Food delivery isn’t new. In the aughts, technology got more of a hold on the food delivery space with the introduction of food delivery apps such as UberEats and Grubhub. Then, technology tried dipping its toes into grocery delivery. And other services like meal kits started to break into the market.

These services grew slowly. But the COVID-19 virus forced us all inside for extended periods, and people looked at new ways to get food. The pandemic drove massive adoption of all these food delivery services: restaurants, grocery, and meal kits.

As things opened back up after lockdowns, all these services fell back from their pandemic highs. However, every service has come out better on the other side. Almost all metrics suggest the services are better than before any lockdowns occurred. The pandemic is over, but delivery is here to stay.

The How, the Why, and the What

Thanks to our friends over at Drop, we looked at transactional data trends for pre-lockdowns, lockdowns, and post-lockdowns. But it was time to do some extra digging. We wanted to know exactly how people used these services, why they used them, and what opportunities there are for companies within the restaurant, grocery, and meal kit delivery space to make people use them more often.

To do this, we ran three surveys (one for restaurant delivery, one for grocery delivery, and one for meal kit service delivery) across 1000 people in the US and Canada.

Respondents answered behavioral questions before going through an idea screening exercise, where they saw a bunch of different delivery offers. If they swiped right on an offer, they liked it. If they swiped left, they didn’t.

The initial swiping helps us calculate an Interest Score. If they swipe right on 2 offerings, they enter a trade-off where the respondent must select which offer they like more, which helps us understand initial commitment. After we’ve got both Scores, we can calculate the Idea Score – a proprietary, absolute score calibrated to predict the success of an offer in-market.

Dig deeper into each study:

- Grocery Delivery in 2022: How Food Retailers Can Thrive

- Restaurant Delivery, Right Now: What Delivery Services Need to Know

- The Meal Kit Delivery Landscape in 2022

Findings – across all food delivery

Restaurant, grocery, and meal kit delivery services performed mostly the same as we journeyed from pre-lockdown to post-lockdown. They all had massive revenue increases with everyone staying inside. Revenue numbers started to fall back to pre-lockdown norms after restrictions loosened. But, there were more similarities than just that.

Consumers’ top three needs across all methods are saving money, better delivery options (i.e., speed), and more sustainability (i.e., plastic-free, locally sourced ingredients).

Even the top reasons to stop using delivery were similar across all three. Most thought the options were too expensive, or they prefered to make or select their own food.

Food quality (mostly produce) matters a lot for grocery and meal kit delivery. And if you find that your recipes are better than a restaurant or meal kit service, then the value of the savings would have to be astronomical for someone to choose it over something they cooked themselves.

Price, like for basically everything, is always a top factor. But it could affect certain services more than others.

Grocery, restaurant, and meal kit delivery findings – who won out the most?

While a couple of main factors played into how each person started or stopped using one of these delivery services, there are a few things (relatively) unique to each one.

Grocery delivery and the quality issue

Grocery delivery services saw the largest drop after restrictions loosened. It was the one that fell back closest to pre-pandemic norms. However, it also had the highest revenue increase during lockdowns (averaging 232% over the pandemic), which means it might have the biggest opportunity to lean on untapped potential.

As mentioned above, choosing ingredients (specifically produce) plays a big factor. 95% of respondents said this was somewhat or very important for them. This is most relevant to grocery delivery as close to a quarter of people don’t think they’re getting the freshest produce. And there are some people who just prefer to grocery shop in person; of those who have never tried grocery delivery, 52% say they prefer shopping in person (and 60% prefer to select their own produce).

For people who use grocery delivery, the more grocery services they’ve tried (3 or more is the sweet spot), the more likely they’ll continue to get their groceries delivered. Plus, they are more willing to venture into different food categories (i.e., delivery from smaller/international grocery stores (e.g., small Asian grocery stores)) than people who’ve tried 1 or 2 grocery delivery services. So you might want to cater to these people first, finding out what makes them choose your service over others (or others over yours) to create an offering that stops them from switching. Connect with your biggest advocates to develop new features that might entice lapsed or brand-new users.

Restaurants: the ‘treat yourself’ delivery option

The biggest winner of the bunch. Frequency of restaurant deliveries increased the most during lockdowns (42% increase). People still wanted to order from their favorite restaurants during the pandemic, and in some ways, the motivation was heightened – enjoying their favorite restaurant meals was a ‘taste’ of their much more active social lives pre-pandemic. Even though restaurant delivery did decline post-pandemic, it didn’t happen at quite the same rate as the meal kit or grocery delivery, and frequency remained well above pre-pandemic highs (23% increase from pre-pandemic highs).

