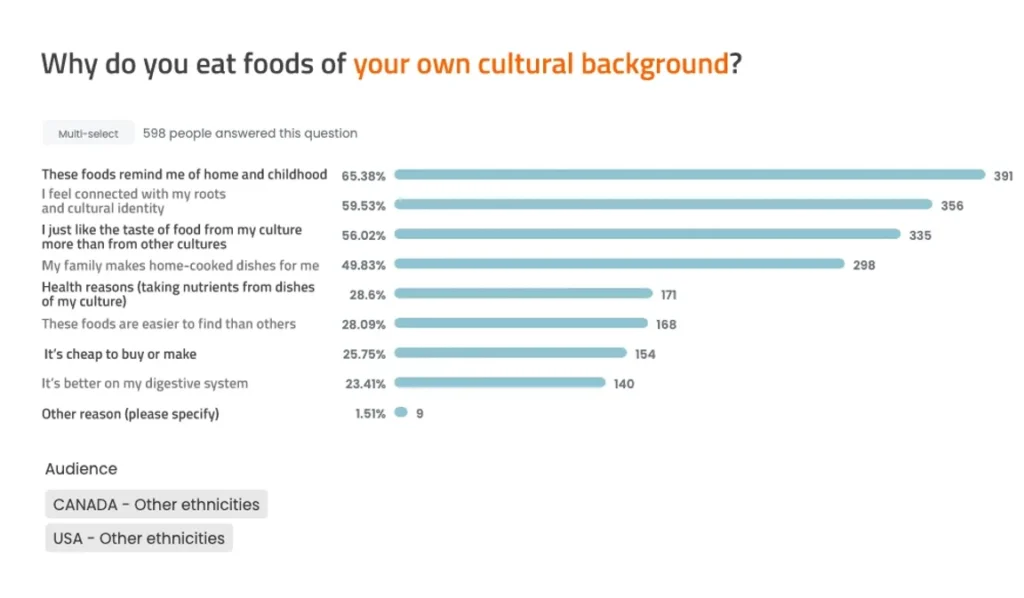

When we look at those respondents that self-identify as other ethnicities, we notice that cultural reasons significantly overpower practical reasons. Only 26% eat their own cultural food because it’s cheaper to buy or make and 23% because it’s better on their digestive system. In contrast, 60% eat foods that are typical of their cultural background to feel connected to their roots, and 56% because they prefer the taste of their own cultural foods over other foods.

What does this data tell us?

Nostalgia is the main driver for people to eat foods from their own cultural background. If a restaurant knows their consumer base is diverse and consist of people who identify with different backgrounds, it’s best to offer cultural staples or popular dishes that tap into that nostalgia and sense of belonging.

Insight #2: Dish familiarity affects people’s choice of dumplings and curries

We discovered that different ethnicities had different preferences for dumplings and curries.

Dumplings:

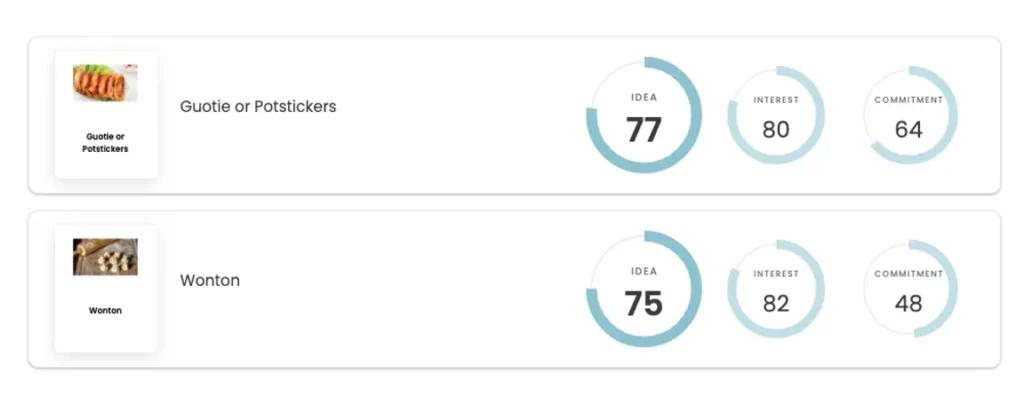

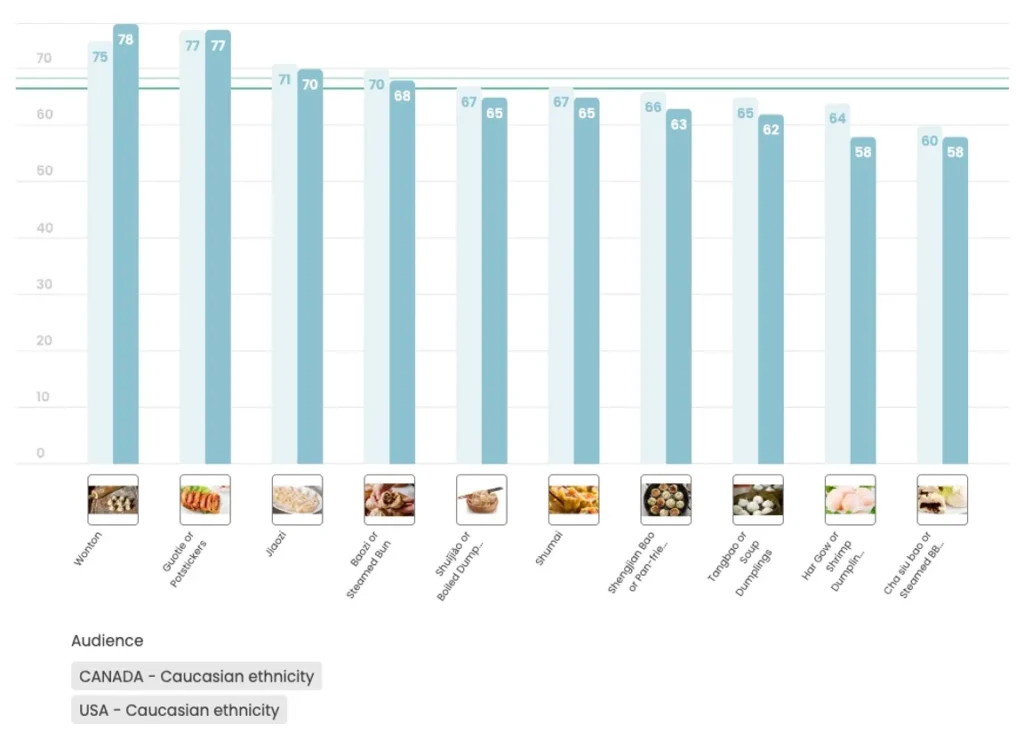

Looking at the dumplings results, we see that Guotie/Potstickers and Wontons were the most popular among all audience groups, garnering Upsiide scores of 77 and 75 respectively. This could be because these two dumpling dishes are generally well known in Canada and the US, so consumers are likely to have been exposed to them more than other types of dumplings.

When we look at Caucasians, these dumplings remain the most popular: Wontons have an Upsiide score of 78 and Guotie/Potstickers is 77. In contrast, Har Gow was one of the lowest ranking dumplings with an Upsiide score of 58.