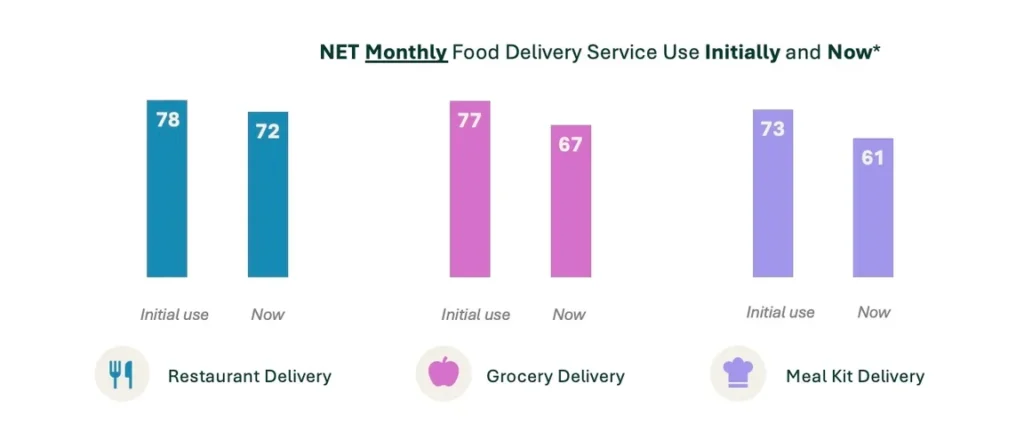

The numbers signify the percentage of people who use food delivery services. So, 78% of people that order from restaurants do so at least once a month when they first start using the service. The second number shows the drop compared to how many people order at least once a month now.

Meal kit delivery is all about inspiration

Price is probably one of the biggest deterrents for meal kit delivery services. While it matters for all of them, the discrepancy between trial to purchase is significantly higher with most meal kit offerings. A promo or coupon for a restaurant or grocery delivery might include free delivery or a few dollars off. On the other hand, meal kits often have a free trial and prices jump significantly when the trial is over. With up to 46% of consumers trying a meal kit service because they got a coupon or discount, it’s reasonable to believe many of these people will drop off after the trial period.

That said, the biggest differentiator for meal kits is their ability to inspire. One of the main reasons people like meal kits is because it exposes them to new recipes or ingredients (90% of meal kit consumers said that exposing themselves to new recipes or ingredients was very or somewhat important). People get exposed to new stuff in restaurants as well. However, these people likely order their favorites instead of trying something new. Consumers of meal kits actually like thinking about new recipes and how they can use some of what they’ve learned in the future.

It’s all about retaining, regaining, and attracting across all food delivery services

Across all three delivery services, we looked at three segments: current, lapsed, and never users. Most of the opportunities are dependent on how you’re going to address specific user groups. However, a few service-specific offerings might cause lapsed users to come back or never users to give delivery a chance.

Current Users

Current users originally tried these services because they wanted to save time, try something new, or they got a discount/coupon. Now, their main reasons for using these food delivery services are to save time, discover new foods, and have healthier meals.

Some opportunities to retain this group include saving time, discovering new food, and having nutritious and healthy options.

Lapsed Users

Many lapsed users started ordering from food delivery services because they were quarantining or social distancing throughout the pandemic. Similarly to the current users, they often started because they got a discount or coupon or wanted to try something new. However, these elements didn’t keep them around. The top three reasons why they use it less often or not at all are because it’s too expensive, their discount expired, or they prefer selecting their produce or cooking their own recipes.

This segment might have the biggest potential to grow. So much of what this group cares about revolves around the quality of the product. Grocery delivery doesn’t always hit the mark. People are super specific with produce. So, sometimes, just doing the simple things correctly might encourage someone to keep using your service or entice them to come back. No more overripe bananas. Or, in some cases getting 6 bunches of bananas instead of 6 bananas. There was a subgroup of lapsed users that were intrigued by the prospect of tracking the produce selected for them live, with the chance of reviewing it before it gets delivered to ensure it’s up to their standard.

For meal kit delivery specifically, same-day delivery options might encourage lapsed users to return. They typically order less often until they don’t order at all. So, offering an alternative to a restaurant (which tends to be more expensive per meal and often less healthy) could bring people back to meal kits.