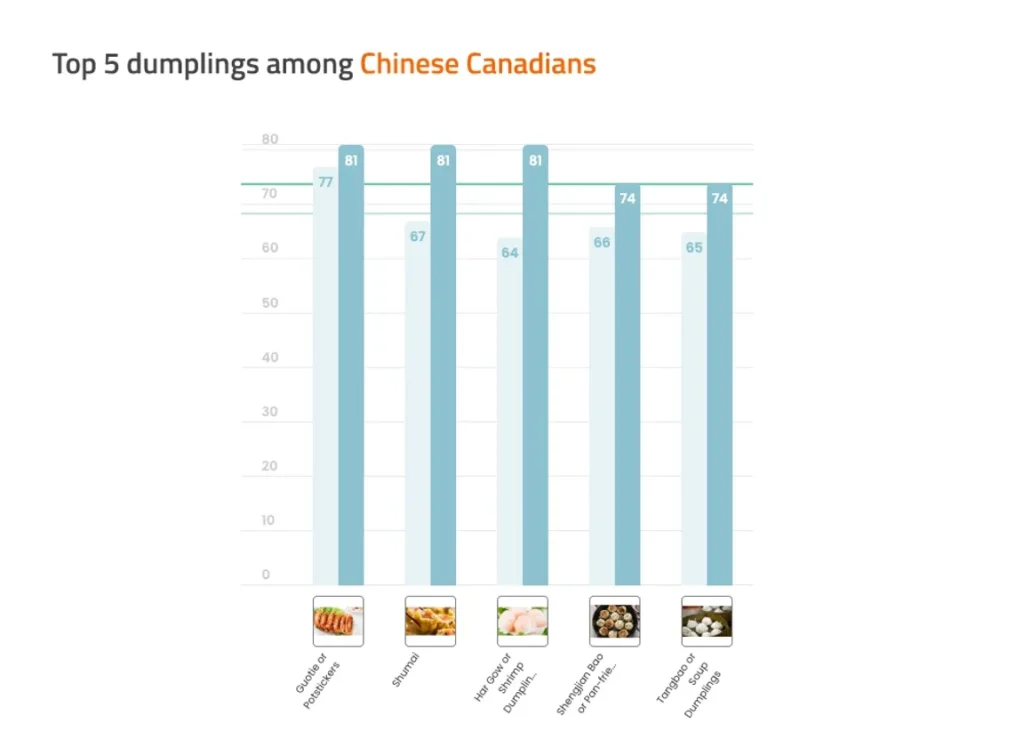

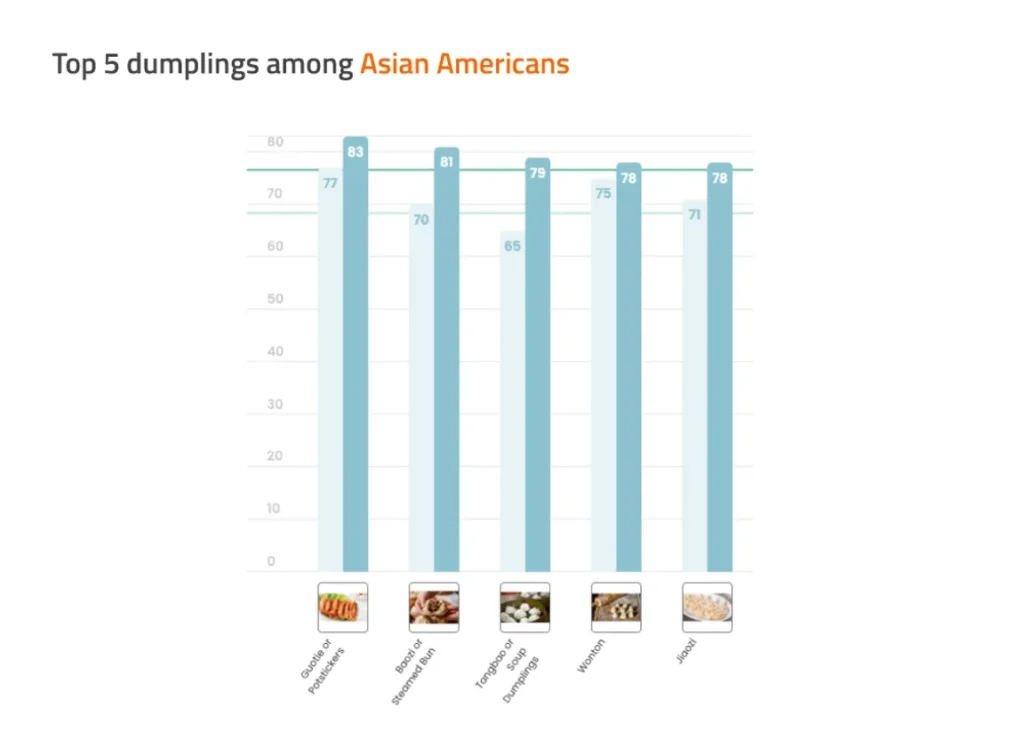

But as we filter down to people who self-identified as Chinese or Asian, the results change drastically. Chinese Canadians still prefer Guotie/Potstickers, but they feel the same way about Shumai and Har Gow/Shrimp Dumplings (staple dim sum dishes!) – all three types of dumplings got an Upsiide score of 81. Asian Americans like Guotie/Potstickers (83), Baozi/Steamed Bun (81) and Tangbao/Soup Dumplings (79).

We believe Har Gow/Shrimp Dumplings, Shumai, Baozi/Steamed Bun and Tangbao/Soup Dumplings share high popularity among Asian-Americans and Chinese Canadians, likely because these sub-groups have been introduced to a wider variety of dumplings than Caucasian consumers.

This is especially apparent when we look at the Idea Split section of our study. Upsiide’s Idea Split feature allowed us to assess dumplings and curries against specific attributes and discover which items people found most and least appetizing (and why).