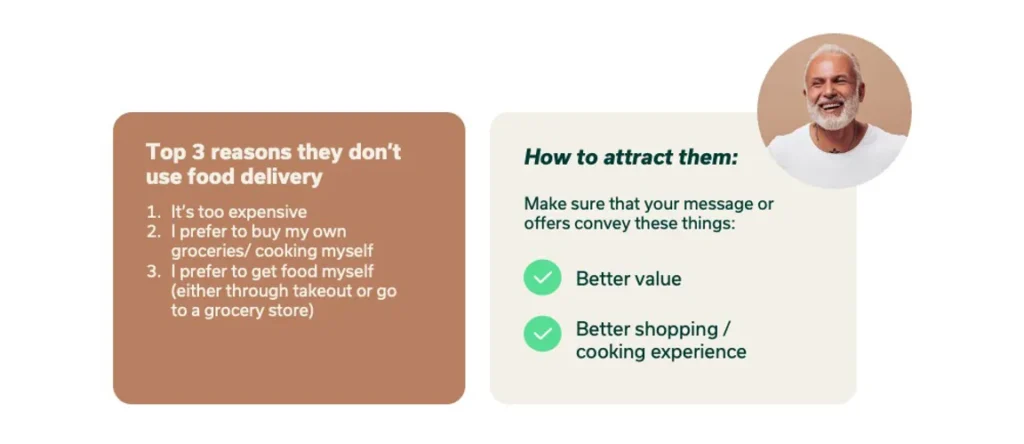

Regardless of the delivery service, lapsed users need a little encouragement to return. To retain people in this group you need to focus on something that provides them with better value than they can find elsewhere, improves the shopping or cooking experience, saves time on meal prep, as well as continuing to offer deals. A mighty ask.

Never Users

As the name suggests, these people have never used a food delivery service. Most likely, this is because of their age, as they skew 50 and over. Similar to lapsed users, never users want a better value and shopping/cooking experience for them to even consider giving any of these services a try.

The top reasons they have never tried a food delivery service are they think it’s too expensive, and they prefer to buy their own groceries and cook their own meals. And if they order some food from a restaurant or grocery store, they want to pick it up themselves.

There is a bit of niche potential in the never user space for meal kits; catering to specialty diets had low interest overall, but those that were interested in this kind of food delivery were VERY interested in it. So, people that follow a specialty diet (vegan, keto, paleo, etc.) might feel left out of meal kit services because there just isn’t an offering that matches up to their eating habits.

Canada versus America – We’re the same, but we’re not the same

For the most part, American and Canadian consumers trended the same during lockdowns and after, with only slight differences.

Convenience plays a larger role for American consumers. For grocery shopping/delivery, American consumers want to subscribe to items they regularly use (i.e., toilet paper). Sixty percent of American consumers are interested in this compared to 49% of Canadian consumers. If anyone has shopped for paper towels on Amazon, you can see this kind of offering is already available in-market and likely to scale up in adoption.

Sticking with the convenience factor, 74% of Americans prefer heat-and-eat options (rather than cook-and-eat) for meal kit services compared to 59% of Canadians.

Another outlier is that Canadian consumers are more interested in things that are good for the planet. Sixty-six percent of Canadian consumers wanted eco-friendly options for their food deliveries (compared to 57% of Americans). So, while we’re mostly the same, there could be some differing options for you depending on the market you’re in.

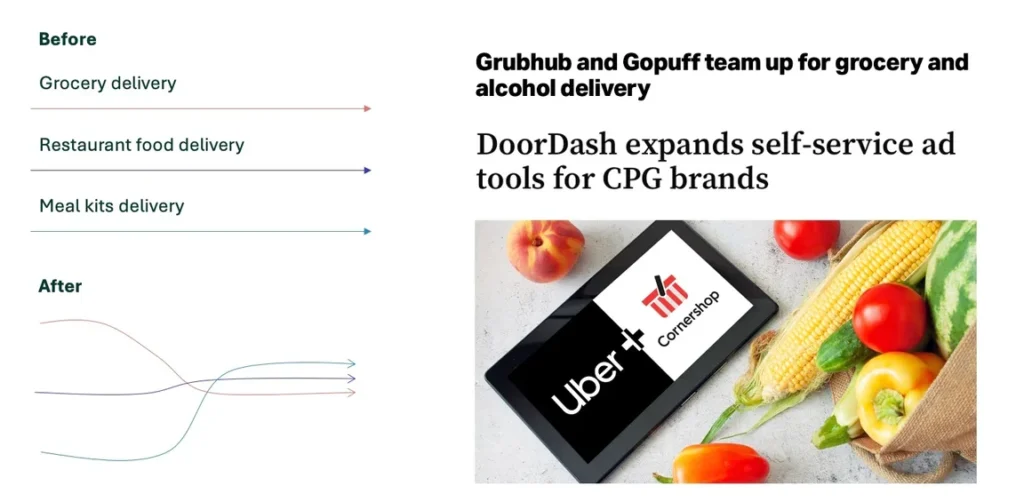

Convergence – The lines are blurring

Restaurant, grocery, and meal kit categories used to feel somewhat defined, but the lines are blurring and fast.

Some of this might be out of necessity. For example, for grocery stores to set up their own delivery service costs money and technology, and they might not have access to that technology. The infrastructure wasn’t in place for them to keep up with the pandemic demand, so outsourcing deliveries became the done thing. Now that the frequency and quantity have scaled down, it might make more sense to partner with brands like UberEats to fulfill those orders.

Is this the start of a bunch of new partnerships? Or are new innovations just around the corner? Only the best will survive, and the collaborations and opportunities in the next few years will be fascinating to watch.

Watch our digital event on this topic to get a better understanding of the food delivery landscape.