Caucasians in Canada found Har Gow/Shrimp Dumplings least appealing and least tasty, whereas Chinese Canadians people thought the opposite. Familiarity with more ingredients and dishes likely allowed Asian American and Chinese Canadian consumers to choose beyond Wontons and Guotie/Potstickers.

Preparation style also differed between consumer groups. Caucasian consumers were more attracted to fried options like Guotie/Potstickers, whereas Asian American and Chinese Canadian consumers preferred boiled and steamed dumplings like Har Gow/Shrimp Dumplings and Baozi/Steamed Bun.

Curries:

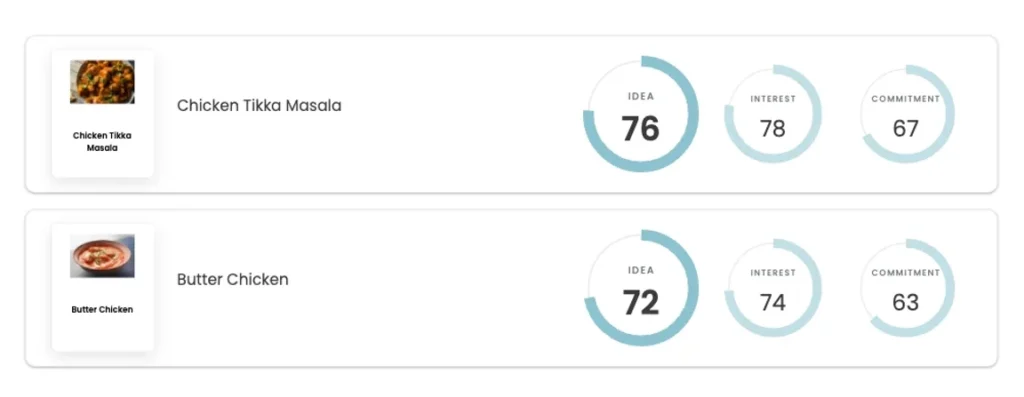

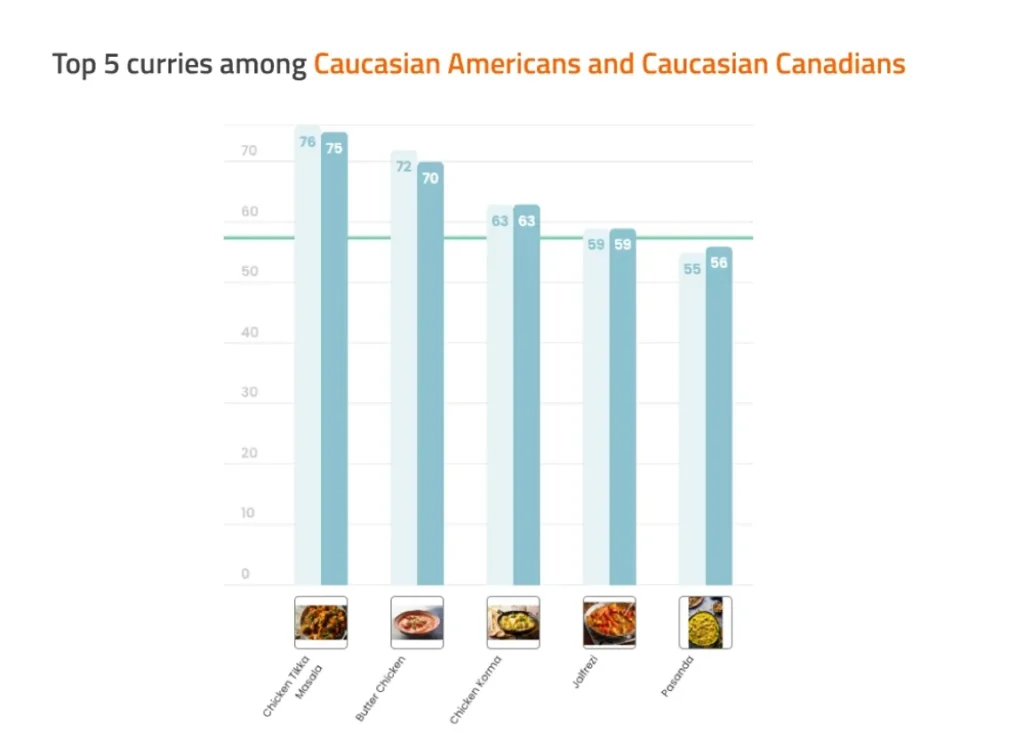

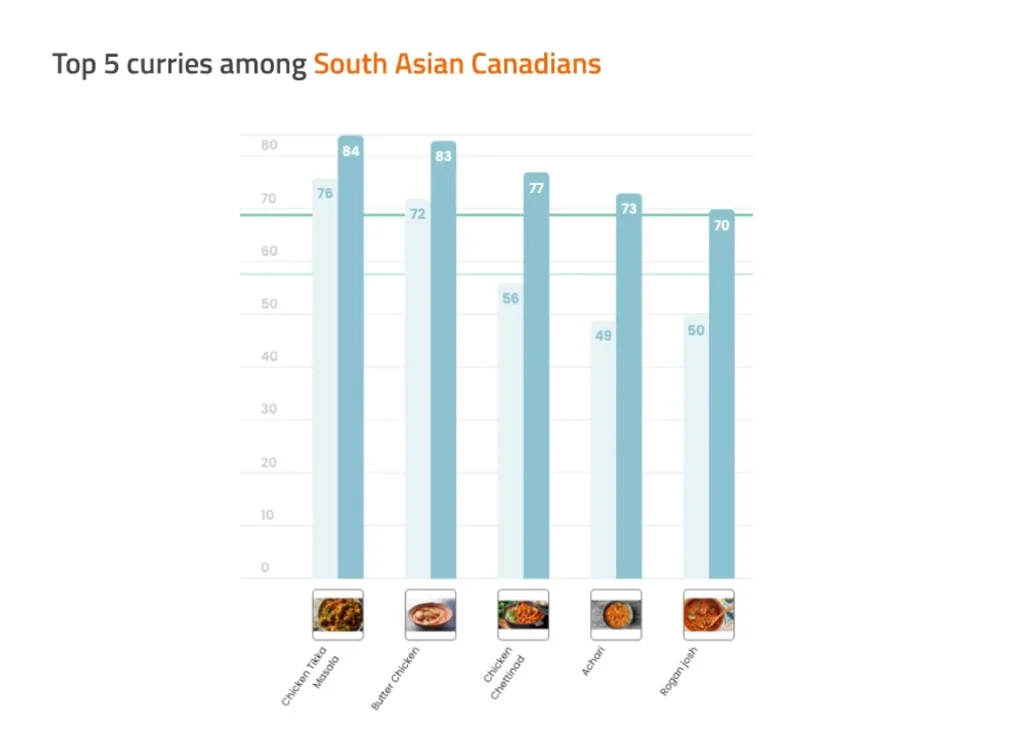

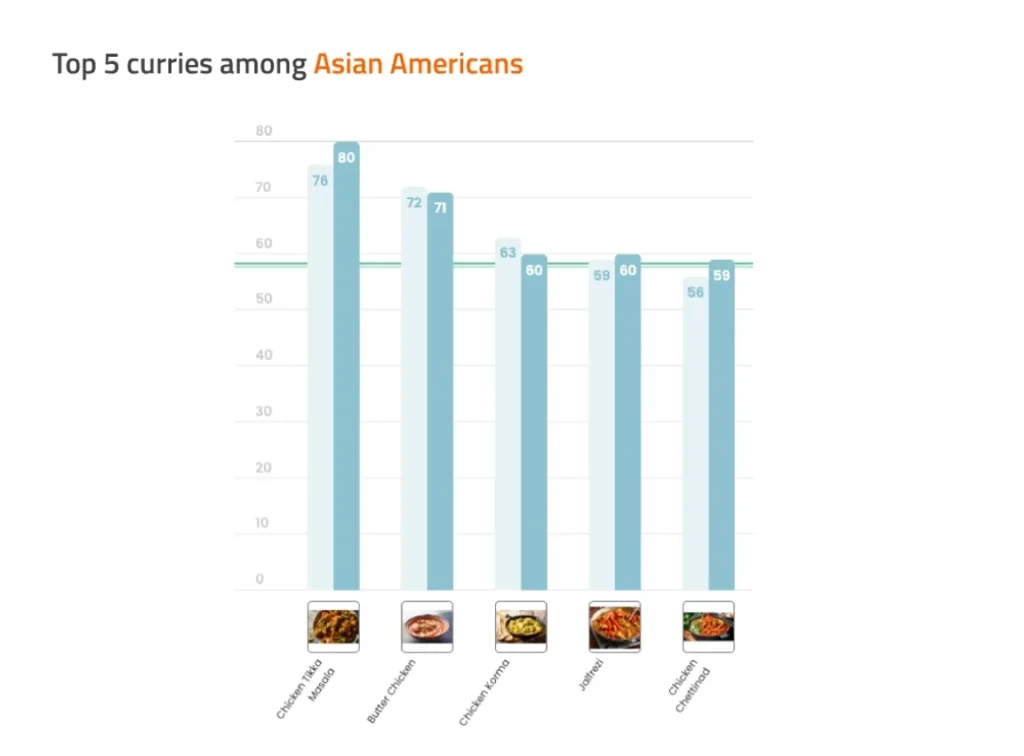

The results aren’t as black and white when we look at curries. Consumers across all audience groups were generally more attracted to Chicken Tikka Masala (Upsiide score of 76) and Butter Chicken (Upsiide Score of 72).

And this trend continues when we look at specific ethnic groups. Caucasians and South Asians in Canada and the US always chose those two curries over others, making these dishes absolute favourites among both groups.

So, what’s the lesson here?

Restaurants and food providers should be thoughtful about who their ideal customer is; they don’t need to rely exclusively on familiarity with dishes. After all, 58% of respondents stated that they eat foods from different cultures because they feel adventurous or like to switch things up.

Insight #3: The perfect restaurant menu should contain both mainstream and niche dishes

Welcome to Dig Café. While this restaurant is entirely fictional, it’s our take on the optimal menu of dumplings and curries based on our research.

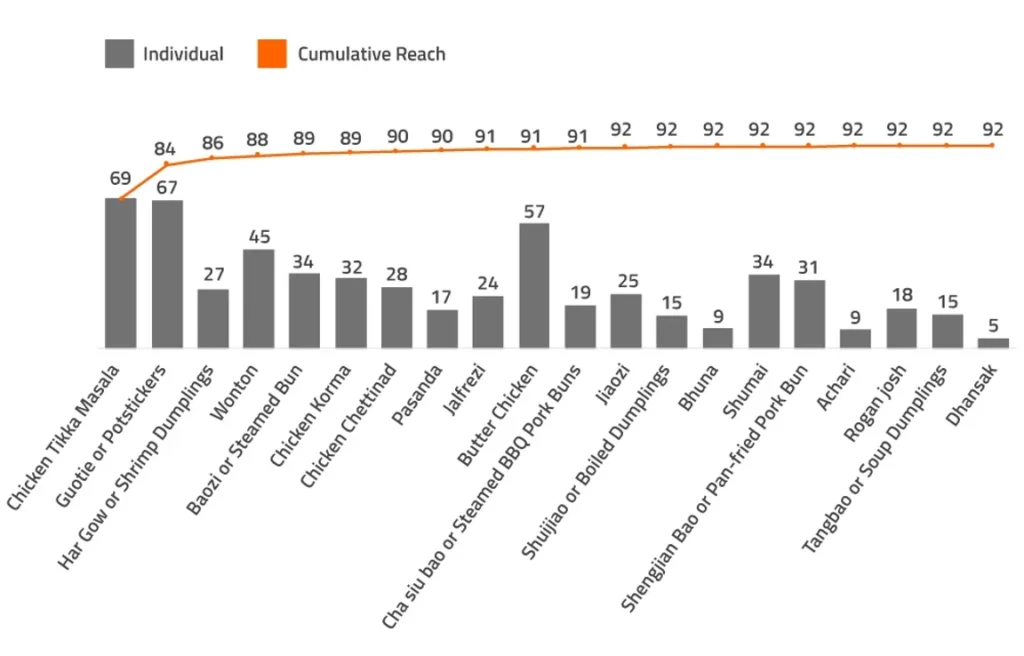

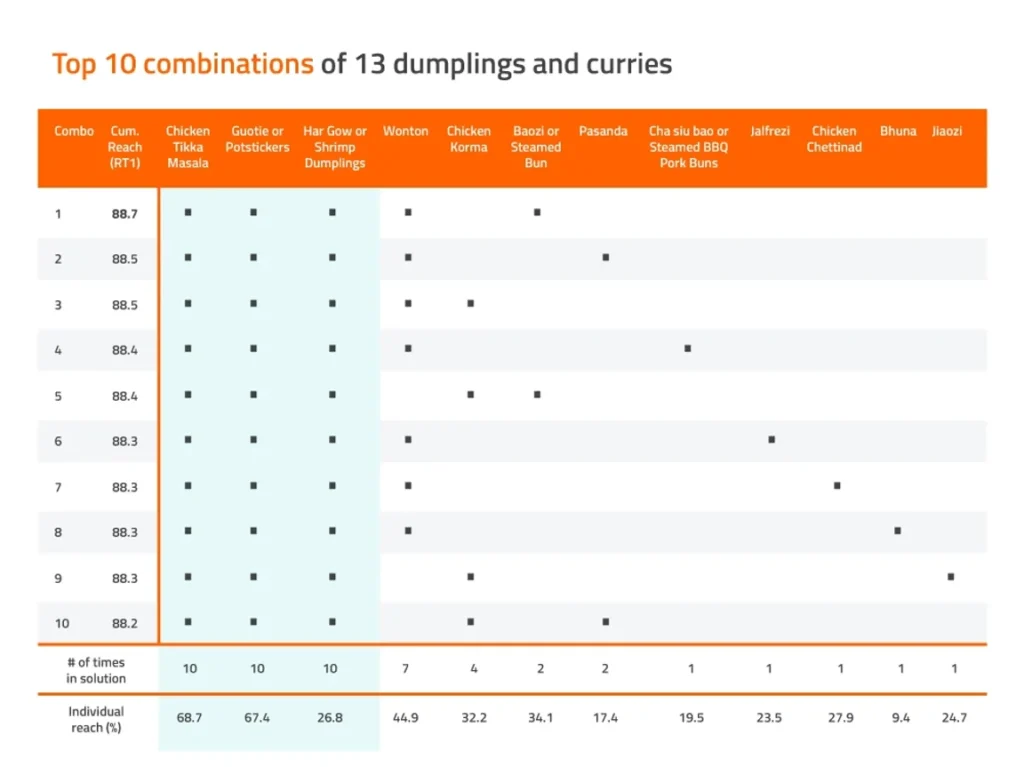

To identify the dumplings and curries that are likely to convert the most diners, we worked with Dig’s analytics to model Total Unduplicated Reach and Frequency (TURF). TURF tells us the percentage of customers that a product can potentially reach, and identifies the combination of menu items that reaches the most customers.

Here’s what came back:

What the chart shows is which dumplings and curries can, in combination, bring in the most customers. For instance, if Dig Café sells Chicken Tikka Masala, we’ll be able to capture 69% of the market. But if we also add Guotie/Potstickers on the menu, we’re likely to increase this potential to 84%. The percentage of customers reached increases as we add more menu items, until the results slowly plateau.

And the combination of items isn’t limited to the above line-up. TURF modelling reveals 5 different product mixes that have the potential to reach a similar percentage of people. If we look at different combinations of dumplings and curries in total, we can see 3 winning items that are likely to capture the most consumers – Chicken Tikka Masala, Guotie/Potstickers and Har Gow/Shrimp Dumplings.

A restaurant can then choose the remaining 2 items based on their business capabilities – e.g. access to ingredients, supplier availability, etc. For instance, if the restaurant chooses to sell Wontons and Baozi and then realizes that access to Baozis ingredients are difficult to get their hands on, they can move on to the next best option, which is Pasanda.

What the restaurant can learn from this is that it’s not the best practice to only choose the best-performing dishes for a new menu because those can only capture so many consumers. It’s better to have a variety of dishes that are both general crowd pleasers and dishes that cater to different taste preferences.

To show how TURF can be used in action, we created a menu for our fictional Dig Café.

This menu includes items that almost everyone will find interesting. Because we want to offer a variety of dumplings and curries that have different flavours and textures, we went with the combination number 3 from the TURF table.

And to make things more fun and to pay homage to some of the things we do at Dig, we also included popular cocktails that Dig’s Cocktail & Mixology Club made for us in the past. Honestly, what a great way to complete your evening of eating delicious dumplings and curries!

Final thoughts

While this study showcased some of Dig’s and Upsiide’s research capabilities, we also aimed to take a D&I angle and pay homage to some of the largest cultural groups we have at Dig. We believe food is one of the things that make our cultures different and unique, but it also is one of the things that unites us.